|

1/1/15 -

On 12/31/14 the S&P 500 closed at 2059, resulting in a total return of 13.7% for the year. The market has become even more overvalued as the U.S. economy is finally showing some signs of recovery, and the Fed's policy rate remains at a zero bound. This would, in theory, cause astronomically high financial asset prices - which are. However, this year will likely be the year when the Fed begins to carefully wheel the punch bowl away.

An investment portfolio should also be structured, as Keynes wrote, for "really secure" income. Under current monetary conditions, "really secure" income is not available, so we invested in "rather secure" gas pipeline limited partnerships. However, as we chronicle below, due to Saudi Arabia's new goal of seeking oil market share, even the better pipeline limited partnerships in the higher marginal cost shale oil industry are now less secure. They can be considered pure equity risks.

This is why we reduced our investment in these partnerships. Our portfolios now favor cash.

The Oil Industry

The following

graph shows what happens in the world oil markets, where production and

consumption are kept in reasonable balance by the volatile prices shown below and by OPEC administrative actions.

Brent Oil Futures, Feb. 15 - Opening 1st Trading Day

source: investing.com

2009 Q1 =

$43.85/bbl

2010 Q1 =

$78.49/bbl

2011 Q1 =

$94.75/bbl

2012 Q1 =

$108.35/bbl

2013 Q1 =

$111.50/bbl

2014 Q1 =

$111.00/bbl

12/31/14 =

$57.61 /bbl

The following

table from the U.S. Energy Information Administration shows that the worldwide

production of oil has increased substantially since 2009

due to the shale oil boom in the U.S.

EIA World-Wide Daily Oil

Production (mm bls/day)

International Energy Statistics, 12/14 Short-term Energy Outlook Report Table 3a

|

2009

|

2010

|

2011

|

2012

|

2013

|

2014

|

2015 (E)

|

Daily

Production

|

85.0

|

87.6 |

87.9

|

89.8

|

90.1

|

92.0

|

92.8

|

OPEC Market Share, Percent World Oil Production (mm bbls/day)

|

2013

|

2014 (E)

|

2015 (E)

|

Daily

Production

|

90.1

|

91.5

|

92.3

|

OPEC

Production *

|

35.9

|

35.8

|

35.0

|

Market Share

|

39.8%

|

39.1%

|

37.9%

|

* Including natural gas liquids.

Led by the Saudis, OPEC has now undertaken

to defend their market share by allowing the oil price to drop below the marginal production costs of many non-OPEC

producers, thus preempting market share deterioration. The Kuwaiti Oil Minister said, "It is not fair that OPEC takes the decision to reduce while the others are producing and investing." (WSJ, 12/21/14) Present low oil prices are likely to be long-lasting.

Enterprise Products

Partners are one of our limited partnership pipeline investments. We think

their management is prudent and sober. In a recent Wells Fargo Energy Symposium12/9/14 presentation, (we do not reproduce the graph on page

11 due to copyright restrictions), they detail the consequences of $65/barrel

West Texas Intermediate upon U.S. production.

During the first six months of 2015,

production will increase rapidly no matter what the price of oil as previously

written drilling contracts are completed. Production growth then decreases. At

$65/barrel oil, the U.S. shale oil industry is still quite viable, assuming a

25%-35% reduction in well completions in favor of those that also produce natural gas liquids that can be sold separately. Under this oil

pricing scenario, U.S. oil production will still increase at a 3.5% annual

rate, adding .65 mm bbls/day * by the end of 2015 to

world supply, helping to meet an increased world demand of 1.1 mm bbls/day. Since OPEC expects a 2015 increase in oil production from the Americas alone of 1.2 mm bbls/day, that increased production will supply all the world's demand growth.

The outlook is then for a prolonged period of low oil prices, very likely below $65/bbl, prices held low by OPEC’s effort to maintain market share and to reduce the growth of U.S. production. There are many consequences to this. Low gasoline prices are an opportunity to replenish the U.S. Highway Trust Fund and repair infrastructure. There are, furthermore, numerous foreign policy implications because these prices adversely affect Russia, Iran and Venezuela.

* The U.S. Energy Information Administration 12/14 Short Term Outlook Report projects U.S. oil production will grow by .7 mm bbls/day in 2015. Assuming $58/bbl oil, "...EIA expects 2015 drilling activity to decline due to unattractive economic returns in some areas of both emerging and mature oil production regions. Many companies will redirect investment away from marginal exploration and research drilling and into core areas of major tight oil plays. Oil prices remain high enough to support development drilling activity in the Bakken, Eagle Ford, Niobrara, and Permian Basin, which contribute the majority of U.S. production growth."

** OPEC 12/14 Monthly Oil Market Report projections, p.p. 1, 91.

2/1/15 -

According to the World Economic Forum, the present world economy is fraught with "complexity, fragility, and uncertainty."

Although the U.S. economy is beginning to recover from the Great Recession of 2008, the median family wage, the typical wage earned by half of American families, has not. The following graph shows that the fifteen year improvement in family income peaked in the late 1960s and has declined since, going negative in the last few years as the result of the Great Recession of 2008.

Clearly something is happening. A 1/17/15 NY Times article suggests four main reasons:

1) Globalization, forcing Americans to compete with other workers around the world.

2) Technological change, replacing human labor with machines.

3) Education, as the rest of the world becomes more skilled.

4) The shifting balance of economic power away from workers and toward companies and management, resulting in income inequality and lower growth.

Robert Lucas, an American economist, once remarked, "Once one starts to think about (economic growth) it is hard to think of anything else (because) the consequences for human welfare involved are simply staggering." Industrialization and technological changes are the main drivers of economic growth and the above. These are also the likely reasons why the Fed's expansive monetary policy has not had a timely effect.

Industrialization

What is it about industrialization that in uniquely conducive to rapid economic growth? Almost all countries in the world want it. As described by Adam Smith in the 18th century and amplified by Henry Ford in the 19th, the industrial assembly line made semi-skilled workers just off the farm highly productive by splitting complex tasks, formerly performed by craftsmen, into small components that could then be optimized by time and motion studies. A 2000 Argonne National Laboratory study citation found that direct labor comprised only 6.5% of an automobile's price; it therefore supported 93.5% of other costs: jobs in engineering, R&D, advertising, accounting, dealers, transportation, profits, and (according to the labor theory of value) many jobs at other suppliers.

Due to its improvable labor and capital productivities, GDP/input costs, the industrial system has a high ability to produce wealth. But industries have departed the developed world in search of lower labor costs, leaving...as the British say, "redundancies." If you consider economic history, the industrial system first grew in England in the early 19th century, departed for America and Europe, then went to Japan and China, and now has set foot in Southeast Asia. This, we think, explains the failure of the median income of the U.S. family to improve because the economy's greatest source of productivity growth has migrated elsewhere. Theoretical equilibrium economics generally assumes the full employment of resources, and the ability of the economy to easily shift the factors of production (land, labor and capital) from one use to another.

Technological Change

In "Automation and Capitalism in the 21st Century," we cited three authors who suggest that the growth of automation and artificial intelligence is the major economic challenge we face. A 2/3/13 FT article writes, "With each month, the U.S. economy becomes steadily more automated. In January the U.S. economy added just 4,000 manufacturing jobs....Yet last month, manufacturing activity rose by its fastest rate since April, according to the Institute for Supply Management. The difference boils down to robots, which pose an increasingly nagging paradox: the more there are, the better for overall growth (since they boost productivity); yet the worse things become for the middle class. U.S. median income has fallen in each of the last five years." Left to itself, the neoclassical supply and demand economy will simply minimize costs until marginal cost = marginal revenue, oblivious of the consequences to a factor of production (workers). The future economy will provide fewer opportunities for the average American.

Since tastes and institutions (formed by politics) are external to markets, market fundamentalism, where private parties decide almost everything, fatalistically offers no management of large and changing economic forces that also include climate change. The U.S. has to adapt itself and its markets to an increasingly complex world outside its borders. Furthermore, because competitive markets tend to self-destruct, it is necessary for government to periodically level the playing field in favor of the average American. In the 19th century it was the Sherman Antitrust Act; in the 20th century it was the New Deal. Now, not only are livelihoods at stake, but also America's democratic political system. *

The growth of automation and artificial intelligence ** will eventually require asking how society is going to handle the basic economic functions of production and distribution.

* These high stakes justify a slight additional taxation on those who can afford it. In a consumer economy, if the middle class does well, so does everyone else.

** MIT director of the Center for Digital Business, Erik Brynjolfsson, succcinctly notes that machines are beginning to replace the human brain and asks what will be the role of humans in the future? That future may be a decade or so out. According to Moore's law, the computational capability of a computer doubles roughly every two years.

It can be argued that a drop in oil prices is, on balance, good for the U.S. economy because it gives consumers more spending money. It can be argued that European quantitative easing is bad for the U.S. economy because it weakens the Eurodollar and increases imports, as increased U.S. consumer spending flows abroad. In any case:

The stock market continues to be around 30% overvalued, at a 8% required rate of investor return that assumes a normalized Fed policy rate of (only) 2%, see our 1/1/14 comment for details. Until interest rates increase sufficiently add: or growth drops, our strategy is simply to preserve capital.

This is a good time to discuss the possibility of losses. Keynes was an accomplished value investor. He wrote, "My purpose is to buy securities where I am satisfied that the assets and earning power are there. My purpose is to buy securities where I am satisfied as to assets and ultimate earnings power and where the market price seems cheap in relation to these....The other day we were looking at our back records...to discover whence the satisfactory results. The answer seemed to be that...there had scarcely been a single case of any large-scale loss (our note: permanent loss of capital). There had been big fluctuations in market prices. But none of the main investments had, in the end, turned out otherwise than all right." *

Note that Keynes went for soundness, value and didn't care about market fluctuations. If you are a momentum investor or leveraged, then losses matter. The first downturn may not be the last; the markets are influenced by many factors that could align unpropitiously. For a value investor, the reaction is the opposite. If the price of a value stock drops, it is an opportunity to buy more. Note, this is not the same as "doubling down" a bet, which wagers only against a rudimentary statistical law of nature.

* J.M. Keynes, "Economic Articles and Correspondence: Investment and Editorial," Cambridge University Press, 1983, p.p. 82-83.

__

A Federal Reserve Board member discussed the effect of Europe's Quantitative Easing upon the markets. It's going to drive the dollar up, thus slowing the U.S. economy. He further added that he is concerned that the suddeness of Europe's QE combined with the Mideast oil price shock is going to add additional uncertainty.

The markets seem to be affecting matters quickly according to this perception. On 1/27/15, the Dow decreased 291 points (1.65%) because of a corporate slowdown, among other things. Durable goods orders fell 3.4%; Procter & Gamble reported that fourth quarter revenues dropped 4% and profits fell 31% (sic) due to its exposures to Russia and a short against the soaring Swiss Franc.

It is now likely that the 30% overvalued stock market will eventually become fairly valued (according to the Gordon model) - either because interest rates increase or growth decreases.

__

The continued improvement of U.S. employment suggests the former; interest rates will begin to increase because the Fed is first responsible for the U.S. economy. Mohamed el-Erian noted on Bloomberg, "(The Fed worries)...that the market is getting used to the concept that zero percent is normal. Zero percent is not normal; zero encourages excessive risk taking. They want to start normalizing interest rates, very slowly, but that is what they will do."

Since 2008, the financial markets have not been operating in a normal environment. Now, as the employment picture improves, the Fed is going to nudge them to act more typically.

The Fed will slowly begin to increase the policy rate (and thus long-term interest rates); but many international events can affect its timing and speed. The stock market will begin to adjust * around the normalized (present value) Gordon model.

* After 2008, we use the term "adjust" imprecisely.

__

This website is also about change. Although crucial, theories of economic equilibrium, actual or by formula, are well researched and somewhat less interesting because they are static, like a butterfly collection. What is more interesting to us (and investors) is how the forces of change are handled by societies - their institutions and habits - in political economies because markets left to themselves result in social chaos. Yale economist Robert Shiller writes about markets in the 2/7/15 NYT:

"There is a great deal that we don't know about market movements. Interest rates and prices generally reach extreme levels when there is an unusual confluence of many precipitating factors, like anxiety, and others as well. We are usually puzzled by this multiplicity."

And, because markets (our note: Mr. Market) are really not very efficient, the effect of these varied factors tends to be amplified through emotional feedback. For example, when people start to see rates or prices changing, some of them take action: They are enticed into the market when prices are rising, and often leave when prices fall. We then are typically surprised by the events of apparent market overreaction to precipitating factors that we didn't think were really on everyone's mind."

Value investing requires both logic and optimism.

............................................................↓ WE ALSO SUGGEST THE FOLLOWING: ↓

3/1/15 -

Stock investing requires that logic and emotion be in the same direction. If they differ, then the best judgment is not to act.

About Logic: On 2/24/15 Fed Chair, Janet Yellen, testified before the Senate Banking Committee and laid the groundwork for the first of a series of interest rate increases. To maintain economic growth, these increases will likely be very slow and highly conditions dependent.

How will these increases affect the stock market? We begin by asking how these increases will affect the treasury bond market. If the 10 year treasury bond yield is 2%, an 1% increase in the yield will decrease the bond price by 9%, or 4.5 years of interest. Low interest rates are especially adverse to bond investors, when interest rates increase.

At least initially, interest rate increases could have a lesser adverse effect on the stock market (due to expected earnings growth) and a subsequently larger effect (due to an increase in the cost of capital). The Fed currently assumes a policy rate of 3.63%-3.87% by the end of 2017 (Monetary Policy Report 2/24/15, p.49). That Fed funds rate, which may or may not occur, could cause a substantial correction in the 30%+ overvalued stock market. The financial futures market currently expects a Fed policy rate of around 2% then.

We would invest in the present stock market only if we thought that the Fed's policy rate will remain at zero for many years (which it won't).

About Emotion: It has been difficult to remain aside while the stock market soars to new highs. The U.S. economy is beginning to improve.

We hope our readers will consider the logic of market circumstances.

On 3/6/15, after a report indicating a 295,000 February U.S. payroll growth, the 10 year treasury dropped by 1.13%; and the S&P 500 dropped by 1.42%. In the future, it is quite possible that changes in the S&P 500 will begin to track significant changes in the price of the 10 year treasury.

4/1/15 -

The Fed will likely begin a

liftoff of interest rates sometime this year; what will be their trajectory and

effects on the financial markets?

On March 23, 2015 Fed Vice-Chairman, Stanley Fischer, gave

a significant speech at the Economic Club of New York. In that speech, he

outlined the most important reasons why the Fed will raise interest rates, and how:

1) The unemployment rate, at 5.5% in February, is nearing estimates of its natural rate...Beginning the normalization of monetary policy will be

a significant step toward the restoration of the economy's normal dynamics, allowing future monetary policy to respond to shocks without recourse to

non-conventional tools (such as interest rates at the zero bound and

quantitative easing).

2) A number of potential costs might be associated with

unconventional tools When interest rates are extremely

low, risks to financial stability might grow.

3) Despite monetary stimulus, the recovery

from the financial crisis had been more sluggish than we had expected.* The slow

recovery provides more evidence that severe financial crises have long-lived

effects, as Reinhart and Rogoff have documented.

4) As liftoff approaches, we need to think also about what will happen next....discussion of monetary policy needs to begin to shift to the future path of interest rates, and thus to the basis on which the FOMC will set interest rates followng liftoff....One might even look back to the period from 2004-2007 and conclude that the FOMC will raise interest the fed funds rate by 25 basis points every meeting...

I know of no plans for the FOMC to behave that way. Why not? Isn't that what the calculation of optimal control paths shows? Yes. But a smooth path upward in the federal funds rate will almost certainly not be realized, because inevitably the economy will encounter shocks (Isaiah Berlin noted the contingent nature of history)--shocks like the unexpected decline in the price of oil, or geopolitical developments that may have major budgetary and confidence implications, or a burst of greater productivity growth, as the Fed dealt with in the mid-1990s (This is error-correction)....The two sure elements of forward guidance that the FOMC will be able to offer after liftoff are that monetary policy will continue to be aimed at fostering the Committee's dual objectives, and that will be data driven.

Mr. Fischer's comments have implications for the behavior of future stock bond prices. Interest rates will increase but slowly, thus the add: bond market downside due to Fed policy alone might be limited. But, the low profit potential of the U.S. stock market is due to its overvaluation at normal interest rates.** At present, stocks and bonds are no great buys; and the restoration of 4-5% low risk savings returns will take some years. Income investors might take a number of measures that include: individual medium term corporate bonds of decent quality to earn at least some income; investing again in fewer gas pipeline limited partnerships, if there is a change in current industry conditions; and considering other income assets when appropriate.

Add: An interesting question is how a slow increase in interest rates will affect the U.S. stock market. Our research indicates that the stock market will likely not respond in the same way as the bond market to the gradual pace of interest increases.

* A reason for slow growth is the lack of appropriate fiscal spending by an ideological Congress. In the 3/30/15 Time Magazine, Rana Faroohar writes, "The problem has been brewing for decades, as loose monetary policy has become the fallback position for governments that don't want to do the hard work of training a 21st century workforce, paying for new infrastructure or coming up with smarter, less consumption-based means of growth....In lieu of more political action to address the root causes of slower growth, central bankers felt they had no choice but to keep the money spigots on."

** At a normalized interest rate, assuming a 4% ten year treasury. It's only 1.88% now.

__

Former Fed Chairman, Ben Bernanke, has started blogging. In his latest post, he explains why interest rates are so low. Real rates are low around the world because the equilibrium real rate has dropped (the world economy is caught in a Keynesian liquidity trap). He will discuss why this equilibrium rate has dropped in future posts.

A return to normal interest rates will require economic reforms that result from a political consensus. As these low interest rates have proven, the private sector alone can't create growth. Government "in the way" is not the cause of low growth. (Are all governments around the world, "in the way?") Economic growth also requires long-term investment that isn't being provided here either by government or the private sector.

5/1/15 -

The future path of Fed policy rate increases will likely be moderate. In March, the economy added only 126,000 new jobs, below the 260,000 monthly average of the prior year that is more normal. Concluding a possible slowdown, the S&P 500 - it's mind unconcentrated by the prospect of immediate interest rate increases - rallied to a record of 2126. The exact path of the Fed's policy rate increases, beginning in June or later in the year, will be "data dependent."

Beyond the immediate, the 4/11/15 Economist cites a survey that found 70% of American companies plan to increase wages at least 3% a year from March. The economy is beginning to return to normal; and, eventually, so will interest rates.

The long-term bond and stock markets will likely be affected by moderate Fed policy rate increases over the next few years. The IMF's April, 2015 Global Financial Stability Report estimates, although macreconomic risks are broadly unchanged since October, market and liquidity risks have increased. The report states, "Asset valuations remain elevated relative to the past 10 years as monetary policies continue to exert downward pressure on spreads." But both the Fed and the IMF are preparing the markets for decreased liquidity, as the punch bowl is trundled away.

We will later discuss an IMF paper on asset management that clarifies the time horizons of the different investment strategies and explains recent market behavior.

We will also discuss what we're doing and why.

6/1/15 -

add: The S&P 500 closed at 2,111.

On 5/22/15 Fed chair, Janet Yellen, gave a speech, stating that she expects the Fed to raise the policy rate this year in a gradual manner depending upon the economic data. "It will be several years before the federal funds rate would be back to its normal, long-run level."

It is very abnormal for a capitalist economy to be operating with the policy rate at the zero bound for many years. The Fed views the recent economic slowdown as "transitory" due to increasing housing prices, fiscal actions of government that are no longer a drag on economic growth and the expected growth in foreign economies due to central bank policies that, "generally remain highly accommodative." Thus, as U.S. economic growth is expected to remain at a "moderate" level of 2-2 1/2%, the Fed will, "at some point this year...take the initial step to raise the federal funds rate target and begin the process of normalizing monetary policy."

This is the appropriate action, noting that the Fed's dual mandate is to control inflation and to foster growth in the real economy that is relevant to most Americans. But the restoration of growth may cause turbulence in the overvalued financial markets. The reason is the price sensitivity of both bonds and stocks to increased interest rates. If the policy rate increases very moderately over the next three years from 0% to 2%, assuming a parallel shift in the yield curve, the drop in the value of long-term assets will be noticable. This is likely why some excellent investors place their own assets in cash.*

The Fed's Open Market Committee meeting of April 28-29 was notable for the fact that it started and ended by discussing "Normalization Procedures," during the period immediately following the first increase in the target range for the federal funds rate, that include more frequent updates of market behavior. Policy normalization tools (such as providing more market liquidity, managing communications and influencing the prime rate spread) could then be adjusted to maintain control of money market rates. The policymakers also, "highlighted possible risks related to the low level of term premiums. Some participants noted the policy that, at the time when the Committee decides to begin policy firming, term premiums could rise sharply..."

* During a period of increasing interest rates, long-term income assets will depreciate. If events proceed as the Fed projected in March, the policy rate beyond 2017 will be between 3.5% and 3.75%. It will be better to stay short and reap the benefit of increasing short-term rates until 2018.

But if economic growth continues to remain low, then an income strategy involving MLPs to a moderate degree might be appropriate.

The Fed is going to hike interest rates in a "data dependent" manner. We would like to see what will happen to economic growth as interest rates increase, and then act accordingly, from the base case in the first paragraph. Current financial conditions are unprecedented.

__

In May, the economy added 280,000 new jobs, a large increase from April's rate of 221,000. This places the Fed on track to start raising interest rates, maybe in September. Then what? If rates rise slowly as far as the eye can see, everyone will pull out their present value calculators and then all the financial markets, except the dollar, will experience negative acceleration.

The key question is whether real U.S. economic activity can accelerate when the rest of the world's does not. If it can (domestic consumption accounts for 68% of GDP and domestic economic growth has its own momentum), then interest rates will increase continually. If the economy can't accelerate (foreign monetary policies are not too effective and the dollar increases), then interest rates will increase only to a degree and stall out. In that case, income assets bought at the right time would be appropriate.

We tend towards the first scenario and will likely buy just a few income assets.

............................................................↓ WE ALSO SUGGEST THE FOLLOWING: ↓

7/1/15 -

On 6/25/15 the S&P 500 closed at 2102. Investment income offers both an interest rate and safety of principle. In years past, a bank savings account paying 4-5%, with the option to withdraw principle immediately, was the prototypical income asset. With short-term interest rates at the zero bound and the Fed beginning to tighten, there is no safety of principle.

The reason for this is expressed by the concept of duration, which applies mainly to bonds and which can also be extended, with qualifications, to stocks. A 1% change in a bond's yield will cause the price of a bond with a duration of two years to change by 2%. At current interest rates, the duration of a 5 year treasury is 4.7 years; the duration of a 10 year treasury is 8.8 years. Standard and Poors applies this concept to equities which, unlike bonds, have uncertain dividends and terminal values. A 9/10 S&P research paper suggests three ways of calculating equity duration.The flow-through duration method that S&P finally uses is, "intended to suit the purposes of long-term asset allocation involving rebalancing every three years or more..." because it includes the long-term variable of dividend growth.

At the June, 2015 FOMC meeting, the participants discussed "the removal of policy accomodation". We used their median estimate of the policy rate, reaching 2.75% by the end of 2017. A S&P 500 duration of 15 years is a key assumption we make from the S&P analysis.We also assume a parallel shift in the bond yield curve.

Our analysis indicates there could be a loss of principal exceeding 30%. This analysis complements our previous contention that the U.S. stock market is overvalued by around 30%. Changes in long rates are responsible for both these conclusions, but their effects on the S&P 500 are derived from different models. Concentrating on Fed policy, we do not discuss foreign events, which of course have effects.We obviously think present risks outweigh likely returns.

The idea that portfolios can always be configured to the risk tolerances of the owner is true only in placid Gaussian markets; and as we have elaborated, the U.S. stock market is not Gaussian. Which leaves us with a problem: what if investors need income for the next few years? All bonds and stocks will eventually experience at least a short-term loss of principal if interest rates rise. To qualify as income, in our mind, an investment must reasonably promise to return original principal in at least 5 years. But simply buying a 5 year treasury won't produce meaningful income because its current yield is only 1.59%.

Since short-term rates will increase, the best thing to do is simply to let an investment portfolio increase by 4% or so for the next 2 1/2 years (according to FOMC estimates) from accumulated interest. During that time, both the bond and stock markets might overeact.

__

We held only two pipeline MLP partnerships: one has a substantial exposure to shale oil and the other does not. In spite of the tax consequences, we sold the former and kept the latter.

__

The U.S. bankruptcy code seeks to rehabilitate the debtor, by reforming the company and writing down its debts to manageable levels. In the last round of international negotiations, the Greeks have shown they do not want to endure years of further IMF austerity. Similar reforms were successful in Asia in the 1990s because, unlike Greece, the Asian economies had export industries that could earn foreign exchange, benefiting from the economic slack created by austerity. This article attributes Argentina's rapid economic recovery after default to its export sector. It also stresses the importance that the present situation be "organized." On their part, the Eurozone government creditors, due to their own political constraints, have been unwilling to write down debt to sustainable levels.

The Greek negotiations have been fraught with name-calling by radical Prime Minister Tsipras and his finance minister, a game theory expert. This has been met, most predictably, by even more creditor intransigence.

The goal of both parties should not be, justice, but solving the problem of returning a credit-worthy Greece to the debt markets by appropriate reforms and writedowns. Prosperity is mainly caused by the productivity of industrial growth and the export of tradable goods, not just by flipping real estate and paper. The major role of the dollar enables the U.S. to run large permanent trade deficits, to the detriment of its industries, skills and pay levels. Greece has no such option, and the world could now see the tragic real consequences of a financial breakdown. We suggest this article by Mohamed El-Erian.

Greece requires additional support of its financial system and a reformation of its economy. It is much better off within the Eurozone.

7/6/15 -

In a popular referendum, the Greeks voted against proposed Eurozone reforms. Nonetheless, the financial fates of Greece and the Eurozone are still intertwined. Neither party wants the situation to entirely fall apart because the Greeks will lose access to the Euro and then, according to the 7/6/15 Barrons, about 335 billion in Eurozone guarantees of Greek debt will have to be funded - somehow. Of that, around 145 billion is located in the European Stability Mechanism, which is a SIV (if our readers remember what happened to those in 2008). Europe has a choice of funding massive loss guarantees now, or giving Greece some debt relief and funding limited yearly losses in the future.

The Eurozone's negotiating strategy is letting the Greek government make the next offer; that offer had better be close to acceptable. Athens has to keep its banking system from rapidly unraveling. Both parties are under great pressure to settle.

__

All parties ought to try their best to keep Greece within the Eurozone. In his history, "Global Capitalism, p. 196" Jeffry Frieden (2006) writes:

"(During the Great Depression) One after another semi-industrial country embraced the new economic nationalism. Romania and Mexico, Argentina and Japan, Italy and Russia all rejected the (international capitalist) gold standard, imposed prohibitive trade protection, tightly controlled foreign investment denounced foreign bankers and the debts they were owed, and force-marched modern industrial growth. An entire stratum of the global social structure-the middle class of nations, neither rich or grindingly poor-moved along a path that was a great and sometimes violent variance with that of western Europe and North America.

One needs to know only one thing to determine whether a country moved toward autarky and authoritarianism or remained economically open and democratic: whether it was an international debtor."

It would be most short-sighted for the creditors to push Greece over the brink; it is strategically located at the boundary between Europe and increasingly tumultuous regions. It would also be impolitic for Greece to overplay the cards it has.

__

In what has been described as a "Torture Summit," the Eurozone (effectively the Germans) demanded and obtained from the Greek government a set of Draconian measures that, on paper, would result in a large primary surplus that will enable Greece to repay its restructured debts, without writedowns. These measures, "to rebuild trust" must be enacted as "minimum requirements to (re)start the (financial) negotiations with the Greek authorities." These measures, to be monitored by the IMF, include:

1) The streamlining of the value added tax system and the broadening of the tax base.

2) Pension reform.

3) Introducing quasi-automatic spending cuts in case of deviations from ambitious primary surplus targets. (The Eurozone wants to be repaid, further noting "a remarkable set of measures" by creditors in restructuring Greece's debt obligations.)

4) Developing a scaled up privatisation program.

5) Valuable Greek assets (maybe the Parthenon?) transferred to an independent fund for monetization.

6) Strengthen the administrative capabilities of the government.

7) Consulting with the Eurozone on all draft legislation in relevant areas.

8) Enacting other economic reforms.

We don't see how all these reforms are possible at once (even the IMF has advocated debt writedowns in place of more austerity). This agreement reminds us of the post W.W. I Treaty of Versailles, that the Allies imposed upon Germany - in order to extract reparation payments.

8/1/15 -

On July 29th, the Fed concluded its Open Market Committee meeting noting, "The Committee expects that, with appropriate policy accomodation, economic activity will expand at a moderate pace, with labor market indicators continuing to move toward levels the Committee judges consistent with its dual mandate."

This assessment places the Fed on track to increase rates for the first time since 2006. A gradual but conditional series of rate increases is appropriate for the real economy when rates are at the zero bound and some economic growth has been restored; but a) The civilian labor participation rate is at a historic low of 62.6% b) The economy has not grown at a rate exceeding a noticable 3% in any of the past ten years.

What does the likely slow pace of interest rate increases imply? An investment in equities would be appropriate if the effect of S&P 500 earnings growth exceeded the effect of interest (discount) rate increases. Using the duration model, if the yearly S&P 500 earnings were to increase by, say 4% (2% real + 2% inflation), then the maximum tolerable yearly equity discount rate increase would be 4%/duration of 15 = .26% - without changing the price of the S&P 500. This is a very small tolerable increase in rates.

What really matters to the Fed is the performance of the real economy, not the performance of the markets, unless they have to be rescued. This is generally true; judgment is knowing when to act and when not to.

__

The economic statistics above indicate that the U.S. economy needs restructuring. The solutions go way beyond a simple laissez-faire mantra, "Too much regulation." In an increasingly complex world, the solutions have to be reasoned and realistic in context; not acted out of frustration.

__

There is always a debate in the U.S. about more or less government. We don't think that is the crucial issue. There is a role for both at different levels. a

A major role of government, the Constitution says is to, "promote the general Welfare," e.g. to construct and maintain the infrastructure that makes possible I-80 from coast to coast, to conduct the scientific research that resulted in the Internet, to promote foreign trade, to provide for the education of the next generation and to supply appropriate regulation. It is the role of private enterprise to make things happen in the short-term, for instance to translate government research into specific new products and services that people want.

Businesses are now concerned with next quarter's profits; they do not do basic scientific research, with its uncertain payoffs far into the future. It is notable that the transistor, which became the basis of the digital economy, was developed by Bell Telephone Laboratories, funded by AT&T's monopoly profits. Fit that with an untrammeled market fundamentalism.

Another example: On 7/31/15 the World Health Organization announced an Ebola vaccine that has been 100% effective in trials, with financial contributions from foundations and from the governments of Norway and Canada. The Canadian government is the original developer, and Merck is the manufacturer.

Effective government and efficient businesses are both important.

8/14/15 - (add: The S&P 500 closed at 2091.54)

A 4.4 % managed depreciation of the Chinese yuan in the last three three days was meant to counter that country's 2015 decrease in exports. The U.S. stock market will likely decrease due to foreign earnings deterioration, a possible increasingly moderate series of Fed discount rate hikes, or both. Rather than saying we knew the depreciation of the yuan would happen all along, it would be more accurate to say that the slowdown of China's economic growth, manifest by decreasing world commodity prices, also made us cautious.

The depreciation of the yuan might also have knock-on effects on the exchange rate policies of other countries resulting in competitive currency wars. In this complicated environment where many events have to play out, it is easier to simply take a valuation approach and say we'll buy stock when the investment margin of safety is adequate.

Is our valuation methodology to determine this margin of safety realistic? We did a valuation of IBM stock, assuming the company had already been turned around by the cognitions of Watson (tm). The company would then be valued close to an adequate 33% margin of safety, if present operational risks were not present. If many GARP (growth at a reasonable price) stocks had around a 33% margin of safety and carried only a minimal operational risk - that would be a buy signal. At current stock prices, the only way to get an adequate rate of equity return is to take a lot of operational risk, which would not be a good idea.

add: A stock market momentum trader said one of the few things we agree with. The reason to have investment rules is to make sure that you don't get wiped out on the downside. The problem with winging it, as would be the natural tendency, is that Mr. Market can swing wildly when you least expect it.

............................................................↓ WE ALSO SUGGEST THE FOLLOWING: ↓

9/1/15 -

On 8/21/15 the S&P 500 dropped to 1971, a drop of -3.19% in one day. There are two general things to note from this selloff:

1) Markets do not behave with Gaussian symmetry. The slope of market increases is more gradual than the slope of market decreases.

2) It is often not one thing that causes a market effect, but several acting jointly. That is why, if you consider macro factors, you have to keep an eye out for at least several foreign developments that might occur. For the sake of simplicity, you might collapse the above to a single factor, but in so doing you give up interesting social details for the reductive simplicity of an equation that reflects, at best, the partial truth of the situation.

Take an analysis of the current downturn. The 8/21/15 CNN attributes this to three main factors:

1) Concerns are growing that China's economy is slowing down faster than government says.

2) Investors have been preparing for the U.S. Federal Reserve to raise the benchmark interest rate in reponse to increased employment.

3) Oil prices dropped below the $40 level.

These facts taken in tandem allow us to predict suggest that the duration of this market downturn might be prolonged because its causes are likely to be long-lived. China's economy is the second or third largest in the world with large as yet unsolved structural problems. The Fed is likely to raise the benchmark interest rate very slowly, providing a constant if now minor headwind. The 8/11/15 U.S. Energy Information Administration report predicts that in 2016, the world production of oil will continue to exceed world demand, adding to massive existing oil inventories which continue to depress prices.

Contrast this analysis with a reductive, single-factor analysis that says because the dollar is the international currency, the mere expectation of a Fed rate increase is causing a flow of capital away from the emerging market countries. This analysis might be partially true, but it does not allow us to conclude anything about timing which requires an analysis of significant local national situations. For stock investing, a description of asset price levels is sufficient; but to determine overall portfolio policy, some indication of timing (if possible) is also necessary because that will usefully determine portfolio bond maturities.

8/24/15 -

The stock market rout continues. The S&P 500 closed at 1893. We began to move our portfolios from cash into 5 year corporate bonds of A or better credit quality, yielding 2.24% to maturity. (At least its not a 1.39% treasury.) As we indicated above, the equity correction might have a way to go. We will complete our bond purchases after the Fed's September 17th meeting.

Usually, stocks are for growth and bonds are for income. Under present conditions of overvalued equity and bond markets, our investment policy is simply to do what is the most practical and the least risky.

Our portfolios will eventually be around 50% bonds and 50% stocks. Bonds will place our portfolios in a holding pattern, and stocks will be for capital appreciation when values appear. If you are interested in this strategy, we suggest you talk with qualified investment professionals: ask skeptical questions, watch out for dodgy credits (bond ratings are only a very general guide) and high fees. They should be able to recommend specific bond issues whose duration risks decrease with time, not bond mutual funds whose duration risks don't.

__

"In economics (i.e. markets), things take longer to happen than you think they will, and then they happen faster than you thought they could."

............................................................................................Kenneth Rogoff, Professor of Economics, Harvard, Quoting

__

8/26/15 -

We completed our bond purchases today. A .25% contemplated rate hike in September would very likely have no impact on the real economy. But, during a time of market turbulence, it could have symbolic import - signalling the commencement of a prolonged series of further rate hikes (conditions depending). The Fed might not want to give such a signal at this time, so we completed a purchase of corporate bonds maturing in 5-6 years, yielding between 2.24%-2.31%. It will be very interesting to see what happens in the equity markets.

The highly unlikely risk to this investment strategy is that inflation gets out of control. Discussions in Washington about deficits are highly politicized, presenting extreme-case choices and that often relate to identity politics. Here are two extreme cases:

1) A 2015 Federal Reserve Bank of St. Louis study of monetary policy choices notes, "...the No Credibility model has terrible implications for the post crisis period. The time-series properties of this (inflationary) regime strongly recommend against it as a policy choice...Worldwide, this policy regime has been seen in countries that lose control of their federal government budget process. Losing the ability to curb spending or raise taxes, such governments print money to pay for spending."

2) The other extreme has placed all the burden of reviving business growth upon monetary policy. The problem with this alternative (which we here note) is that interest rates at the zero bound have sluiced liquidity into the overpriced financial markets, not affecting the real economy - that has been afflicted by deindustrialization, technological and social trends. IT'S NOT EXCESSIVE TAXES OR REGULATIONS.

The way to get out of the second dilemma is to avoid the first. The way out is to restore balance by well-targeted federal spending on: scientific research to increase productivity, useful infrastructure and programs that counter the trends mentioned in (2). Low economic growth is not restricted to the U.S. - The Tea Party could note.

10/1/15 -

Static equilibrium economics does not allow for markets and their volatility. Because the intersection of supply and demand curves guarantees that the amount supplied always equals the amounts demanded, economies can never get out of balance. Furthermore, since all factors of production are pushed to the level where their marginal efficiencies (profits/price) are equal and also equal to the rate of interest, economic outcomes in a complicated economy cannot be improved by anyone.

In the real world, however, evolved national economic structures matter:

1) Economic slowdowns are caused by growing economic imbalances.

2) The major imbalance between supply and demand will reduce the prospects of world-wide economic growth. It is trite but true to say that this imbalance must be corrected by increasing production and jobs in the U.S. and increasing consumption in Asia. But it is no easy task because a nation's economic structure is highly influenced by government actions, politics and history.* Regarding Japan, Francis Fukuyama (2012) writes, "...little progress has been made in increasing levels of consumption or reducing the productivity gap between export-oriented industries and the rest of the economy."

3) The current crisis differs from 2008, the latter involved the U.S. financial system and was therefore systemic. The current crisis, emanating from China, involves the issue of supply and demand like the internet bubble of 2000. Asian manufacturing, now in excess, produces almost half of the world's goods; but a large proportion of consumption demand has been located in the developed world. Unemployment in the developed world was a problem due first to job export. Then the larger forces of technological change and the de-skilling of the workforce gathered momentum, becoming the primary causes of unemployment.**

To sum up; because economic growth is usually path-dependent, it is possible for economies to proceed along the wrong path. That is why many now need restructuring, to produce more economic opportunities; low interest rates alone are not effective. A diagnostic question: Why aren't there more 15%-20% annual return investment projects in the U.S. economy? Current U.S. politics concerns itself mainly with the symptoms rather than the causes.

* This 9/8/15 FT article discusses why more than interest rates matter. As broad economic structure evolves, the resulting new opportunities create new investments and thus jobs.

The CFO of the German firm, Siemens, discusses why company built a new 200M Euro wind turbine plant. "...[jobs] were not created because interest rates are low...Investments are driven far more by assumptions about growth, potential profit and technological barriers to entry, rather than movements in interest rates...We don't decide to spend more just because interest rates are lower for a couple of years."

Mohamed-El-Erian: "While central bankers knew there would be a lag between...the resulting boost in financial assets feeding through to real economic activity, they didn't anticipate that the lags would prove so stubborn and last this long."

"First, the west had invested in the wrong growth model, overemphasizing finance rather than real investment. (This model produces a lot of paper, purportedly to control risk, that is traded back and forth among very few large financial institutions. As we discussed in 'Financial Engineering and the Banks,' this activity is 'accident-prone' and its benefits few.)

Second, national and regional inequality matters as it drives a wedge between the ability and willingness to spend. (Creates imbalances.)

Third, firms don't invest when there is excessive indebtedness. (This may be less so, as large U.S. companies have been using their excess cash-flow to repurchase stock and make acquisitions, not investing in new projects creating new growth.)

Fourth, if the architecture is incomplete - as it is in the eurozone - this in itself undermines economic recovery and lift-off. (The eurozone is now developing monetary controls; but it has no way of correcting for regional differences by transferring resources, as the United States does.)

The article further cites a capital budgeting problem, "...it's very difficult to find projects where you can still earn the (15%-20% weighted average cost of capital) in the forseeable future."

** John Gray; False Dawn; New Press; N.Y., N.Y.; 1998; p. 84. Mr. Gray was a political philosophy professor at the London School of Economics. He has written on Isaiah Berlin. add: This book essentially argues, that through the operation of the economic law of one price, mass-production jobs aren't coming back to the U.S. when producers can take advantage of cheaper foreign labor, due to the mobility of capital and production. A WSJ article, however, notes that foreign textile mills are doing some relocation and hiring in the U.S., to take advantage of: 1) decreased wages 2) increased automation requiring higher skills 3) to get around prospective tariff barriers. The creation of new jobs in the U.S. depends upon costs, the degree of automation and (admitting it) the existence of some trade barriers - which are subject to intense negotiation. Government, that is collective power, also exists to get the best overall deal possible from the trade partners.

Particularly with increased economic interdependence, the best results are achieved by negotiation rather than by the autopilot of ideology.

__

The U.S. stock market is theoretically valued by the Gordon Model which states that P = E/(cost of capital- growth). Consider only the terms of the equation. In the future, 1) the cost of capital might increase slightly due to Fed action, not important for real investment but maybe noticed by the financial markets. 2) the unobservable expected growth will likely drop.

In the meantime, an excellent 8/28/15 WSJ article advises that, "Buying the Dips Doesn't Work for Everyone," particularly with overvalued markets in a low-growth economic environment.

"A 30-year period in which the stock market drops in the beginning and rises toward the end can have the identical average annual rate of return as a three-decade period in which stocks rise at the beginning and fall at the end. But the results will be drastically different. (Because investors should also consider "sequence risk.")

Let's say you're in your 20s. At this point, your 401(k) and similar accounts hold only a small fraction of the total retirement savings you'll accumulate over your working lifetime. Meantime, the money you can add each month while stocks are down is sizeable enough, as a proportion of your total assets, to add a noticeable boost to your wealth if stocks eventually recover.

Now imagine that you're in your late 50s. You already amassed nearly all of your lifetime retirement savings, and the amount of money you can use to buy more stocks at bargain prices is a pittance in comparison to what you will lose on the stocks you already own.

The 20-year zone centered on the age of retirement - from around age 55 to 75 - is when 'the greatest amount of your capital is likely to be exposed to sequence risk...'

A final straw: Once you do retire, you might have to fund your expenses at least partly by taking money out of your stock portfolio. If those withdrawals coincide with falls in the stock market, you are effectively 'selling on the dips and locking in all the losses...Even if the market recovers, your portfolio can't recover at nearly the same rate, because you've already taken that money out of stocks, and it's gone forever.'"

Investors should always be careful; particularly as they approach retirement.

__

10/5/13 - Concerning the real economy, the September report of only 142,00 additional jobs, versus 201,000 expected, has reduced market expectations that the Fed will be able to increase interest rates soon - not that a 25 b.p. increase would make much real difference. But concerning the symbolic economy, that is the markets, the argument for increasing rates somewhat, after nearly 7 years of rates at the zero bound, is stronger. The main reason is to give monetary policy the ability to lower rates, at least symbolically, if the economy should turn down again. Another, as the Bank for International Settlements suggests, is to avoid further speculation in the financial markets. The extent of that speculation is unknown, but likely quite high; better now than never. Both the markets and the real economy can become addicted to easy money, which should not continue for a very long time.

__

10/12/15 - Many of our readers are not in finance. It is therefore appropriate that we provide them with a general solution (that is to provide them impersonal investment advice per SEC regulations) to transition them to an inexpensive minimal attention strategy that is appropriate.

To discuss where we are now. The overvaluation of debt and equity markets and the likelihood of at least some increase(s) in the Fed's policy rate, argue for an investment strategy that will preserve capital. Here is where investment advisors can lead their clients astray. Taking excessive risk in order the earn more (apparent) income is a very bad strategy. It was partly responsible for the Financial Crisis of 2008. Our present strategy is to place our portfolios in a holding pattern; perhaps adding a Master Limited Partnership, as risk equity not for income, when appropriate.

With this as a basis, we will then add both value stocks (which are really our concern) and a S&P 500 index fund (which you might consider) when we think appropriate, no guarantees. Unless you are really interested in companies and stocks, you shouldn't invest in them. We will discuss the S&P 500 index fund, as an investment, in the future; there will likely be a lot of time to do so.

__

10/16/15 -

IBM's Watson ® excelled in the quiz game, Jeopardy. We attended an IBM conference to find out what it was all about, particularly whether Watson could predict the U.S. stock market. We were told, no. Watson can identify (likely ephemeral) market correlations, can apply thirty quantitative prediction models; but because the market environment is so complicated, the human interpretation (of events) is necessary. Watson will likely do well when playing games against a fairly fixed but accumulating body of knowledge, such as found in the sciences and elsewhere.

IBM has the ambition of turning Watson into an artificial intelligence operating system for cognitive computing, that is creating computer systems that can learn.

11/1/15 -

The September meeting of the Federal Open Market Committee reaffirmed previous expectations that inflation will gradually rise to 2% as the economy improves and that the economy will expand at a moderate pace. In September, employers added only 142,000 jobs; but unemployment was at a seven-year low of 5.1%, although the participation rate was only 62.4%. The present performance of the U.S. economy is highly mixed.

Absent a large adverse market reaction, a Fed increase of the policy rate of .25% will very likely have no effect on the real economy and help keep the bond, stock and real estate markets from departing further from their fundamentals. "The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen some further improvement in the labor market...(which might dampen that adverse reaction)"

__

If you have bought a bond above a par of $100 and hold it in a taxable account, you should seek the help of an accountant to determine the bond amortization premium, to be deducted from the figure your brokerage firm reports to the IRS on the 1099-INT. If you are concerned about the additional cost, we hope you will take solace in the fact that bond mutual funds charge an average of .7%/year, a high figure usually covered by taking a lot of credit risk compared with holding actual A or better bonds.

The true income of a portfolio holding actual bonds is equal to its yield to maturity, at the actual time of purchase. Its not the 1099-INT reported income.

In October, the economy added 271,000 new jobs and the unemployment rate dipped to 5%. This employment report figure virtually assures that the Fed will raise interest rates, maybe by 25 basis points, in December. Of interest is the anticipatory shift of the 5 year A bond yield from 2.06% last month to 2.35% now, a 29 basis point increase. This parallel yield curve shift signals to us that the markets can bear such a Fed rate increase.

12/1/15 -

In 1929 the famous economist, Irving Fisher, said, "Stock prices have reached what looks a permanently high plateau." One week later, the N.Y. stock market crashed, initiating a sequence of events that led to the Great Depression.

Seven years after the Great Recession of 2008 we ask whether, "Bond prices have reached a (more-or-less) permanently high plateau." Laubach and Williams (2015) of the Federal Reserve System suggest the strong possibility that interest rates will remain low for many more years. This has consequence for future investment policy. We condition the following remarks on the absence of adverse events in the Mideast, affecting the world's oil supply.

In the words of the authors, "Since the start of the Great Recession, the estimated natural rate of interest fell sharply and shows no sign of recovering. These results are robust to alternative model specifications. If the natural rate remains low, future episodes of hitting the zero lower bound are likely to be frequent and long-lasting." They then define the inferred natural rate of interest as, "...the real short-term interest rate consistent with the economy operating at its full potential once transitory shocks to aggregate supply or demand have abated. Implicit in this definition is the absence of upward or downward pressures on the rate of price inflation relative to its trend. Our definition takes a 'longer-run' perspective, in that it refers to the level of real interest rates expected to prevail, say, five to 10 years in the future, after the economy has emerged from any cyclical fluctuations and is expanding at its trend rate."

This definition is the long-run characterization of short-term interest rates (to be perfectly clear), given 1) Productivity growth 2) Demographics 3) The evolution of the global economy. This long-term causal view of interest rates is more useful than the simple view that Fed policy rate is a short-term tool to accelerate or deaccelerate the economy. The authors use a model to determine the natural rate of interest:

rt* = cgt* + zt

where: rt* is the natural rate of interest, gt* is the estimated trend growth of potential GDP and zt is all other factors including demographic growth and the evolution of the global economy.

Although the model is simple, its estimation involves a complicated statistical technique that relates predicted interest rate changes to the deviation between the predicted economic output gap and actual. The predicted output gap is in turn informed, among other things, by the lagged output gap and movements in the relative prices of oil and non-energy imports.

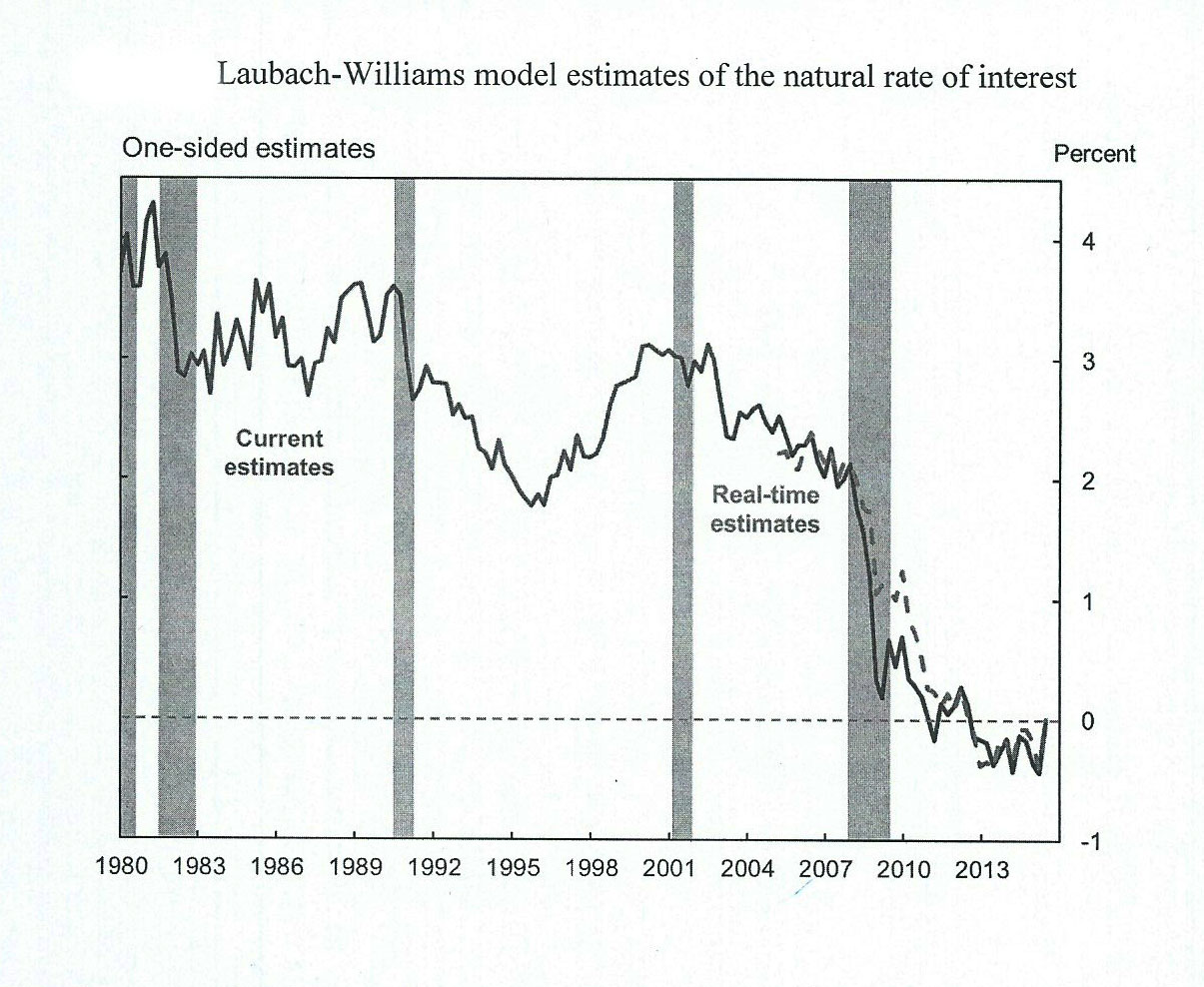

This interest rate model estimates, "...two periods of significant declines: a moderate secular decline over the two decades preceding the Great Recession, and a second, more substantial decline during the Great Recession (Williams 2015). The following figure shows the model estimates of the natural rate of interest from 1980 through the first half of 2015. As measured by this model, the natural rate was around 3-1/2 percent in 1990. It fluctuated but exhibited downward trend reaching about 2 percent in 2000, right before the Great Recession, and then continued downward after."

"This represents an unprecedented decline and an historical low level of the natural rate over the past half century for which we have estimates....Even with the economy (now) mostly recovered from the recession, there is no sign of rebound in the natural rate of interest. This pattern of declining natural rates of interest is also seen in estimates implied by economic forecasts and yields on Treasury inflation-protected securities (TIPS)..." as seen in the following Table 1 from the study which describes the decline in the estimated natural rate for 1990-2007 and 2007-2015.

| 1990 | 2007 | 2015H1 | |

|---|---|---|---|

| Blue Chip Survey | 3.1 | 2.4 | 1.2 |

| TIPS Yields | n/a | 2.5 | 0.9 |

| Laubach-Williams | 3.4 | 2.1 | -0.2 |

The authors write, "While it is not possible to ascertain the reasoning behind the changes in the Blue Chip and TIPS-based measures, the LW ascribes the slowdown in the potential GDP growth a major role in the decline in the natural rate over the past 25 years." This analysis illustrates:

1) "...real interest rates can spend very long periods away from (their) unconditional mean....There are decades-long periods of high and low real interest rates...this evidence does not prove that the recent decline in the natural rate is permanent, but it does dispel (GAUSSIAN!*) arguments that it can't be so."

2) Are persistently low interest rates the result of the depressed post-recession economic activity that Reinhart and Rogoff (NBR,14656) describe? The authors measure the effects of financial crises using a dataset of 17 countries over 140 years. They do not, "...see any evidence that crises are typically followed by lower than normal real interest rates. Indeed, if anything, real rates tend to be higher following crises."

The authors conclude, "...low real rates are the new normal. The evidence in favor of this conclusion is that the LW model estimates show no sign of rebounding, six years after the end of the recession. Nor is this picture likely to change over the next year or so....Overall...evidence suggests that a very low natural rate of interest may well be with us for a long time. Although individual estimates differ, it is striking that a wide variety of approaches point to historically low levels of future real interest rates...Market participants have come to share this perspective, as seen in economists' surveys yields on TIPS, and forward rates, as discussed above."

The article then discusses the implications of this for Fed policy, suggesting that in the event of another major recession, "...negative short-term interest rates in combination with forward guidance and asset purchases would provide central banks with a potent set of tools to respond to undesirably low inflation and economic weakness."

But no one, including the Fed, likes negative interest rates (you pay the banks to take care of your money). The implications of this analysis for bond investors, individuals or pension funds, are not positive. What about stock investors? Are stocks at, "...a permanently high plateau?" If so, the correct portfolio strategy would be to consider high yielding stocks a bond substitute, as many in the market currently do. But, unfortunately, they aren't. High credit quality bonds are definite contracts, with high margins of safety. Stocks are long-term contingent assets, whose dividend payment abilities are contingent upon the continued profits of the company. And, as history has well demonstrated, Mr. Market for both financial and real assets is fickle.

This time, the Fed will likely not cause a large stock market drop; but stock prices are also affected by changing supply and demand, foreign financial collapses and geopolitics. Stock market investors should be very careful because the overvalued S&P 500 now has an estimated return of slightly less than 6%, with no margin of safety. What is more controllable by the United States is its economic growth. Our next article will be, "Modern Economics and Growth."

* For those who are interested in the analysis of financial data: Pages 3-5 of this article contains a discussion of the statistical techniques used to handle both persistence and volatility in (non-Gaussian) financial data. Business people like to compute averages, with the idea that this figure is descriptive of the future. "The stock market has returned 10% in the past and therefore..."We have been suggesting that since most business data is non-Gaussian, the average is not predictive; it is merely a convenient way to characterize a series of numbers.

__

At a meeting on 12/16/15, the Fed raised the policy rate by .25%. "However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data." The S&P 500 increased to 2073.