1/1/17 -

On 12/30/16 the S&P 500 closed at 2239, resulting in a total return of 11.96% for the year. Almost half of that return occurred after the U.S. elections, on the hope that the Trump administration will result in a very unregulated business environment.

On 12/14/16 the Fed increased the policy rate by 25 basis points to a range of .50% to .75%. Because the economy is expanding at a moderate pace and inflation is still below the 2% target, "...(these) will warrant only gradual increases in the federal funds rate."

The actual path of interest rates will be "conditions dependent." We think the economy is close to full employment, and therefore warrants only a very gradual increase in fiscal stimulus. But the actual amount of fiscal stimulus is uncertain; still undetermined are the degree of tax cut and the speed at which the infrastructure money will be spent, whether by direct expenditure or by slower indirect tax credits.

Nonetheless we think that last month's analysis of interest rates,

where the Fed assumes additional tax cuts and infrastructure spending totalling 2% of one year's GDP, is quite very useful.

add: We are trying to be as logical as possible, in a market that is sometimes not. Before making an investment decision, logic and emotion have to pull in the same direction. (Those who consider only the latter are likely to make mistakes.) An investment analysis in the 1/9/17 Barron's is of note:

Take a typical 60/40 pension split between stocks and bonds. As a measure of stock market valuation, take the earnings yield of stocks, multiply it by 60%. Then take the treasury yield and multiply it by 40%, thus mimicking a balanced portfolio. "...the combined prices of stocks and bonds rank in the most expensive percentile of readings going back to 1962..."

__

The U.S. Presidency exists to enable the country to handle emergencies and to empower the nation to influence and adapt to the world.

1) Faced with the worst financial crisis since the 1930s, President Obama rescued and reformed the financial system and the auto companies, thus saving the nation and the world from Depression.

2) By waging a sophisticated campaign against terrorists, he fought them to a standstill, using a variety of measures that included working with partners, diplomacy and very limited U.S. military action. He was able to preserve our civil liberties and then substantially roll back the territory the terrorists had gained.

3) He was able to achieve a climate accord with 174 other countries, who will start by monitoring their carbon emissions.

4) By making healthcare insurance available to 22 million more Americans, President Obama was able to begin healthcare reform, a goal that had eluded seven previous presidents starting with Theodore Roosevelt.

What is common to these situations is that they are complex, requiring nuanced adjustments of complicated systems involving other people, ideas and facts. The result of these policies has left the nation in a much better place than it was in 2008. Thank you President Obama. Hillary Clinton would have continued these necessary political and economic adjustments - we use the exact word - to a complex world.

__

The electoral college victory of Donald Trump, who proposes to, "...bomb the s... out of (the terrorists)," still raises the question why so many people voted for him and the large but unspecified change he claimed to represent. Trump mobilized a formerly unmobilized group of voters. He addressed their main economic concern, jobs. Many of his voters considered nothing else.

Donald Trump may be able to create some new jobs and block some companies from leaving, but at a high long-term economic and political cost. Republican solutions to the malady of low economic growth don't address its root causes. Very high proposed 35% tariffs to keep manufacturing jobs in the U.S. mean a trade war, inflation, and high consumer costs. Historically, lower taxes has very little to do with economic growth, which occurs due to entrepreneurship interacting with larger technological, financial and cultural forces that create or discourage new opportunities.

The much larger costs of a Trump presidency will likely be political. Donald Trump lives in a post-factual world where the facts are fitted (or created) to justify what he wants to do. What truly matters to him is his will: unrestrained by other people, the Constitution, norms, consistency and reality. * A European politician recently counseled the voters, "Trust your gut and not your brain..." Combine this irrational willfulness with technological advances (as in the 1930s); these are the means for the total control of society known as totalitarianism.

The major assets of United States democracy are its people, values, leaders and institutions. With this executive, what now matters is legislative checks and balances - both federal and state - that have to be maintained in spite of the attractions of unrestrained power. On the Right, commitments to their local communities and the national interest are a check on the authoritarianism of the executive. On the Left, the commitments that FDR made to real individual Americans and the national interest are a check on authoritarianism. The U.S. Right and Left may disagree, but they should be able to agree that authoritarian irrationalism is not a principle on which the Republic was founded, noting the Revolution against King George III, the Enlightenment and the Federalist Papers (1787). Authoritarian tendencies, if manifest in the executive, should be denounced and thwarted - by the legislature and especially by a press that must now fight for its freedom.

To avoid widespread and dangerous disappointment, it will be necessary to devise a way for Americans to produce goods and services under some modifications of the current economic system. There are crucial situations when the unfeterred price system will fail to improve welfare. The alternative would be to witness economic failure and then to suffer the usual search for scapegoats, Pandora's Box having been opened. The next essay will also illustrate that the effect of automation on U.S. employment is substantial.

This site discusses political economics. Politics is now front and center to what should have been relatively benign, the Fed error correcting a misbehaving stock market from time to time (thus maintaining it in a dynamic stability). We remain value investors in spite of the above, because we believe the Republic will survive.

* The 12/10/16 Washington Post reports that Donald Trump, "...mocked a CIA report that Russian operatives had intervened in the U.S. presidential elections to help him win. The growing tensions set up a potential showdown between Trump and the nation's top intelligence officials..."

This is an outrageous attempt by a foreign power to meddle in the conduct and outcome of U.S. elections, to spread fear, uncertainty and doubt. Donald Trump is acting like a deal person - does this help me or hurt me? Oblivious to all larger questions, he will construct his reality out of these criteria. Putin must see some advantage to dealing with him. As this current controversy too well illustrates, as senators from both parties call for an investigation, charges of political motivation fly fast and furious. The main concern of all should be simple fact, because this is obviously a serious matter.

In a diverse marketplace of ideas, is your reality the same as mine? The faculty of reason ties market societies together, allowing people (and intelligence agencies) to determine relevant fact, be reasonable and cooperate with each other. Lose this commonality in a blanket of tweets or chaotic social media opinions, you will lose democracy. People then lose the ability to make choices about the course of their societies. The result is masses trusting in, "the leader." This editorial in the 12/10/16 NYT discusses the importance of truth.

The new Administration should not be allowed to dance around the truth, however, inconvenient.

__

What in the world is happening? We think the 2016 election of Donald Trump as the next president of the United States can represent a turning point in the history of U.S. democracy, if we allow it.

In 1996, the late Isaiah Berlin published an essay called The Sense of Reality. In that essay he described the major political phenomenon of the 20th century.

"All these schools (of political thought) believed that human society grew in a discoverable direction, governed by laws; that the borderline which divided science from Utopia, effectiveness from ineffectiveness in every sphere of life, was discoverable by reason and observation...These beliefs were rudely shaken by the evidence of the twentieth century. The notions, the ideas and forms of life which were considered to be inalienable...were broken or twisted out of recognition by new and violent leaders: Lenin, Stalin, Hitler....they achieved what had hitherto been regarded as virtually impossible, contrary to the laws of advancing civilization - a breach of the inexorable laws of human history. It became clear that men of sufficient energy and ruthlessness could collect a sufficient degree of material power to transform their worlds much more radically than had been thought possible before...Human beings and their institutions turned out to be much more malleable, far less resistant, the laws turned out be far more elastic, than the earlier doctrinaires (of the Enlightenment) had taught us to believe."

Donald Trump is unusual. During the Republican primary, as a political novice, he vanquished sixteen (sic) competitors by opening a Pandora's box of "FUD" - fear, uncertainty and doubt in the Republican base; then performing a "bait and switch" to the business and military Establishment after the election. His goal, we think, is to establish a corporation-friendly authoritarian regime in the United States. Businesses, which are organized to get a task done or a mission accomplished, are necessarily rather authoritarian in their own domains. Wider U.S. society is not. It is more an environment where people can achieve their personal best. It is more like baseball rather than football.

So what does the future hold, if the checks and balances of the Constitution do not? On 12/5/16 Foreign Affairs published an excellent article, "How Democracies Fall Apart."

"Populism is gaining ground. Around the world, economic hardship and growing unease with globalization, immigration, and the established elite have propelled such movements into power, leading to a groundswell of public support for parties and leaders viewed as capable of holding the forces of cultural and social change at bay. In Europe, populist parties dominate parliaments in Greece, Hungary, Italy, Poland...In Southeast Asia, the Philippine strongman Rodrigo Duterte is pursuing a populist agenda. And in the United States, Donald Trump has been elected president.

The objectives of contemporary populists are not new. Like most of their historical predecessors in Latin American and Europe, today's populist parties extol the virtues of strong and decisive leadership, share a disdain for established institutions, and express deep distrust of perceived experts and elites. But the tactics that today's populists employ to implement their vision of iron rule (note this) have evolved. Rather than orchestrating sudden and decisive breaks with democracy, which can elicit domestic and international condemnation, they have instead learned from populist-fueled strongmen such as Venezuela's Hugo Chavez, Russia's Vladimir Putin, and Turkey's Recep Tayyp Erdogan.

Post-Cold War populists as Chavez, Putin, and Erdogan took a slow and steady approach to dismantling democracy. These leaders first came into power through democratic elections and subsequently harness widespread discontent to gradually undermine institutional constraints on an straightforward: deliberately install loyalists in key positions of power (particularly in the judiciary and security services) * and neutralize the media by buying it, legislating against it, (suing it, our note), and enforcing censorship. This strategy makes it hard to discern when the break with democracy actually occurs, and its insidiousness poses one of the most significant threats to democracy in the twenty-first century....

Finally, populist-fueled authoritarianization is likely to put countries that we typically think of as stable democracies at risk. Recent political science research reinforces the idea that new democracies do indeed consolidate sometime between 17 and 20 years after they are established. However, the research shows that a declining risk of coups is the primary factor driving down a country's risk of democratic failure beyond this time frame. The threat of authoritarianization, it turns out, does not diminish over time."

* Before giving its advice and consent, we hope the Senate will thoroughly vet Administration cabinet and Supreme Court appointees to be sure that they are really dedicated to realizing U.S. democratic values, believe in due process and in our system of checks and balances, and can make good decisions - considering the crucial factors, which are always different.

2/1/17 –

add: The S&P 500 closed at

2,280. Our valuation analysis of this index is based on the present value model

that assumes:

1)

A required long-term return on investment of 8%, a

figure that will double an investment in the S&P 500 in 10 years. Since an

investor should always balance risk and return, we think this required return

is absolutely reasonable in light of (cyclical) planned Fed interest rate

increases and the international risks posed by the Trump presidency, discussed

below.

2)

A 2016 trailing S&P 500 operating earnings of

$108.52; a current Goldman Sachs estimate of this figure has dropped from $110

to $105. We then take a nine year average of these operating earnings to

include also the last negative quarter of 2008. Even with this data, the nine

year annual average earnings of $90.87 is not far off from last year’s

earnings.

3)

A low forward earnings growth rate of 2% real growth

and 2% inflation is again reasonable, given the fact that the present economy

is close to capacity.

This 8% investment return assumes only a 4% ten year

treasury bond rate (2.48% currently). With these assumptions, the present

S&P 500 is 51% overvalued. Value investors invest when the market goes

down, not when it goes up. Momentum investors invest when the market goes up.

This is what investment philosophy means.

_

Boating requires noting the water’s cross currents

and the weather. Short-term currents affect the stock market. The first, and

major, cross current is the historically low level of interest rates - due to

increase for cyclical reasons and will increase even faster if Congress passes

Donald Trump’s high infrastructure spending program. The second cross current

is the near term expectation of corporate earnings increases - due to tax cuts,

“reduced regulation” and fiscal stimulus. Expecting only the latter, the

S&P 500 closed at 2293 on 1/26/17, near a record.

A value investor seeks first to protect capital if

the weather turns bad. We think the major medium-term risk to capital will come

from foreign policy, because there the President has discretion; Donald Trump:

1)

Ordered “The Wall” to be built – thus antagonizing

Mexico, a neighbor and significant trade partner, resulting in the cancellation

of the Mexican president’s visit.

2)

Might fulfill a campaign pledge to terminate DACA,

thus stranding more than a million children of undocumented immigrants, leaving

them with uncertain economic futures, at the margins of the U.S. economy.

3)

The 1/25/17 NYT

reports that the Administration

is drafting orders to reduce U.S. funding for international organizations by,

“at least a 40 percent overall decrease,” thus beginning to relinquish U.S.

leadership in the international order.

These

actions might make his supporters feel better, but blowing up the international

system will not increase economic growth, see our latest article. What of the

future? On the 1/24/17 PBS Frontline,

a Republican pollster Frank Luntz said:

“You guys need to get used to that there is no pivot

(to the Presidency; Donald will be Donald); that there is no normal and the

fact that there is no normal is the new normal. The only thing that is

predictable is the unpredictability of Washington, D.C. from this point forward

so get used to it, buckle your seatbelts, sit back because it is going to be a

wild ride.”

This kind

of uncertainty will eventually cause lower stock prices, among other things. It

will also shift international leadership to…

__

In 1985, the late N.Y. governor, Mario Cuomo said, "

You campaign in poetry. You govern in prose." As Donald Trump forms his

new administration, the outlines taking shape tell us what next to expect. The

crucial departments of defense, state and treasury will be placed in the hands

of experienced managers. We expect their administration to be generally fact

and program based. They will be governed in prose.

However, Donald Trump's political and business history suggests

that the direction of the United States will be set by poetry. During the 2016

campaign, he said that politics is like art (a creation, rather than the result

of interest adjusting to interest). * Consider the nature of real estate

construction and operation. Managers build and manage projects, but the

developer's vision determines where the buildings will be sited and how the

deals are struck.

Donald Trump's presidency, so far, has been like the siting of his

Atlantic City casinos. Issued after his first week, his latest Executive Order

will (temporarily) ban Muslim immigration from seven countries, fulfilling a Trumpean campaign vow of, "strong borders and extreme

vetting." But this Order, issued without consulting the rest of the

government:

1.

Compromises the trust of

our Muslim allies in the Mideast, whom we expect to fight ISIS on the ground.

2.

Offends Muslim Americans

communities, whose cooperation we need to fight domestic terrorists.

3.

Has caused tens of

thousands of demonstrators to take to the street and airports in New York,

Washington, Boston, Los Angeles and Houston, signifying an American will to

keep this society open and much less fearful.

We think this ban will be typical of future Administration policies;

all pain no gain (wait until they try to do anything on healthcare). **

In 1976, the New Yorker

magazine published a famous cover titled, "View of the World

from 9th Avenue.” In 2017, we would add

Silicon Valley. This is the view of the world that Donald Trump ran against.

The artfulness of his populist appeal would gain Donald Trump the presidency.

What is populism? Where can unchecked Trumpean

populism lead?

In a November/December 2016 Foreign

Affairs article, Fareed Zakaria writes that populism, “…share(s) a suspicion of

and hostility toward elites, mainstream politics, and established institutions.

Populism sees itself as speaking for the forgotten ‘ordinary’ person and often

imagines itself as the voice of genuine patriotism.” Although, “Noneconomic

issues – such as those related to gender, race, the environment- have greatly

increased in importance….Europe and North America…face a common

challenge-economic stasis….The sensible solutions to the problems of advanced

economies these days are inevitably a series of targeted efforts that will

collectively improve things: more investments, better worker retraining,

reforms in healthcare. But this incrementalism produces a deep sense of

frustration among many voters who want more dramatic solutions and a bold,

decisive leader willing to decree them. In the United States and

elsewhere, there is rising support for just such a leader, who would

dispense with the checks and balances of liberal democracy.”

People subject to hardship can become impatient and start pushing around

others like concrete, which only makes things worse.

Zakaria writes, “…in the end, there is no substitute for

enlightened leadership, the kind that, instead of pandering to people’s worst

instincts, appeals to their better angels.” Can Donald Trump, being Donald,

provide this kind of leadership? We ask this as a serious question. If not,

then the only alternatives are for people to demonstrate in order to preserve

their democracy - at all levels of government and society and

to organize for the 2018 elections. Vote this time!

*A movie character once ominously said, "To create, one must

first destroy."

3/1/17 –

The S&P 500

continues to new highs as the stock market concentrates its mind only on Donald

Trump’s expected tax cuts and infrastructure spending. The market in its

speculative phase is able to focus on only one story. It does not consider the

nearly simultaneous fact that with the economy at capacity, inflation and

higher interest rates will follow.

This site discusses

political economics. But a 2/13/17 NYT

article

notes, “It’s Probably a Bad Idea to Sell Stocks Because You Fear Trump….Letting

one’s political opinions shape investing decisions is a good way to lose money.

Whether a given chunk of your savings should be in stocks, bonds or cash

depends upon your appetite for risk and when you’re going to need that money.

It shouldn’t be shaped by whether you love or hate the current occupant of the

White House.” A decision on an investment is about weighing its return and, in

this case, policy risk.

Return

Last month we

estimated that the S&P 500 was 51% overvalued. The market has since

non-error corrected by rallying another 68 points to 2348. A 2/13/17 Bloomberg article

presents two graphical analyses of valuation according to different metrics.

The first graph is, “Hours of Work (in the real economy) Needed to Buy the

S&P 500.” That figure is at a record high of 108.3 hours of work per share

at the current average wage. The second graph is, “S&P 500 Shiller

Cyclically P/E Ratio (the average earnings over ten years, in constant

dollars).” That figure at 28.2 is the second highest for the entire period

(1950-2017).

Using a number of

measures, the S&P 500 is very overvalued; therefore its future returns will

be very low.

Risk

The 2/20/17 Barron’s features an article, “The Tale

of Two Trumps – Judging by the stock market’s reactions, the Trump administration

so far has been a grab bag of policy proposals, some good for the economy, some

bad, some potentially disastrous. Our future depends on the president’s ability

to champion the good ones and his willingness to back off the disastrous ones.”

The President was

voted into office in order to “drain the swamp” (of experts). The NYT article further writes, “Whatever

probability you assign to positive and negative outcomes, it’s hard to dispute

that the range of possibilities for what the global economy will look like four

years is uncommonly large. All else being equal, more variation in the economic

future means that stocks are riskier.”

The above is a

logical investment analysis.

add:

On 3/1/17 the S&P

500 continued to soar to 2396, adding 1.4% in one day. What happens after

market blowouts? Consider an extreme example, Japan. On 12/29/89 the Nikkei 225

closed at a record level of 38916 (at a P/E > 100). On 3/1/17 it closed at a

level of 19394 (at a P/E = 16). The Nikkei dropped by 50% in more than 27 years.

It is possible to explain this by the fundamentals: Japan’s economy has been

deindustrializing and stagnating. But consider just this issue of valuation;

the Nikkei was obviously much too high in 1989. Which leads to the value

investing principle, never pay retail.

This asset allocation

model

from The Vanguard Group is very useful. But unlike value investing, it assumes

before the fact, risk and return are related. However, it asks some very

specific questions that all investors should ask themselves. We took this test;

it suggested that we set a stock target allocation slightly in excess of our

comfort level.* Which is what we do – when stocks are bargains. Our experience

is, either on market upsides or downsides, we should be slightly uncomfortable.

This leads to the best results.

*This is a question

of portfolio strategy. This Vanguard model very likely assumes some measurable

relationship between risk and return, before the fact, regardless of market

level. A value investor, on the other hand, assumes that as prices drop, risks

go down. For a value investor, this model is indicatory, something to keep in

mind.

The following is a political analysis.

__

Although proceeding

from the same culture, business is not the same as government. Business can

create something out of nothing and is highly focused on the task at hand. The

components of business are land, labor and capital. Note that labor is but an

element on the road to profits or to the realization of the idea. In liberal

democracies, government proceeds from the consent of the governed, and ought to

be the aggregation of diverse individual interests and individual viewpoints

that include the institutions of society that abide – these result in orderly,

but at the same time, complex and continually creative societies.

The main function of

political parties is to aggregate those interests. The Republican Party,

however, no longer aggregates the conservative interests of society, but with a

few notable exceptions, has driven out all but the most doctrinaire or the most

opportunist – invoking the negative emotions of a discontented populism, as

happened in Germany during the 1930s. The result is a party and leader that try

to attain power by stoking fear (of the other), patriotic honor

(which promises to make an isolationist (?) America great again) and interest

(promising jobs). Here you have Thucydides’ ingredients for a war of all

against all – against the government, against foreigners, against logic and

eventually against society itself when the failures and the need for scapegoats

expands.

We say, “try to

attain power,” this is both fortunate and unfortunate. Fortunately, Donald

Trump can’t get “buy in,” that is cooperation from the rest of government and

society – he consequently can’t govern. Unfortunately, the presidency also

exists to handle foreign crises; and we do not think he will be able to handle

these well, being incurious and not noted for his experience and judgment.

Putin understands this.

Sensing the threat of

this presidency to American democracy, numerous interest groups both within and

without government, are already finding significant flaws in Trump’s conduct.

From the people, numerous demonstrations against environmental, immigration and

traveler changes. From the judiciary, the declaration of his (temporary) ban on

Muslim immigration from seven countries unconstitutional. From the intelligence

community, leaks about possibly questionable campaign contacts with the Russian

government. From the Senate, a refusal to approve his nomination of a labor

secretary. From the press, focused questions that demand clear answers – for

instance why consider Putin a friend, when he is clearly not? All these

problems, and more, have emerged within the first month of Donald Trump’s

presidency.

We think the best way

to handle this administration is to resist the extension of Trump’s personal

rule, further justify Affordable Health Care and develop education programs

that invest in the nation’s economy and the future. In the interim, we hope

that foreign policy will be managed as professionally as possible.

The U.S. has a

democratic political system; what do democracies require? It has been noted

that democracies require: 1) People with a democratic temperament. 2)

Institutions. 3) At times, good leadership. Democracy is now challenged by the

broad forces of globalization, technological and climate change. In the U.S.,

democracy’s ability to improve the country requires a continuation of good

leadership, leadership that will both tell the truth and give hope. The

solution to these real problems is not telling people what they want to hear,

selling them an authoritarian, backward-looking deal that will foreclose the

future.

__

“The advantages of having an enemy are well-known. In Orwell’s

dystopian novel “1984” –suddenly a new best-seller in the Trump era – the

masses engage in a daily mandatory ritual the “Two Minutes of Hate,” during

which their anger is feverishly stoked against the foe of the moment.

Dictators, strongmen and autocrats have practiced the art of drumming up

loathing toward others to great effect.

Trump is no dictator, but he does have strong authoritarian

tendencies and, like other demagogues, he knows that perceived enemies can help

him fire up the base, rally the crowds and shift responsibility. Don’t look at

me, this script cries out: look over there, there is a threat, a danger, a foe.

When it comes to enemies, a demonized media is even more useful than the

average antagonist.

Trump’s real nemesis is the truth. By attacking the media, he

opens up a new line of attack against facts, his true target (Which is why we

think his administration will likely not be effective.)…

What he wants is to

manufacture his own pseudo-truth; to create a reality where he always wins.

Where the only polls that count are the ones where he’s doing great. Where the

only comments about him are compliments, and where anything negative is false,

the work of an out-of-control media.

When things go wrong it is (always) someone else’s fault:”

CNN 2/18/17

4/1/17 –

At its March 15 meeting, the Fed raised the policy rate 25 basis

points to 1%. If, as is anticipated, the economy continues its path of gradual

growth, and labor market conditions continue to improve, the Fed expects two

more gradual rate hikes this year and maybe three more in 2018. The result will

still be an historically low fed funds rate of 2.1% by the end of 2018, a 10

year treasury yield of around 4%, and an expected S&P 500 return of 8% -

rather than currently 5.9%.

Stock market returns can increase, either by a drop in prices or

an increase of real economic growth to 4% (up from about 2% historical), with

the economy already at capacity. Guess which.

__

For all the storm and stress Donald Trump created during the

campaign, his three signature promises are now likely to be unfulfillable, or

will be very difficult to implement:

·

Build the wall that

Mexico will pay for. They won't pay. Now, why cut the discretionary U.S.

government budget to build a $21 billion wall, when net immigration has been an

outflow since the Recession of 2009? Aren't there better uses of the money, for

instance, not cutting the research

budgets of many agencies? The

problem is, this President doesn’t believe in research, foreign relations or

national improvement. He believes everything is a bilateral ideal.

·

A 90 day ban on travelers

entering from six Moslem countries because the President deems it necessary for

security. A federal judge in Hawaii has essentially held that what the

President "deems" is not credible because of his original animus (animosity)

against Muslims. By constitutional provision, the government is not supposed to

favor or disfavor any religion. This is how the federal government came

together at the Constitutional Convention.

·

Repeal and replace the

Affordable Care Act by a Republican Party that has built no consensus on an

alternative. The President promised he will provide, “insurance for

everybody…much less expensive and much better.” *

A successful U.S. Presidency obviously requires a

well-reasoned and positive attitude towards the whole country and the rest of

the world. But the President’s continuing cascade of untruths and Twitter

storms are now consuming his domestic and international political capital at a

very rapid rate. A columnist says he is told by White House sources that Trump

can’t stop "" from doing this. Now, about his

promised tax policies, tariff barriers and rapid economic growth...

*Washington Post article, 1/15/17.

5/1/17 -

The economic conditions of moderate economic growth described in the March 15 Fed meeting are likely to continue. The S&P 500 is very overvalued as the Fed will gradually raise the policy rate from a current 1% to 2.1% by the end of 2018, resulting in a S&P 500 required rate of return around 8%.

__

Contradicting the above scenario of gradual economic growth and interest rate increases; on April 26, the administration unveiled a tax cut plan that provided something for everyone:

·

Doubled

the deduction for a married couple to $24,000.

·

Eliminated

the Alternative Minimum Tax for high income taxpayers, including Donald Trump.

·

Reduced

the corporate tax rate to 15%.

Christmas in April, except since the administration offers no real way to pay for these; the Committee for a Responsible Federal Budget estimates that this plan could reduce federal tax revenues by an average of $300-$700 billion per year over the next ten – adding to a 2016 federal budget deficit of $552 billion - at a time when the U.S. needs additional revenues to pay for increasing social security and Medicare expenditures. If this plan passes Congress, which is highly unlikely, the Fed will have to increase interest rates rapidly to counter an overdriven economy currently operating at full labor capacity.

Here are the average real GDP growths during the terms of presidents Carter, Reagan, Bush and Clinton:

Carter (1977-80) 3.3%

Reagan (1981-88) 3.5%

G.H.W. Bush (1989-92) 2.3%

Clinton (1993-00) 3.9%

Was that extra .2% per year worth a near tripling of the federal debt during the Reagan years from $997 billion in 1981 to $2.857 trillion in 1989? There are also many other factors besides tax cuts that determine the GDP growth of the economy.

__

In the few months since becoming President, Donald Trump has escalated confrontations with the Judiciary, Congress (at times) and his own Executive branch. By firing FBI director, James Comey, for getting too close to the truth when investigating Russian influence in his campaign, Trump has created such controversy that it is likely no one will work with him to pass his agenda.

Furthermore, in a 5/13/17 Washington Post article Harvard Professor of Constitutional Law, Laurence Tribe, called for his impeachment on the charge of obstruction of justice due to the firing of Mr. Comey and his reported request for the FBI director’s pledge of personal loyalty, undermining the rule of law. This was the charge that Nixon sought to avoid by resigning. We think this is a significant development.

__

We’re really trying to contain our Trump discussions, but the President seems to make one major blunder every few days. The 5/15/17 Washington Post reports, “Trump revealed highly classified intelligence to Russian foreign minister and ambassador.” In a meeting with Russian foreign minister Lavrov and Russian ambassador Kislyak, “…Trump went off script and began describing details of an Islamic State terrorist threat related to the use of laptop computers on aircraft….Most alarmingly, officials said, Trump revealed the city in the Islamic State’s territory where the U.S. intelligence partner detected the threat.”

__

5/17/17 – The temporary head of the Justice Department, Rod Rosenstein, appointed the widely respected Robert Mueller, former head of the FBI, to investigate the possible collusion of the Trump campaign with the Russian government. The appointment of an impartial special counsel will determine the facts and establish the truth.

This is a very good example how U.S. governance goes beyond ties of personal loyalty, its self-correction based upon both the healthy self-interest of its participants and the overarching sense of justice ordering society.

Justice is a key concept unifying the U.S. It comes from the ancient Greek conception of dike (dee kay) , a general rule, “whose constraints applied equally to all….This higher standard was the dike…(which established) a true equilibrium among citizens, a guarantee of eunomia (good laws): the equitable distribution of duties, honors, and power among the individuals and factions that made up the social body. Dike was thus to reconcile and harmonize these elements and make of them a single community, a unified city.” (Vernant, 1982)

6/1/17 –

Since the economic expansion is now capable of sustained growth, the Fed should reach its expected policy rate of 2.1% (currently 1%) by the end of 2018. As again mentioned in its May press release, the central bank will also eventually begin to shrink its $4.5 trillion balance sheet by selling its long-term bonds, thus maintaining a positive yield curve. If bond yields across the spectrum of maturities increase, then so must stock dividend yields and therefore stock s returns. The Fed will raise interest rates cautiously in order to maintain economic growth, but that will affect the stock market. On 5/25/17, the S&P 500 closed at 2415.

The first goal of value investing is to preserve capital. In the March 13, 2017 Barron’s, investment strategist Martin Conrad describes why:

“High market prices are more reliable indicators of past success – often illusory or only temporary (as is the present case) – than of future success....Market history shows that prediction of the continued growth in economic. business or investment cycles are not reliable. Mistakes at high market prices are brutally punished by the power of compounding arithmetic, which greatly favors defensiveness: Huge investment gains of thousands of percent are possible over time, but they can be quickly destroyed by a single loss of nearly 100%. This is why big market tops are deadly: At high prices, where everything is priced for perfection in a harsh and uncertain world, there is no margin of safety when volatility strikes. Best to remember at such times the wise advice is leave the last 10% for the next guy.

Graham proposed instead to base investment decisions on strong price discipline with a ‘margin of safety.’ Use protection instead of prediction of growth that cannot be reliably predicted and may never come. He urged investors to remember that price is what you pay, but value is what you get. Those who understand the difference have learned the patience to buy stocks cheaply, as they would groceries, not perfume”

The four most dangerous words in the English language are, “This time is different.”

7/1/17 –

Is the Fed’s current monetary policy loose or tight? Is the policy rate likely to increase slowly or rapidly?

In addition to making rate hikes “conditions based,” the Fed also considers

a model that calculates the “natural rate of interest,” the inflation adjusted

interest “consistent with the full use of resources and a steady rate of

inflation (currently 2%).” To add some nuance to this; the natural rate of

interest is not directly observable and is calculated using an extremely

sophisticated mathematical technique. The Fed develops monetary policy by using

this and other economic models along with continual surveys of actual economic

conditions, and judgment. The following analysis answers the above questions,

using the “natural rate of interest” model. The following analysis, although

expressed quantitatively, is at least indicatory and directional. For stock

market investors, it says patience.

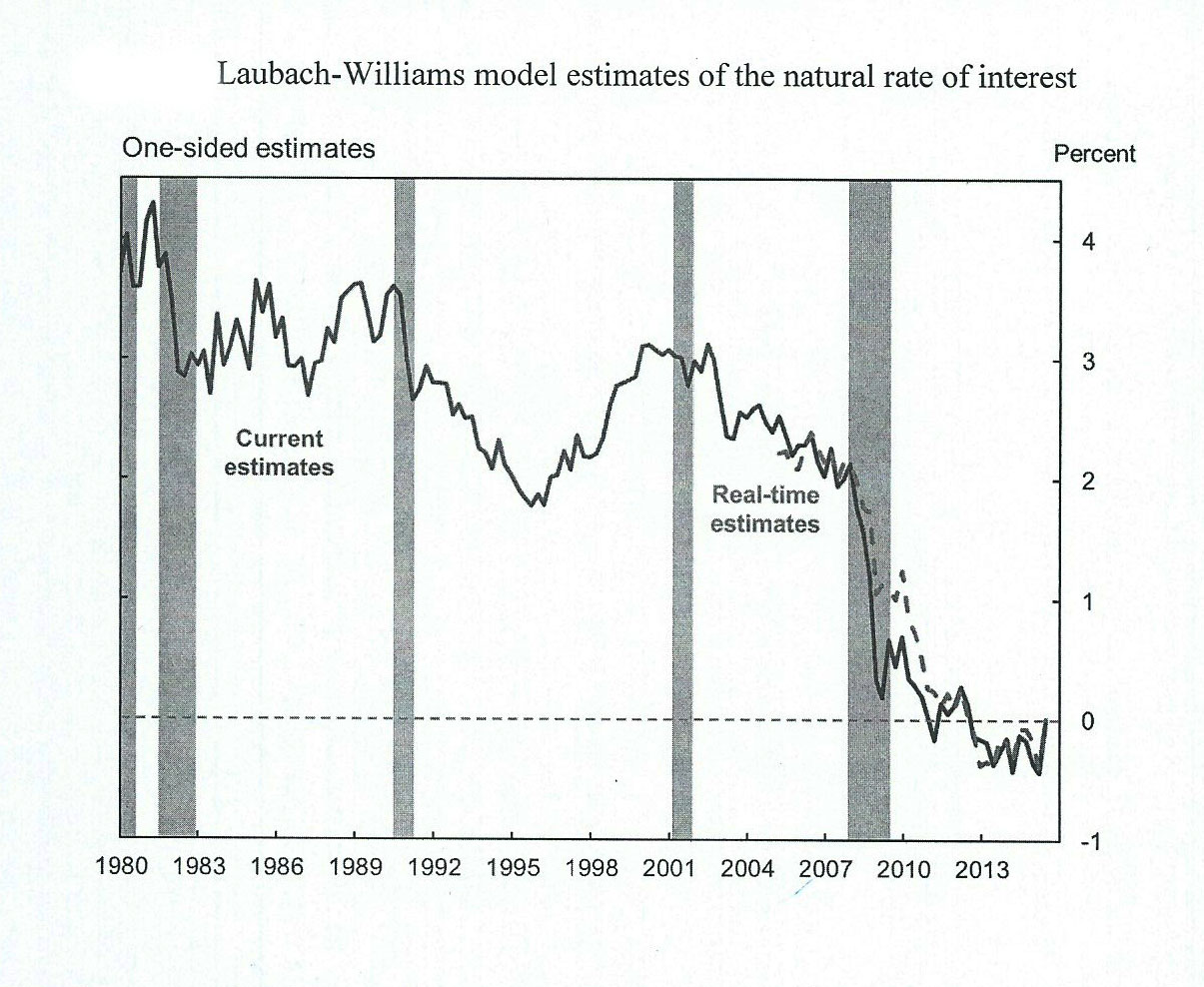

Source: Laubach and Williams, “Measuring the Natural Rate of Interest Redux”

The graph above shows that the natural rate of interest has dropped from 3.4% to -0.2% in the first quarter of 2015. The economic reason for this decrease is likely Larry Summer’s “secular stagnation” hypothesis; add to that the dematerializations of the digitizing economy.

The purpose of monetary policy is to prevent economic growth from causing resource constraints, and thus an inflation in general price levels. In the past, industrial capacity utilization was the binding resource constraint. Now, the labor force is. The following Table I tracks the U.S. unemployment rates before 2007, right before the Great Recession; and before 2015, and recovery.

Table I

U.S. Unemployment Rate

|

Year |

Average Unemployment Rate |

|

2005 |

5.08 |

|

2006 |

4.61 |

|

2007 |

4.61 |

|

|

|

|

2015 |

5.25 |

|

2016 |

4.85 |

|

2017 (3 mo.) |

4.54 |

Source: Bureau of Labor Statistics Data

The following Table II calculates the degree of Fed monetary tightness. The form of this calculation is in general accordance with a rule which sets the level of the Fed’s policy rate according to both the output gap and the actual deviation from the policymaker’s inflation objective. Economic theory supplies first-order principles for the design of actual economic policy. For the sake of simplicity, we have not lagged the inflation variable, as is the custom in econometric analysis.

Table II

Degree of Fed Monetary Policy

Tightness (positive signs) or Looseness (negative signs)

(1) (2) (1)-(2)

|

Year |

Avg. Fed Funds |

Est. Natural Rate of Int. |

PCE Inflation* |

Nominal Natural Rate |

Difference |

|

2005 |

3.4 |

2.4 |

2.2 |

4.6 |

-1.2 |

|

2006 |

4.9 |

2.4 |

2.3 |

4.7 |

.2 |

|

2007 |

4.5 |

2.0 |

2.2 |

4.2 |

.3 |

|

|

|

|

|

|

|

|

2015 |

.5 |

-0.2 |

1.6 |

1.4 |

- .9 |

|

2016 |

.8 |

-0.2 |

1.8 |

1.6 |

- .8 |

|

2017 ** |

1.1 |

0 |

.8 |

.8 |

.3 |

|

|

|

|

|

|

|

|

Long-term Est. a/o 3/17 |

3.0 |

1 |

2.0 |

3.0 |

0 |

Sources: Average annual Fed Funds data calculated from Federal Reserve data; Natural Rate of Interest from Laubach and Williams; Average U.S. Core PCE Inflation calculated from Bureau of Economic Analysis data; 1% Est. Long-Term Natural Rate of Interest from Federal Reserve Bank of San Francisco 8/29/16 Economic Letter.

* The core Personal Consumption Expenditures Index is the Fed’s preferred measure of inflation because it uses a different commodity basket than the CPI. The PCE index has different commodity weightings than the CPI, tries to account for the substitution effect of different goods and includes not directly paid medical costs.

** Calculated from the first three months of 2017 data.

The differences between the the Fed funds rate and the nominal natural rate outline the complex story of the U.S. economy in two crucial periods. In 2005, monetary policy was likely too loose. The unemployment rate had decreased to 5.08%; and according to the carefully worded 8/29/16 FRBSF Economic Letter,” Some have argued that this period of “loose” monetary policy contributed to excessive run-ups in U.S. house prices and mortgage debt that subsequently reversed and triggered a severe crisis and recession….Others argue that low interest were not a major contributor to the U.S. housing boom….Much evidence points to lax lending standards as a primary driver of the episode (as lenders reached for higher subprime yields).” In February of 2006, Ben Bernanke was appointed head of the Federal Reserve and proceeded to tighten monetary policy in order to arrest this excess. But then after a period of financial distress, the threatened implosions of the Bear Stearns and AIG brought the world’s entire economic system to a halt; and the Great Recession began.

Considering only the Fed funds rate - monetary policy was loose in 2015 and 2016. It apparently tightened in the first three months of 2017 due to a hike in the Fed funds rate and a decrease in the three months annualized PCE. The flattening of the treasury yield curve that Barron’s reports on 6/26/17 is consistent with this tightening. Economic growth occurs in a feedback loop; growth begets more growth – it can be argued. But in this case, Fed tightening will likely continue to be slow - as automation, demographics and international factors exert their effects on the real economy. This suggests that the Fed will be very “conditions dependent.”

How far?

By the end of 2018, the FRBSF expects the natural rate of interest to remain around 0%. With a 2% inflation target that would imply a Fed funds rate of around 2%; and a required equity rate of return around 8%.

Over the next ten years, the FRBSF expects the natural rate of interest to increase to 1%. With a 2% inflation target that would imply a Fed funds rate of around 3%; and a required equity rate of return of around 9%. We aren’t factoring these far projected increases into our decisionmaking. This estimate of a 3% Fed Funds rate is the same as that found in the 6/14/17 Fed economic projection..

8/1/17 –

The political tumult in Washington has not

adversely affected the S&P 500. The stock market is affected mainly by

economic events, earnings trends and, with a lag, interest rates. Under

unprecedented economic conditions of prolonged low growth worldwide, the

present relationship between U.S. employment and inflation is

unpredictable - thus Fed policy must be very "conditions dependent." A

cyclical economy is simpler.

The present stock market hasn't seen anything it doesn't like, but we don't think the stocks are at a "permanently high plateau" because interest rates won't remain in a permanent valley. Others are concerned with the low volatility of the present market.

Irrational markets and politics do not end well because emotion,

unregulated by logic, is ungrounded in reality. Both must eventually reflect

reality.

__

Liberal democracy is a reasoned form of government; as the

American expression goes, "That's a plan." Over the long-term, reason

is the best way to handle markets and politics. Of late, both have been

motivated by unreason and untruth. Read this admission by Eric Cantor, former

Republican House majority leader. Governments should not operate that way.

After trying for more than seven years, and

finally winning - by its complaints two branches of government, the GOP failed

to repeal the Affordable Care Act and to replace it with a "better"

one. Americans justifiably consider health care a right in an increasingly

uncertain world. The party has no viable alternatives to the carefully (and

rationally) designed Act, that balances the care of those with pre-existing

conditions with the requirement that all buy insurance.

How can the Party of "No," with no

new ideas, offer Americans the hope of change for the better? Can they offer

viable alternatives to an America that must earn its way in an increasingly

interdependent world?

Dealing with the very complex situation of 19th

century Europe, the German statesman Bismarck said, “Preventive war is like

committing suicide out of fear of death.”

In the North Korean situation, escalating rhetoric can lead to

escalating mistakes. A former Pentagon strategist says all military options,

“…wouldn’t end well. The US would win, but it would be ugly.” In this Brookings

Institution article, Jeffrey Bader,

clarifies the alternatives and suggests a well thought out strategic plan for

dealing with Kim Jong-un.

9/1/17 –

Valuation determines the long-term profitability of the stock

market. What about its short-term trading? In an 8/22/17 Bloomberg article titled “Wall

Street Banks Warn Downturn Coming,” analysts at HSBC, Citigroup and Morgan

Stanley cite the following “indicators,” among others:

1)

The short-term correlations between stocks and foreign exchange

have collapsed, also keeping volatility at bay, feeding investors’ risk

appetite. This occurs in a late-cycle environment.

2)

The stocks of companies that outperformed analysts’ earnings

estimates did not reward investors.

3)

The value of goods produced after adjusting for the costs of

production is now negative.

4)

Corporate profit margins pre-tax have been decreasing.

Then there are the momentum indicators. Value investors are

ultimately concerned with an investment return, based on the fundamentals, that

justifies risk; and not the market’s short-term trading behavior.

__

There is no “moral equivalence” between the rioting, gun-toting

fascists and their Antifa opponents. But there is a very practical danger that

as both groups turn to increasing violence; some people are going to get very

badly hurt. If this violence spreads, that will further unravel the social

fabric of the United States.

To counter the fascists who glorify the use of force, it would

be most effective to take a cue from Martin Luther King and Mahatma Gandi – to use

non-violence.

1)

Non-violence would draw an immediate and effective contrast

between the violent fascists and the rest of society.

2)

The best way to oppose the nascent right wing extremists would

be to gain the sympathies of the vast majority of Americans who are, of course,

non-violent.

This strategy would show the violent hate groups to be what they

are. *

* A former extreme right-wing group member said they are

comprised of people who are personally, “In a bad place.” The following

discusses the possible evolution of manufacturing and manufacturing employment

in the United States.

__

The industrial system that evolved in the 20th

century United States provided many workers with steady incomes, secure

retirements and educations for their children. Although one could attribute

this solely to the bargaining power of unions, it should also be noted that

providing these worker benefits was also in the self-interest of industrial

employers who needed a dependable and trained work force. But the advent of globalization incented

companies to move abroad to access new markets and lower costs. The result has

been decreasing manufacturing employment, a continued high merchandise trade

deficit and decreased overall economic productivity as U.S. employment shifts

to the less efficient service industries.

An 8/28/17 Financial Times article suggests how

manufacturing in Britain, and therefore the U.S., might evolve due to market

forces. In 2001, the custom eyeglass frame manufacturer TD Tom Davies Ltd. had

shops across London and sold to 1,000 other opticians worldwide. It

manufactured its eyeglass frames in China. According to its founder, Tom

Davies, the company is moving some production back to England because the

average annual wage at his Shenzhen plant in 2007 was $3,225. (He thinks in

pounds.) It is now $10,000. Some key people earn up to $71,000. Paying these

salaries, “Many Chinese businesses I speak to are thinking beyond manufacturing

in established cheaper bases like Vietnam and Bangladesh and are now looking

elsewhere.” Profit maximization is the rule of capitalist economies.

“Logistics costs will be lower making glasses in London. But

the biggest saving will be because the technology in industry has moved on.

A computer-controlled machine tool once costing $322,000 is now a twentieth

(sic) of that, he says - ironically, from Chinese makers. The software is also

cheaper and easier to use. All this means he needs fewer staff, Chinese or

British than he used to.”

The people employed by Mr. Davies in England will be few, can

handle the complexities of customized products, and be highly trained to

operate and program computer equipment. * This is a possible future pattern of

developed world manufacturing – computerized versions of the workshops found in

15th century Renaissance Italy. Numerous, but maybe not a source of

very wide-spread employment. This is a

possible development of manufacturing in the United States, uninfluenced by

government. The role of government, as it is elsewhere, is to do research and

encourage new industries that will provide for the future.

* Eyeglass frame production is highly automated; the company’s website likely depicts the production of a prototype.

__

So, given the above, will cutting the

corporate tax rate and exempting the repatriation of foreign profits make any

difference? No.

A 8/30/17 NYT article reports, “A recent survey of business

leaders by the international accounting and advisory firm Friedman…found that

just 23 percent would invest repatriated funds. Most would use the money to pay

dividends and engage in share buybacks (as happened before)….(Nobel Prize

winner Joseph E. Stiglitz) argued that the link between tax cuts and economic

growth is vastly overstated. ‘There is no evidence that cutting the tax rates

stimulates more investment,’ he said.

‘Growth is low because labor force growth is slow,’ and it is

only going to grow slower because of immigration restrictions, he said. ‘And

we’re not investing in education and research, which is why productivity is

slow. The notion that changing taxes is going to lead to a growth spurt is pure

nonsense.’”

Company managers are motivated by the pre-tax

business fundamentals; the U.S. is a slow-growth market; and government has the

ability to change industry structure and to invest for the long-term.

10/1/17 –

The present value formula is the most general method of valuing

assets that produce cash flows. At a current S&P level of 2500, the stock

market is 63% overvalued, yielding an expected return of only 4.85%, rather

than a required return of around 8%.

Robert Schiller is an economist at Yale University. In a 9/17/17

NYT article, he notes that

the S&P 500’s CAPE valuation ratio (roughly equivalent to a cyclically

adjusted P/E) is currently above 30, compared with an average of 16.8 since

1881. This average has been above 30 in only two periods, when it reached 33 in

1929 and when it soared to 44 in 2000.

Valuation is a concept that measures long-term profitability.

Catalysts move the market over the short-term.

The number of possible

major negative short-term catalysts, that is “events,” are numerous and can be

described with some degree of specificity, if not precision:

1)

Simple economics – The amount supplied of a commodity exceeds

the amount demanded. This was the economic situation during the internet bubble

of 2000-2001, when the market suddenly discovered that some ideas (like

pets.com) made no sense and that companies had vastly overbuilt the internet

infrastructure.

2)

International events – In 1973, the OPEC oil cartel instituted

production cuts that increased the price of oil from US $3/bbl

to nearly $12/bbl in 1974. In 1980, the price of oil

reached $40/bbl, causing massive inflation in the

world economy, soaring bond yields and decreasing stock prices.

3)

Financial panic – The world’s financial system almost failed in

2008, after the banks loaded their balance sheets with dodgy assets, notably

“insured” structured finance deals based upon sloppy subprime mortgages and off

balance sheet special investment vehicles, that had to be taken on the balance

sheet. The financial system had to be bailed out by Fed guarantees and by years

of interest rates held at the “zero bound.” The lesson learned from the 1930s

was that the financial system must not be allowed to fail

4)

Fed policy - Unlike stock investors, who can choose when to act,

the Fed must be continually involved in the economy. Its monetary policy is

therefore “conditions based,”

considering the likely state of the economy and the above kinds of factors when

warranted. After eight years of interest rates at the “zero bound,” investors

have become complacent, considering stock dividends to be bond-equivalents

(which they aren’t).

Since these catalysts occur in the context of other major factors

– social, political and economic, they are difficult to predict in varying

degrees. It is most simple to invest in stocks when low prices appear, when

their long-term returns justify the risks of buying earnings (dividends), which

are the residual remaining after the costs of producing goods and services.

__

In the 9/25/17 NYT,

columnist Roger Cohen attributed the recent election of 94 extreme right-wing

deputies to the German parliament to four factors, “taking down mainstream

parties in Western democracies.“ They are:

1)

Fear of the future.

2)

Fear of immigrants.

3)

Fear of Islam and of terrorism.

4)

Anger at impunity, inequality and the arrogance of a globalized

elite.

Fear and anger are at the root of violent political cults that

try to resolve deep social contradictions.

To remedy fear and anger, effective government policies have to

be built upon true beliefs and reason. None of the top ten states with the

highest percentage of immigrants in 2012 (Pew Research) are worried. None have

passed stringent anti-immigration laws. Since the 1970s, only 20 out of 3.25

million refugees have been convicted of terrorism on U.S. soil. * Post 9/11,

most of those who were accused of terrorism in the name of an Islamic variant

are U.S. citizens **, and in a bad personal place - which is the issue. A

minority of those accused were visa holders.

Economic fear of the future and anger at

gridlocked or distant *** elites are based upon the true beliefs that people

hold. A solution to political extremism has to provide people with jobs,

meaning and the abilities to influence their lives.

** PBS, 3/12/17.

*** The nation-state is an involving arrangement, both for its citizens and for its government.

11/1/17 -

On 10/26/17 the S&P 500 closed at 2560, and the Fed Funds rate was 1.25%.

At the Fed’s September Open Market Committee meeting, the median estimate of that rate at the end of 2018 remained at 2.1%, unchanged from the June projection. This rate assumes a steadily growing economy. If there is no stock market drop, a doubtful assumption, we can compare an expected stock return of somewhat less than 4.85% with a likely 10 year treasury yield of 4% by the end of 2018. Which asset would you rather invest in at that time? (Answer: Its not the S&P 500 with its higher expected return because its risk is much higher. A study comparing the volatility of stocks with treasury bonds found that between 1950-1999, stocks were about three times more volatile than bonds. The study also found that in 5-year subperiods, that comparison could range from 20:1 to nearly 1:1.)

A 10/24/17 Pew Research poll of more than 5000 adults finds that Americans are more polarized than ever, both within and without their political parties. In 2004, 49% of all Americans, “…took a roughly equal number of conservative and liberal positions on a scale based on 10 questions….Now its dropped to 32 percent,” less than a third.

There is a discussion among political scientists and sociologists whether income pressures or cultural factors cause political gridlock in Washington, preventing economic reforms such as remedies to globalization, automation and demographics. In fact an article notes, “the two factors are interrelated,” and feed upon each other.

The Pew Research poll, however, notes a wide area of agreement; and it is there that we will start our next essay.

12/1/17 -

The continued U.S. stock market rally in the face of projected Fed ¼ point interest rate increases suggests that the markets (or the trading computers) do not expect significant interest rates increases despite a 9/17 unemployment rate of only 4.2%. But according to the Philips curve relationship, if unemployment decreases then inflation will increase. This theoretical economic relationship is drawn on the following St. Louis Fed graph, which shows a downward sloped Philips curve.

But, the economic data from the period 6/09 to 8/15 show an upward sloped Philips curve; if unemployment increased, inflation also increased. Clearly, there is something awry. What is awry is the concept of economics as physics rather than as a social science. Physics is the study of how simple systems behave. In contrast, engineering is the application of physics to the complicated real world. It is therefore more of an art. We think the social “sciences” are much like engineering because, above all, context matters. The most significant development during the period 6/09-8/15 was the Great Recession of 2008, when other trending factors such as decreased business confidence and shifts in labor force composition overwhelmed the Philips effect.

The data from 9/15-9/17 now show an usual downward sloping Philips curve. (We’re only discussing the sign of the slope; the actual location of the curve and degree of slope can furthermore vary all over the place – requiring a judgment of circumstances at the central bank level.) This data, if further reinforced by the policies of the other central banks, suggest an eventual return to normalcy in the capital markets, higher interest rates and not overdriving the economy by additional stimulus.

We have argued the above from the current slope of the Philips curve. This Goldman Sachs opinion argues for higher rates because the economy’s growth outlook has increased.

___

This leads to another point. Markets have spread throughout the world because they are very adaptable. They also aid in producing the greatest social welfare because they are open to competition and are therefore efficient (at least most of the time). How can they be both adaptable and efficient at the same time? The answer is, they can’t be. As this example illustrates, markets are first flexible, responding to shocks that cause the economics curves found in textbooks to relocate; then rational markets cause the economy to be described by these curves, until they don’t. This behavior also occurred with our model of the willingness of investors to buy stocks rather than bonds. And, in fact, economic innovation and the subsequent development of competition is likewise sequenced. Add: Jorge Lemann 3G Capital, “It used to be that industry trends changed only gradually, and management could just focus on being very efficient and you’ll do OK. And all of a sudden we’re being disrupted.”

Considering the above graph in detail. The dictionary defines a regime as a social system or order. An economic regime is a system of institutions, agreements and policies that constitute a general way of doing things. In the example above, a lack of business confidence and decreases in unemployment (due to changes in labor force composition) made the slope of the Philips curve positive (the technically educated can add these two vectors). This situation persisted until after 10/15 when the unemployment rate dropped to 5% and inflation started to increase slightly. The following are excerpts of the Federal Open Market Committee statements on these dates:

10/15 “To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rates remains appropriate.”

(The economy continued its growth.)

12/15 “The Committee judges that there has been considerable improvement in labor market conditions this year, and it is reasonably confident that inflation will rise, over the medium term, to its 2 percent objective. Given the economic outlook and recognizing the time it takes for policy actions to affect future economic outcomes, the Committee decided to raise the target range for the federal funds rate to ¼ to ½ percent.”

The developing economic recovery in 2015 established a new regime for the Philips curve, which will likely continue until another shock (innovation) occurs. We obviously think that it is the role of government to provide the predictable environment within which economic innovation can occur.

__

The Fed’s medium-term inflation target is a rate of 2% which will allow some flexibility in the economy to generate growth, yet substantially preserves the purchasing power of financial assets. What are the economic variables besides the Philips curve that determine inflation?

At a 12/13/17 press conference, Fed Chair Janet Yellen noted three fundamental variables determine inflation (there are also transitory factors). The first variable, that the Philips curve incudes, is labor market slack. The second is oil prices. The third is the relative foreign exchange value of the dollar. But the use of a valid econometric model, which requires finite statistical distributions to predict inflation, is likely impossible. However, this analysis is qualitatively very plausible because 1) In the 1970s, rapid increases in OPEC oil prices sparked very high inflation. 2) In predominantly importing economies, a large depreciation of the currency results in rapidly increasing inflation.

Considering the likely trend in all three variables, also caused by a developing recovery abroad, the future portends some increased inflation and a normalization of interest rates - both in terms of level and the spread between short-term and long-term bond rates. This means higher long-term bond rates. We will discuss what this means for the stock market next month.

The Fed currently has a “strong consensus” for this gradual monetary policy approach; it believes that the risks to both the national and international economies are “balanced.” Absent financial market crashes, the Fed is most concerned with the state of the real economy. This steady state is the result of astute management by both Chairman Bernanke and Chair Yellen.