|

|

1/1/21 –

On 12/31/20 the S&P 500 closed at 3756 resulting in a total return of 18.40% for the year, closing out the very volatile COVID year. The return of the S&P 500 index for long-term investors is only 4.20%. The problem for investors is the very low rates on long-term governments. This could change in the future. Given present mutual fund alternatives, the current income yield of a 50/50 portfolio of intermediate term bonds and stocks is around 1.5%. For a portfolio to also handle inflation *, it is necessary to live within income. This is far off the 4% rule of thumb, that had been the portfolio management norm in the past. Considering how present conditions might reasonably change, we are going to have to settle for a total portfolio income yield between those two figures, but surely higher than the present.

In its September, 2020 Economic Projections Report the Federal Reserve confirmed its pledge to keep short-term interest rates near zero for years. It noted the following changes:

Median

Estimated Policy Path

2020 2021 2022

Fed Funds Rate 0.1 0.1 0.1

12/20 Projections 1.6 1.9 2.1

We will discuss how new economic conditions brought these changes about and their implications for the real economy, savers and investors in the financial markets.

The Real Economy

The most obvious factor affecting these Fed projections is the COVID-19 pandemic. In one year, the scientific community (building upon many prior years of fundamental research) has developed vaccines and begun to distribute them widely, doing what Americans do best – developing and distributing new products at broad scale. These truly hopeful achievements, however, have occurred against the backdrop of an horrific second wave of the coronavirus, which by the end of this winter, might have taken more lives than the 407,000 U.S. military casualties in W.W. II.

The first wave of the virus resulted in a K shaped recovery

in a predominately service economy, sparing the jobs of those who could work in

the rapidly developing online economy, but badly affecting the traditional jobs

that involved contact with the public. The S&P 500 projected average

operating earnings dropped 22.8% between 12/31/19 and 12/31/20. This is less

severe than the 37.9% 34.5% during the Great Recession between 9/30/08

and 9/30/09. The two major factors explaining this difference were that the

present drop has not involved the financial system, which is better

capitalized; and the Fed’s policy response to lower interest rates rapidly is

decisive. But, in the absence of fiscal policy from Congress, interest rates

are now at the zero bound and the U.S. is facing a second wave of the virus,

the 9/9/20 WP reports, “Jerome Powell, chair of the Fed, has repeatedly

said that his institution can’t keep equity and debt assets stabilized if the

economy continues to deteriorate.…Despite this grim reality, the Senate on

Thursday rejected a stimulus bill.”

Giving the real economy time to adapt, to adjust to new circumstances, should be a major priority.

Impact Upon Savers

But the above is not without cost to savers. Interest rates have trended lower in successive economic shocks, beginning with Long-Term Capital in 1998, the 2008 financial crisis and now the COVID crisis – this decline due to a continued decline in the natural rate of interest, the interest rate that supports the economy at full unemployment while keeping inflation constant. According to a 2016 speech by Fed Governor Lael Brainard, the natural rate of interest is now “close to zero.”

The reason why this has happened is structural changes in the economy. To give a simple example of this from the 12/15/20 Bloomberg, “…Butler County…straddles the suburbs and exurbs of Pittsburgh…the fate of an AK Steel plant on the outskirts of Butler that bills itself as the only U.S. producer of electrical steel used in transformers remains uncertain.” Transformer steel is a very pure specialized steel that avoids power losses. Industrial companies, such as AK Steel, are asset-heavy and provide investors with a demand for capital. Globalization and the significant deindustrialization of the economy are the likely reasons why the natural rate of interest has declined.

“Thanks to government action, many metrics of economic pain, such as bankruptcies and evictions, look better than they did before the pandemic. But economists…say that government help is just holding back a tide that may be unavoidable in the end - too many companies can’t last for long in an environment of reduced demand. (A typical small business requires about 70% capacity utilization to break even.) This state of suspended animation applies as well to corporate America, which has benefited from the Federal Reserve’s dramatic cuts in interest rates and moves to support credit markets. A Bloomberg analysis of financial data from 3,000 of the of the country’s largest publicly traded companies found that 1 in 5 were not earning enough to cover the cost of servicing interest on their debt, rendering them financial zombies. Collectively those companies – among them Boeing, Delta Air Lines, Exxon Mobil and Macy’s - have added almost $1 trillion in debt to their balance sheets since the beginning of the pandemic.”

The above suggests that the market economy has painted itself into a corner of zero interest rates. As has become increasingly obvious, the health of your future investments depends upon the health of the U.S. economy, which increasingly requires government to deal with large and unavoidable problems requiring capital: the COVID epidemic, economic growth, climate change and inequality.

The Impact on Investors in the Financial Markets

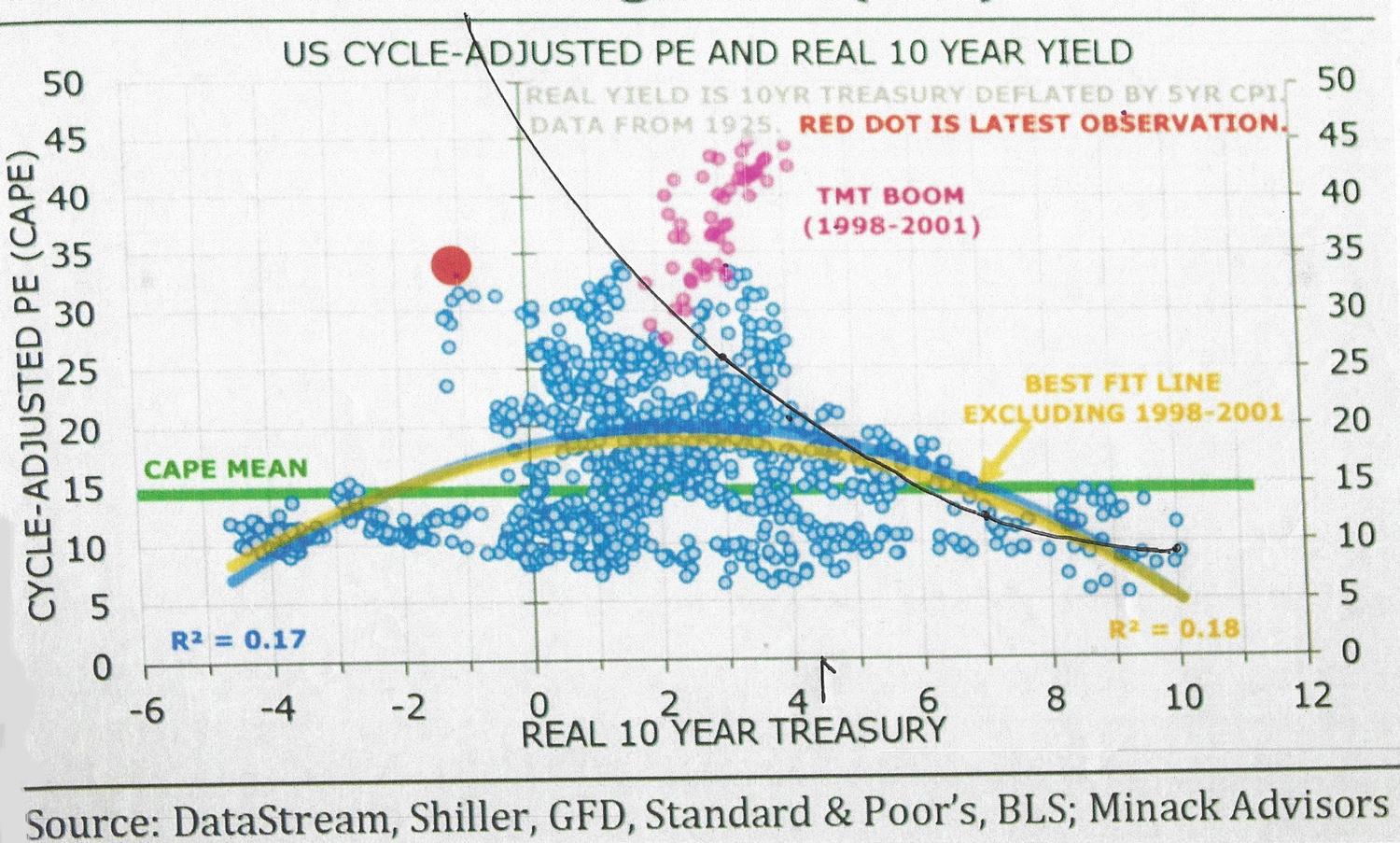

One might think that decreasing real interest rates will inevitably lead to higher stock prices. But, historically, this has not been so. The present high level of the U. S. stock market is an exception. This really useful 12/20 chart by Minack Advisors charts Robert Shiller’s S&P Composite monthly inflation and cyclically adjusted P/E against the real ten year treasury rate for the years 1925 to 2020.

It shows that, with the present exception, the stock market declines when business is either very good (and all interest rates increase) or very bad (and expected short-term earnings decrease). This graph also shows why the financial planning mantra, “Keep to your plan” usually works – but not, we think, now. Interest rates at the zero bound have reduced portfolio income yields to inconsequential levels and the current graph data point, shown by the red dot, shows a very high valuation relative to the negative 10 year real treasury rate. Usually, this mantra works because the very large preponderance of lower stock P/Es are located in the right hand side of the graph, where real treasury returns are positive and P/E values tend to be lower.

The reason why low current interest rates result in high stock prices is due to the preponderance of the five FAANG stocks (Facebook, Amazon, Apple, Netflix and Google) which now account for 15% of the S&P 500. Business has been good for these companies, although interest rates are low. But, do you want the continued performance of your now non-diversified S&P 500 to depend on the 2X or more overvalued growth companies? Does this sound familiar, like the Internet stocks or the one-decision Nifty Fifty of the past? **

Furthermore, U.S. inflation might increase for the following reasons:

1) Sustained economic activity, financed either by continued government subsidies if the economy doesn’t restart on its own; or financed by the capital markets if it does.

2) The continued need to finance deficits as the government makes the necessary capital expenditures to repair our society.

3) The trade-weighted dollar has declined.

The major risk is this: What if the real 10 year treasury rate increases from -1% to 0%, which would cause investors in that bond to simply break even in real terms after a Fed targeted 2% inflation. With increased inflation, there could be a limit to the Fed put, the ability of the central bank to keep purchasing financial assets, thus further increasing the M2 money supply. This is a market for momentum investors only. The trend is your friend, until it isn’t.

Using our nominal interest rate stock market markup model, the long-term return of the S&P 500 could increase to 5.20%.

Financial

Conditions (12/18/20)

.86% 10 year treasury premium +1%

4.20% Equity

return +1%

Our readers can calculate what the large S&P 500 drop would be, or they can (with one additional assumption) solve the problem on the graph above.

Finally

Do finance or economics people know what the drawn curve at the right is? We will discuss this in a future essay.

Does real and sustainable economic growth matter? We think it does very much; but over more than one business cycle.

*Inflation is always a significant long-term threat to the real value of your portfolio. Stocks, a claim on equity in real assets, are supposed to be a hedge against inflation. But one of our earlier studies, using data for the 32 years from 1968 to 1999, found that the coefficient of the willingness of investors to buy stocks, rather than bonds, was negative.

|

The reason for

this negative sign was that we were using yearly data. When expected inflation

increases, and do interest rates, the stock market goes down. However, when

inflation decreases and interest rates go down, the effect of prior inflation

remains on the companies’ balance sheets and income statements. Thus, for

long-term investors, it can be said that stocks are a hedge against inflation.

** There is a

saying, “History doesn’t repeat itself, but it often rhymes.” We much respect

history, but some historically confused people within it don’t choose. Which

stock market event could be the most relevant? Is the better analogy the

Internet crash of 2001 or the Nifty Fifty crash of 1973? In spite of the

technology, we think it is the latter because that crash involved highly valued

large companies, which were “one-decision” investments, companies exhibiting

solid earnings growth for a long period of time. According to the Wikipedia,

“Because of the (subsequent) underperformance of most of the nifty fifty list,

it is often cited as an example of unrealistic investor expectations for growth

stocks.”

Our markup model

for measuring S&P 500 returns will likely remain valid. Here is a quick

analysis of the details:

ROI=

Level S&P 500 CAPE Earnings Yield CAPEx1.33 10 Yr. Treasury Equity Markup

10/73 109.8 5.25% 6.98% 6.91% .07%

09/74 68.1 9.11% 12.12% 7.38% 4.74%

What prompted the

38% S&P 500 correction was the oil shock of 1973-74, that quadrupled the

price of oil from $3/bbl. to nearly $12/bbl. Stock market corrections of

overvaluations, such as the above, require catalysts. In 1973-1974, the main

overvaluation was in the S&P 500. Now, the temporary overvaluation is in

all financial assets due to the COVID crisis. The current long-term ROI of the

stock market is only 4.20%.

__

To discuss the future:

There are two major streams of Western political thought. The first goes back to Plato and the ancient Greeks. In this view, the state reflects a balanced human nature, a balance of powers among Reason, Spiritedness and Desire. This view, according to Harvard Professor Danielle Allen (2013), resulted in the administrative state, modifying Athens’ direct democracy. This state, relying upon Reason, requires foresight and competence.

The second, the Romantic movement, was in direct reaction to the Enlightenment. In “The Roots of Romanticism,” Isaiah Berlin (1999) wrote, “Fascism too is an inheritor of romanticism, not because it is irrational - plenty of movements have been that – nor because of a belief in elites – plenty of movements have held that belief. The reason why Fascism owes something to romanticism is, again, because of the notion of the unpredictable will either of man or of a group which forges forward in some fashion that is impossible to organize (sound familiar?), impossible to predict, impossible to rationalize. That is the whole heart of Fascism: what the leader will say tomorrow, how the spirit will move us, where we shall go, what we shall do – that cannot be foretold. The hysterical self-assertion and the nihilistic destruction of existing institutions because they confine the unlimited will, which is the only thing which counts for human beings; the superior person who crushes the inferior because his will is stronger…”

In the 2020 election, 74 MM Americans voted for the candidate of the extreme right for President. We might consider the consequences of trying to row in difficult weather, not having both oars in the water.

Some political expressions excel in local color. Charlie Dent, (House R-Pa ret.) said on the 12/28/20 CNN, that the leaving President's many legal challenges to the election have been, "Beaten like a rented mule."

_

But the losing and outgoing President will try anything to stay in office. The Washington Post obtained a one hour phone call with Georgia secretary of state Brad Raffensperger:

Trump: I just want to find 11,780 votes (which will give me victory in the state)…

Trump: You should want to have an accurate election. And you’re a Republican.

Raffensperger: We believe that we do have an accurate election.

Trump: No, no, you don’t. No, no, you don’t. You don’t have….You’re off by hundreds of thousands of votes. You know what they did and you’re not reporting it. That’s a criminal, that’s a criminal offense.You can’t let that happen. That’s a big risk to you and to Ryan, your lawyer….But they are shredding ballots, in my opinion based on what I’ve heard. And they are removing machinery…You know, I mean, I’m notifying you. (an outright threat)

Raffensperger: Mr. President, you have people that submit information, and we have our people that submit information, and then it comes before the court…(that already ruled against Trump)

Trump: Well, under the law, you’re not allowed to give faulty election results, okay?...This is a faulty election result….And you would be respected, really respected if this thing could be straightened out before the (senatorial) election.

How can anyone

who supports the Republican party stand for this? It can finally be seen that

the thirst of Senators Cruz, Hawley and Vice-President Michael Pence for higher

office exceeds their devotion to our country and our democratic system.

As the Bard

wrote, “Out, damned spot…”, the lot.

__

In his bunker,

Hitler moved around imaginary army divisions and gave orders to burn Paris.

After losing the presidency, the Senate and the House for a blinded Republican

Party, Donald Trump sought non-existent voters and then on January 6 encouraged

his supporters to unleash chaos, as Congress voted to certify Joe Biden as

president.

CNN 1/6/21

CNN

1/6/21

This Senate chamber inscription can be translated, “Providence

favors our undertakings.”

2/1/21 –

On 1/25/21 the S&P 500 closed at 3855. The return of the S&P 500 index for long-term investors is only 4.10%. The problem for investors is the very low rates on governments. The markup model below illustrates the problem:

Financial Conditions (1/25/21)

0% Policy rate

4.10% Equity

return

It may be argued that although bond markets are overvalued by a zero percent monetary policy, the spread of the S&P 500 above that is still adequate. The problem with that idea is that in March, 2019 the U.S bond market had a value of more than $40 trillion and the U.S. stock market had a value of around $30 trillion. * If the bond market is overvalued relative to expected economic conditions (a rolling idea, everything is expected to be back to normal in a year or so), then the smaller stock market is also vulnerable to increased bond rates.

To discuss in further detail institutional behavior and the people involved:

This Bloomberg article is an excellent discussion of the difference between value and momentum investing. It also discusses how the use of option bets adds an immense amount of complexity (and, in our opinion, ultimate inefficiency) to the financial markets.

On 7/9/07 Citigroup’s former CEO, Chuck Prince, notoriously said, “When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you’ve got to get up and dance.” It was easy for him to keep dancing for a while due to a policy of using OPM, other people’s money, to indirectly guarantee risky assets. A 1/25/21 Bloomberg article writes, “Across Wall Street, signs of speculative excess are everywhere. Penny stocks surging, Cash pouring into trendy thematic bets. Risky debt paying less than ever. With unchecked animal spirits and historic (high) valuations, what’s an investor to do? Keep buying, apparently.” In a 1/5/21 article titled, “Waiting for the Last Dance,” value investor Jeremy Grantham writes, “The long, long bull market since 2009 has finally matured into a full-fledged epic bubble. Featuring extreme overvaluation, explosive price increases, frenzied issuance, and hysterically speculative investor behavior, I believe this event will be recorded as one of the great bubbles in financial history, right along with the South Sea Bubble, 1929 and 2000….this bubble will burst in due time…with consequent damaging effects on the economy and on portfolios. Make no mistake – for the majority of investors today, this could very well be the most important event of your investing lives.”

Recurring excesses are in the nature of markets. A survey of Kindleberger’s epic “Manias, Panics, and Crashes” (2011) reveals that in 390 years there have been 49 financial panics, the last one mentioned in 2007-2008. But improved institutional design and policy might be able to mitigate some of the excesses; to mention two:

1) Treasury market illiquidity in 3/20. Stanford GSB professor, Darrell Duffie, notes the decreasing assets in the dealer banks relative to increased Treasury issuance. He suggests a central clearing house for Treasury transactions.

2) Dampening parabolic stock price increases by increasing the attractiveness of alternatives, raising long-term rates (this will take great finesse, market reactions to changes can be very non-linear), either by reducing long-term bond purchases or increasing long-term treasury bond sales. Stocks are extremely long-duration assets whose durations greatly exceeded those of corporate bonds and nearly all corporate investments.

* Zacks 3/6/19 Report.

__

When day comes we ask ourselves,

where can we find light in this never-ending shade?

…The

new dawn blooms as we free it

For there is

always light…

Amanda Gorman

Joe Biden Inaugural, 2021

In the series, Blueprints

to Generate Economic Growth and Dynamism, the Brookings Institution notes

the three major priorities of the United States should be: 1) Improving fiscal

and monetary policy 2) Generating productivity and growth 3) Boosting the middle

class. To do so, as President Biden noted in his inaugural address, “it is

importance to defend the truth and defeat lies.” Why is this so? The United

States was founded as the world’s first Enlightenment state, where in

Federalist No. 51, Madison wrote, “In the extended republic of the United

States, and among the great variety of interests, parties and sects which it

embraces, a coalition of a majority of the whole society could seldom take

place on any other principles than those of justice and the general good…” In

other words, the founders believed that it would be obvious to all what to do,

when confronted with the truth of a set of common facts. To cite an example, it

would have been obvious to all in 1812 that the British had no right to kidnap

American citizens to fight their wars on the Continent. In 2020, it should have

been obvious to all that the COVID-19 virus presented a mortal threat to the

nation.

Why this did not occur is due to the politization of fact that occurs in totalitarian societies, that is in societies that seek centrally held power for its own sake. As Hannah Arendt wrote in 1948, “The elite is not composed of ideologists (who produce propaganda for mass consumption); its members’ whole education is aimed at abolishing their capacity for distinguishing between truth and falsehood, between reality and fiction. Their superiority consists in their ability to dissolve every statement of fact into a declaration of (political) purpose.” * A society so governed becomes responsive not to external facts from nature, the economy or elections, but to “alternative facts” (justifications) whose sole purpose is serving the whims of the leader. A society in this state will willingly “drink the Kool-Aid” and fail; so will a political party if it cannot be a coherent policy-based “loyal opposition,” loyal to the country.

* Hannah Arendt; “The Origins of Totalitarianism”; Houghton Mifflin; New York; 1948, 1985; p. 385. In the 2016 campaign, candidate Donald Trump ominously said, “…there’s something happening…” This is what’s happening to U.S. politics. A historian said that the U.S. has survived as the oldest republic in the world because it continually and publicly asks how things can go wrong.

__

We think there is a great advantage to having in government people who know what they are doing. On 1/27/21 the White House held a press briefing on Climate Change with press secretary Jen Psaki, presidential envoy John Kerry, and administrator Gina McCarthy (who will integrate policies across the administration). Rather than featuring the untruths and blathering of an incoherent former president, this press conference featured people who are “experienced, passionate, and tenacious.”

President Biden is due to sign a set of executive orders which will align administration efforts to combat the existential crisis of climate change along many dimensions:

1) Jobs, that will open up investment capital and government policies to promote the new economy jobs of the future, rather than trying to preserve the economy of the past. Relevant to this will be new research, technologies, manufacturing and profitable investment opportunities. Relevant to this will be new technical jobs in wind and solar power and local employment opportunities that enable people to work where they live, cleaning up abandoned gas wells (a big problem with fracking), coal mines and a new Civilian Conservation Corp (which will give people a chance to do public service with a benefit to future politics).

2) Our security will be the same as world security. China currently accounts for about 30% of world emissions and the U.S. accounts for about 15%. Presidents Obama and Biden have the credibility (trust) to enable the U.S. to re-engage with the world community and to help lead new efforts to curb global warming. When negotiating with other countries, it is possible – and indeed important - to keep good boundaries, not to confound climate issues with others.

3/1/21

–

On 2/25/21 the S&P 500 closed at 3829. The return of the S&P 500 index for long-term investors is only 4.13%.

Financial Conditions (1/25/21) Current Financial Conditions

(2/25/21)

0% Policy rate

.97% 10

year treasury premium 1.47% 10 year treasury premium

2.14% BAA

corporate bond premium 2.12% BAA corporate bond premium

4.10% Equity return 4.13% Equity Return

The problem this month, and likely in the future, is increased interest rates. On 2/27/21 Warren Buffet wrote, “…bonds are not the place to be. Can you believe that the income recently available from a 10-year U.S. Treasury bond – the yield was 0.93% at yearend – had fallen 94% from the 15.8% yield available in September 1981? In certain large and important countries, such as Germany and Japan, investors earn a negative return on trillions of dollars of sovereign debt. Fixed-income investors worldwide – whether pension funds, insurance companies or retirees – face a bleak future. (our note)” U.S. pension funds generally assume a long-term rate of return around 7%-7.5%.

Long-term investors have and will face a difficult situation. When the national economy was cyclical, rates would fluctuate – typically in a cycle measured by four years or so. As we have illustrated, rates have been trending lower for many years now reaching zero and below for sovereign debt, increasing financial asset prices but decreasing returns. The problem now is likely to be the reverse. A trend of decreasing asset prices but increasing returns. The world-wide demand for capital should increase due to the partial reversal of globalization and increased labor costs, increasing energy costs and -necessary- costs to bring greater social stability.

We have been considering how to deal with this environment. Likely the best way will be to consider stocks and bonds returns only loosely linked, now that conditions are unprecedented. With an ultimate allocation goal of 50% stocks and 50% bonds, we will more rapidly phase into stocks when long-term returns are x. (We will leave this figure open now to avoid front-running.) When 10 year treasury yields to maturity are at least (x-3%), we will begin to phase into a shorter-term bond fund and a treasury bond (step) ladder. The resulting portfolio may experience some losses, but we see no way around this in an increasing interest rate environment. (Option hedges are very expensive; and you have to be right in both time and level, violating a time-tested Wall Street rule pertaining to markets.)

Excluding the effects of inflation, if a reliable portfolio income is your goal:

Income = Constant = (bond income yields to maturity and stock income yields) ↑↓ x (account value) ↓↑

The above equation is one way to think about portfolios, when only income matters. The most important factor over time is likely your career savings rate.

__

The recent near failure of the Texas power grid shows that private enterprise, alone, cannot solve problems that are widespread and uniform. The provision of dependable U.S. electric power is normally a highly cooperative and coordinated effort within two major power grids, called East and West; except in Texas which operates a resolutely independent system that nearly melted down on February 14-15, 2021 when the weather, driven by the long-term climate, changed.

4/1/21 –

On 3/24/21 the S&P 500 closed at 3,889, yielding a long-term investor a return of only 4.06% per year. The following which exhibits asset returns since the beginning of the year illustrates what is happening:

Financial

Conditions (1/25/21) Financial Conditions

(2/25/21)

0% Policy rate

.97% 10

year treasury premium 1.47% 10 year treasury premium

2.14% BAA

corporate bond premium 2.12%

BAA corporate bond premium

4.10% Equity return 4.13% Equity return

Current Financial Conditions

(3/24/21)

0% Policy Rate

2.10%

BAA corporate

bond premium

.41% Equity risk premium

4.06%

Equity return

So, what’s

happening? Contrary to equilibrium economic theory, which posits a perfect (and

usually uniform) discounting of the future, real financial markets exhibit

non-uniformity. What’s happening here is what we call “compression.” At the

short end of the yield curve, the Fed has pinned the policy rate at zero, in

order to facilitate an economic recovery. At the equity long end, investors and

computers have been conditioned for years to “buy the dips,” thus holding up

stock prices. In a declining interest

rate environment, that is a fool-proof trading (not investing) strategy; that

will be a recipe for its mirror-opposite, when interest rates really increase

due to the economic rebound.

At current

question is whether a massive 25% increase in the M2 money supply, from the

first quarter of 2020 to the last quarter of 2020, will overdrive the economy

and create acute short-term and long-term inflation. In the short-term,

inflation will likely increase somewhat due to money supply growth, the

beginning reversals of globalization, supply-chain constraints around the world

(including the Suez canal) and the reduction of

Covid-caused lockdowns. Considering the long-term, the recent Treasury

announcement that President Biden’s infrastructure program will be paid, in

part by more tax revenue, is a relief. Interest rates and stock market returns

should normalize in the long-term, and inflation not accelerate.

However

Investors,

now us included, like to think, finally, the COVID problem may be solved by

vaccines that will result in, “one and done.” As doctors learn more about the

virus itself and as the virus learns about us, this might not be so. It is

estimated that the “herd immunity” level for the present COVID virus is around

80%; but 30% of all Americans are likely to refuse to take vaccines.

Furthermore, this does not take into account variants: of which there are now

three major strains. Most worrisome is the Brazil P.1 variant, that continues

to evolve rapidly; changes in the spike protein affecting antibody response. A

1/28/21 CDC Science Brief reports that in the city of Manaus, the P.1 accounted

for 42% of all variants sequenced from late December, 2020. The 3/27/21 WSJ

reports that Brazil’s more severe P.1 cases and deaths now surpass the U.S.’s;

the virus there continues to fester and generate even more new variants. This

won’t just, “go away.” To deal with this, disease experts recommend continual

monitoring and contact tracing.

If U.S.

COVID infections again spike, we’ve again got major problems. The 3/29/21 Barrons reports that, “Yes, You Can Retire on

Dividends.” But to do so, you have to give up diversification; we don’t think

it is appropriate to give up diversification (over assets and time).

__

Long-term equity investing is mainly concerned with the

valuation of prospects. “Price is what you pay; value is what you get.” Are you

buying perfume or groceries? Consider the event of a price drop. Do you buy

more or lighten up? Are you basically a value investor or a momentum

investor; if you don’t know, the market is an expensive place to find out.

5/1/21 –

incl. two addenda

In 4/23/21

the S&P 500 closed at 4180, yielding a long-term investor a return of only

3.77% per year. It is very likely that the U.S. economy is on the cusp of

increasing interest rates (also rates of investor return) and under these

circumstances, it is crucial – in an environment of uncertainty – to determine

when to start locking in these rates of return. We strongly suggest that you

talk with a qualified investment advisor, should you choose to consider this

strategy.

The

overriding investment factor is that interest rates are likely to increase, due

to an increase in the world-wide demand for capital to combat climate change.

The Biden administration has announced a plan to reduce greenhouse gas

emissions by 50-52% (compared with the baseline year of 2005), by 2030, and

becoming carbon-neutral by 2050, the year chosen by the Paris Agreement that

the U.S. has rejoined. Meeting these ambitious goals will hold the world’s

total warming to 1.5-2 degrees centigrade, up from an increase of 1.2 degrees

at the present time- leaving a livable world for us and our children.

We will look

to an equity rate of return of 6% or above and an investment in a well-managed

BAA or better intermediate term corporate bond fund when 10

year U.S. treasury rates are 2% or above – the two being separate

considerations,

These are

the following reasons for our 6% equity choice.

1) Assume that the Fed will leave its

policy rate at the zero bound. The following is an equity markup analysis.

3% BAA

corporate bond premium *

1%

Equity risk premium

6% Equity return

2)

The following is an equity markdown analysis.

9% Cost of equity capital of a low-risk

company,

per

Greenwald, in class, 2007.

-1% due to S&P 500 diversification (our

judgment)

-1% due to reduced economic productivity

7% Equity return

3) An S&P market rule of thumb by a

noted value investor.

(Average historical S&P 500 P/E=16)

x (estimated earnings next year) = our readers can figure this out

We will

assume a midpoint of 6% (and an income yield of 2.2%). Starting with this, we

would simply increase our equity or bond investments every six months, over two

years. (25%,25%,25%,25%). This strategy might involve losses, if interest rates

continue to rise; but we see no other way around the Wall Street saying, “State

a market level; state a time; but not both.” (That is unless you are an options

trader, but then you are a trader rather than an investor.)

This is the

expected long-term return of a 50/50 portfolio structured according to the

above:

Total Rate of Return Income

Rate of Return

50% S&P 500 equity fund

3.0% 1.1%

50% BAA bond fund 2.5% 2.5%

5.5% 3.6%

The income

result of this portfolio will be less than the rule of thumb that portfolios so

invested can spend 4% of their current balance per year. To further reduce

risk, it would be possible to split the bond fund further into two parts: a BAA

bond fund and a laddered portfolio of U.S. treasuries. Again, we encourage you

to discuss these strategies with a qualified investment advisor.

*We think we

are making a very reasonable assumption that the Moody’s BAA corporate bond

yield will be 5% or above in the near-intermediate term future. This is the

historical record of the rate

(look at the entire record). Ideally, the bond portion of a portfolio should

represent, to use Keynes’ words, a “really secure” income. Bonds rated Moody’s

BAA are still considered “investment grade,” but considered of “moderate

investment risk.” Bond investors can deal with this problem by investing in

well-managed mutual funds that contain add: many (relatively) small and

diversified investments.

add: Taxable purchasers of bond mutual funds are responsible

for long and short-term capital gains (or loss) distributions, for shareholders

of a certain record date, the timing of these depending upon the judgment of

management. These are facts to be aware of and to ask about.

According to

a 2/13/20 Moody’s Analytics Report, US$ denominated corporate bond issuance had

increased year over year by 25% for investment-grade bonds and 83% (sic) for

high-yield bonds. This is not in general a good state of affairs; what, for

instance, will happen when interest rates increase? In finance, there should be

at least some degree of standard (in this case, interest expense coverage).

This is our observation.

__

This is the

political economy context which pertains to the above.

The U.S. accounts

for around 15% of greenhouse gas emissions, such as CO2. The

cooperation of the rest of the world is necessary, and all can work steadily

towards the common interest. The Biden administration has re-established the

cooperation of Russia (which has a permafrost problem), China (which has

ecological problems), Great Britain and the E.U. (which have record heat wave

problems).

Returning to

the U.S. the $2.3 trillion Biden Infrastructure Plan (it isn’t as massive as it

sounds, as the expenditures will occur over eight years) promises to

restructure the U.S. economy. A conservative will balk at the idea of

government intervention. A poll has

shown that 72% of all Democrats agree that there is a climate crisis, but only

10% of all Republicans do. But affecting all Americans are the facts that the

independent Texas energy grid collapsed last winter, the Midwest is flooding,

California has and will experience massive forest fires, and permafrost is

melting in Greenland, affecting the Florida coasts. These are all observable

problems, requiring remedies.

On 4/22/21 CNN held a Town Hall, featuring John Kerry,

Special U.S. Envoy (to other nations) for Climate; and Jennifer Granholm, head

of the Department of Energy.

According to EPA statistics the

bulk of greenhouse gas emissions come from the transportation sector of the

economy (29%), electricity generation (25%) and industrial processes (23%).

Surprisingly, the direct household use of oil and gas account for only 6% of

the total. These proportions suggest the following policies:

1) The

electrification of transportation.

2) The

growth of electric grid capabilities, to move energy around, and the development

of modular and safe nuclear energy to handle the baseload.

3) The

development of new industrial processes to produce commodities, such as cement

and petrochemicals.

The specifics of the Biden plan will result in the above

and:

1) Be good for all Americans, producing new jobs in new

industries.

2) Repair the damage done by fracking and by environmental

degradation.

3) The trillions of dollars spent by the government and the

private sector will reconfigure U.S. production.

4) Those who do not change appropriately will simply be

confronted with stranded assets.

5) With climate change increasingly obvious, the old ways

simply will not work anymore.

6) Democracy, at times, requires good leadership. Now is such

a time.

7) The American public can demand real change, and public

officeholders will respond.

Under the previous administration, the world became

increasingly chaotic and was set adrift. Americans can lead

on climate warming because of the value of seeking appropriate change,

technological skills, and the ability to distribute the benefits to all people

– a promise made in the preamble of our Constitution.

12/15/21 – note

On December 15, 2021 the S&P 500 closed at 4710, close

to a peak, yielding a long-term investor a total return of only 3.61%. On the

same date we bought a substantial holding of Verizon Communications, Inc. (VZ)

at a price of $51.05 and an expected total return of 7.01% (5.01% + 2%), at

close to a yearly trough. This is almost exactly the total return we would hope

for at a much lower level of the S&P 500, (6% +1% return premium for a

single stock). Before you try this, we would definitely encourage you to talk

with a qualified investment advisor.

We purchased this utility stock at a (less relevant)

S&P 500 peak (forget about the CAPM model) because VZ is a sort of long

bond equivalent. Verizon’s current return on total invested capital is an

annualized 7.38%, almost equivalent (including heavy capital expenditures to

build out 5G) to its 7.01% cost of equity capital - (using precise decimals

just to keep track of the various quantities). We don’t expect much growth from

this stock, but do expect a quite decent bond-equivalent income over time.

There are, of course, short-term risks to this investment;

especially since the Fed has signaled that it is wheeling the punch bowl

towards the door. On 12/31/2000 the U.S. treasury 10 yr. bond rate was 5.12%.

That benchmark rate has since decreased to around 1.47% on 12/15/2021. The

reasons for this large decrease were:

1) The large

world-wide growth in the central bank M2 money supply, as the central banks

countered the effects of the 2008-2009 sudden-stop world

wide recession, and then the COVID recessions of 2020 +.

2) The continued

opening up of China’s labor market to the multinationals.

3) The growth of

finely tuned supply chains (and the efficient reduction in inventories) around

the world.

It is possible to construct a cogent argument that all

these effects are now reversing. Central banks around the world are beginning

to signal tighter money and finely tuned supply chains are being compromised by

supply shortages (notably semiconductor), transocean

shipping expenses, and (certainly in the U.S.) trucking shortfalls. The trimmed

mean CPI takes out the most extreme price changes. The following graph shows

that inflationary price pressures have entered the general economy.

This is why the Fed must act decisively to contain embedded

price pressures. But how decisive is “decisive.” When is the right time to act,

to what degree. It’s a matter of judgment.

But, furthermore, and this is crucial, what about the shape

of the bond (now including the S&P 500) yield curve? With interest rates at

a historic low, a yield curve that maintains its current slope when rates rise

will spell great problems for long-term assets. But, if the yield curve becomes

negatively sloped (short rates become higher than long rates), the price

depreciation at the long end will be less.

Over the short term, the VZ holding will at least provide

some income until interest rates rise. If we are wrong, and interest rates rise

greatly, our holdings in cash will become very profitable and we would consider

VZ a long-term investment, which it is. As a long-term value investment, VZ has

a decent expected rate of return; and that is our investment horizon.

__

A Wall Street analyst once said confessed, “The stock

market is like life; it cannot be predicted.” This is why we don’t really try

to predict long-term interest (discount) rates, but choose to invest when rates

of return reach a certain level. The core issue, as Isaiah Berlin once said, is

the contingent elements of history.

An example of this is a 12/16/21 report

on the Omicron strain of the Covid virus from the Imperial College of London.

Although this study has not yet been peer reviewed, Professor Neil Ferguson (et

al.) note:

“Using logistic and Poisson regression(s) to identify

factors associated with testing positive for the Omicron virus…Hospitalization and

asymptomatic infection indicators were not significantly associated with

Omicron infection, suggesting at most limited changes in severity

compared with Delta.”

The highly contagious Omicron strain has the potential to

overload the healthcare system.

__

A Bloomberg 12/29/21 article titled :

“How Errors, Inaction Sent Deadly Covid (Delta) Variant Around the World”;

clearly illustrates that the isolationist MAGA philosophy, “Make America Great

Again,” is precisely what America (and your life) do not need. The same

holds true for the long-term performance of your portfolio. In general, MAGA is

maladaptive.

The reason that MAGA is maladaptive is that, in fact,

people are all biologically related, and therefore all susceptible to diseases,

“…explaining why two years into this epidemic, the world remain on the brink of

economy-shattering shutdowns, with another new variant emerging out of

vulnerable, under-vaccinated populations. But while South Africa acted swiftly

last month to decode the heavily mutated omicron and publicize its existence,

India’s experience perhaps better reflects the reality faced by most developing

countries-and the risks they potentially pose.”