|

|

1/1/20 -

On 12/31/19 the S&P 500 closed at a near record of

3231, resulting in a total return of 31.49% for the year, for momentum investors.

But projected equity returns for long-term investors declined to 4.77%. For

investors who do not plan to actively manage their own portfolios (and who want

to eventually invest in an index that tends to outperform), the latter is the

relevant return.

The following table illustrates that low future rates

of equity return are due to the general decline of interest rates and continued

decreased term risk premia for both long-term bonds and stocks:

Normal Conditions Current Conditions

2.5% Policy rate 1.75% Policy rate

2.0% 10 year treasury premium .37% 10 year treasury premium

2.0% Corporate bond premium 1.98%

BAA corporate bond

premium

2.0% Equity risk premium

.67% Equity risk premium

8.5% Normal equity return 4.77% Equity return 12/31/19

Interest rates remain at the lowest levels in 5,000

(sic) years of recorded history and term risk premia remain compressed. The

following essay discusses why.

__

The

Causes of Low Rates of Return

The following discusses the causes of currently low

interest rates and high asset prices. During the threatened 2008 world-wide

collapse of the financial system, a hedge fund manager commented that the rapid

monetary creation of the central banks would create an inflationary crisis.

That didn’t happen.

If general inflation is too much money chasing too few

goods, why didn’t inflation soar as the U.S. government increased the money

supply by accommodating the yearly deficit, lending liberally to the banks in

return for less liquid (but still sound) collateral and by open market bond

purchases?

Stagnation and the Declining Velocity of

Money

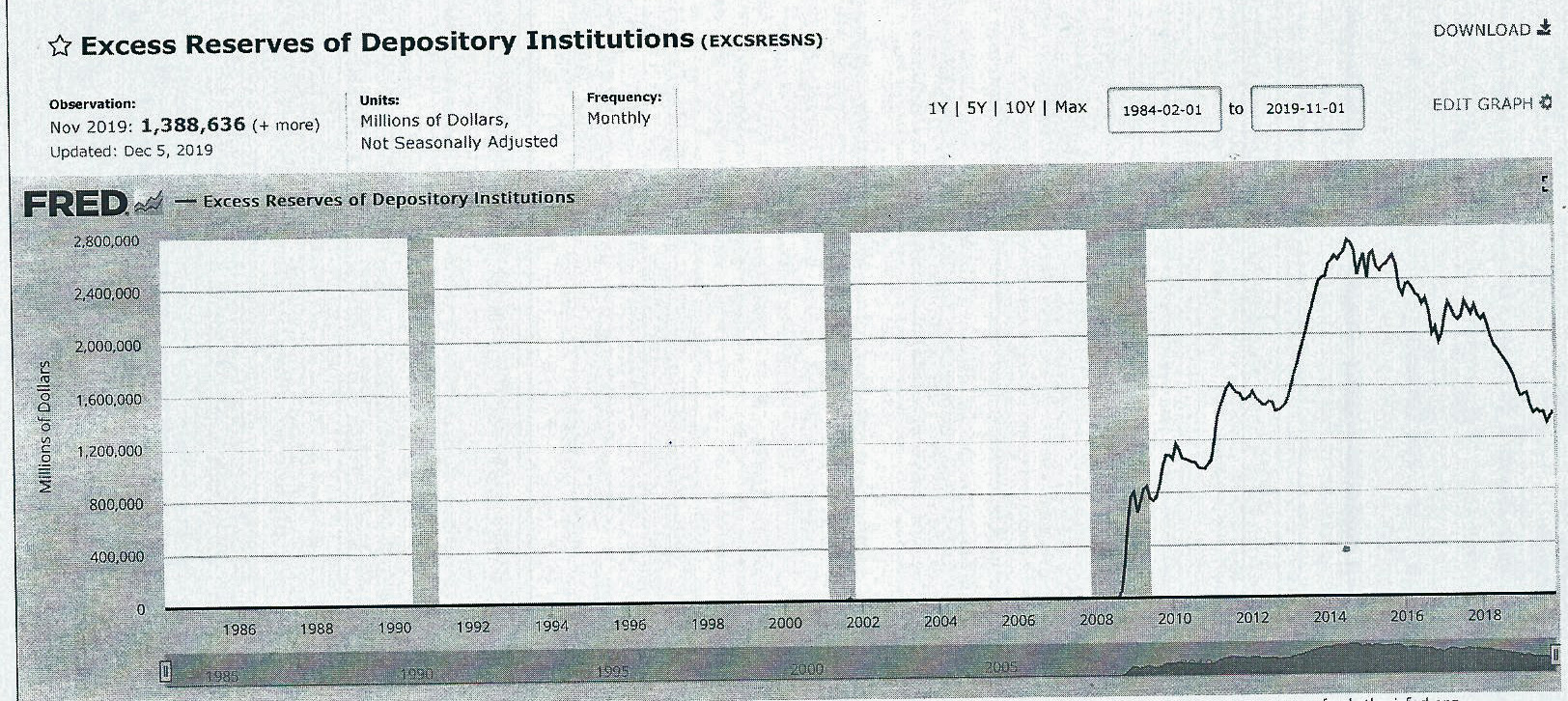

The main reason it didn’t, was that much of the newly

created money remained bottled up in the financial system. The following graph

showed that in 2019, excess bank reserves were at $1.388 trillion, potentially

funding (at a 10% reserve requirement) $13.88 trillion in additional GDP growth

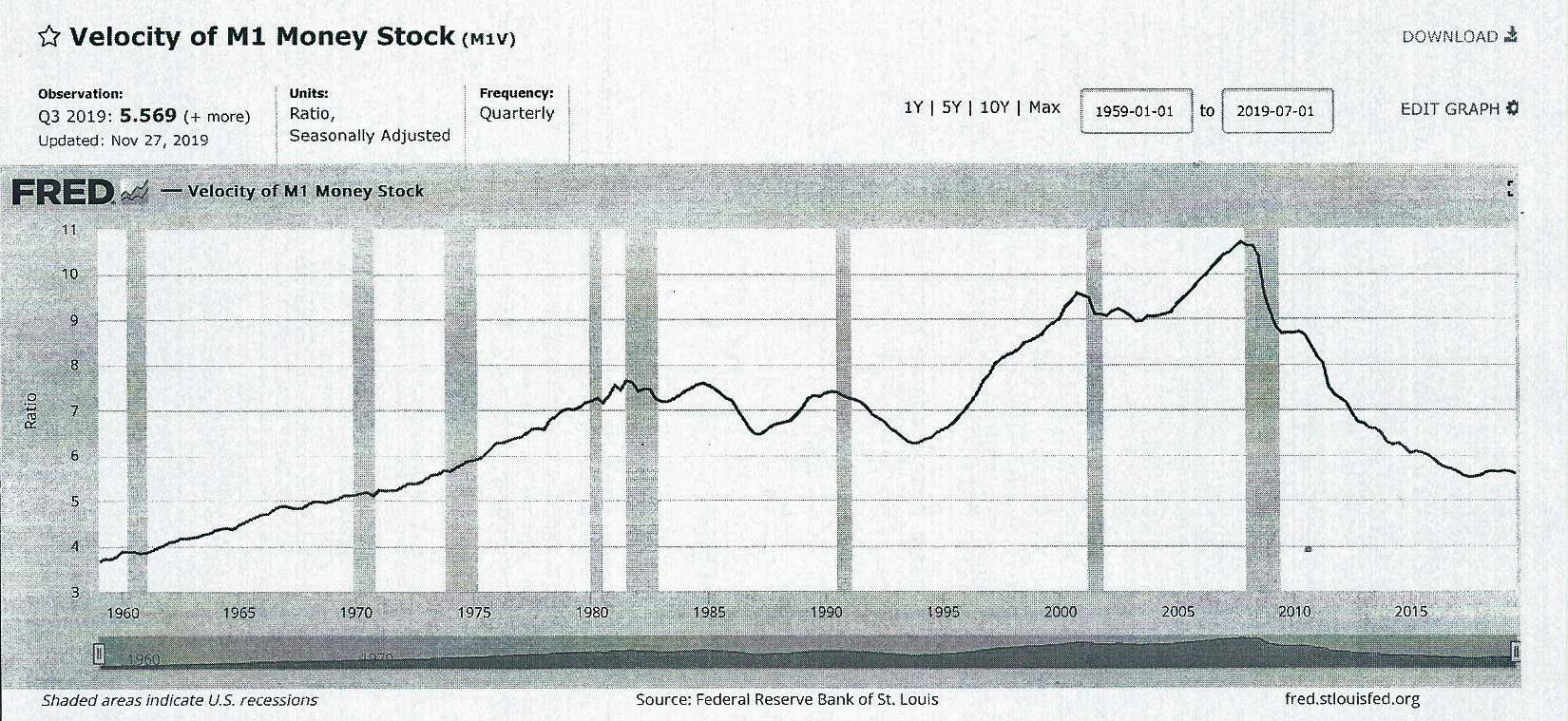

(2019 U.S. GDP will be around $20.5 trillion). But the second graph shows, the

velocity of money, defined as v = GDP/M1 (the money supply) - plummeted.

The reasons for this were:

1) At

the central bank level, possibly to prevent the banks from making ever riskier

loans, the Fed started paying interest on all bank reserves thus keeping

limiting the quantity of money that hit the economy; while still being able to

lower over-all interest rates.

2) The

of-cited factors of globalization and digitization, off-shoring a large amount

of U.S. productive capacity and reducing the amount of capital necessary to

fund economic growth.

3) Very

important, we think, is the ideology of market fundamentalism that limits the

role of government, leaving it to the markets to solve major distribution

questions, the latter to be solved by the “trickle down” theory that all would

benefit by making companies and the upper .01% richer, who would then spend

their untaxed money on additional business investment.

The practical effect of this “trickle down” theory was

highly mixed. In 1981 the Reagan administration cut the top federal tax rate

from 70 percent to 50 percent, among other things. But the subsequent high

economic growth is mainly attributable to Paul Volker’s reduction of the Fed

funds rate from 19.08% on 1/81 to 8.68% two years later. But the federal debt

almost tripled from $997 billion in 1981 to $2,857 billion in 1989. These tax

cuts did not pay for themselves. An article by Columbia professor Joseph

Stiglitz, “The Starving State” *, in the significant January, 2020 Foreign

Affairs magazine discusses the results:

“After the tax cuts in the 1980s, under the Reagan

administration, capital taxation collapsed, but rates of savings and investment

also declined.

“The 2017 tax cut illustrates this dynamic. Instead of

boosting annual wages by $4,000 per family, encouraging corporate investment,

and driving a surge of sustained economic growth, as its proponents promised it

would, the cut led to miniscule increases in wages, a couple of quarters of

increased growth, and, instead of investment, a $1 trillion boom in stock

buybacks, which produced only a windfall for the rich shareholders already at

the top of the income pyramid. The public, of course is paying for the bonanza:

the United States is experiencing its first $1 trillion deficit.” (wait until a

recession hits)

This article

begins by noting, “For millennia, markets have not flourished without the help

of the state…Most economists rightly emphasize the role of the state in

providing public goods and correcting market failures, but they often neglect

the history of how markets came into being in the first place. The invisible

hand of the market depended on the heavier hand of the state.”

In addition to winning wars and dispensing justice,

the U.S. government is also partly responsible for economic demand and social

advances, the construction of the Interstate highway system and other

infrastructure, an environment conducive to life as we know it, medical

R&D, and the development of the internet. The same article notes:

“No successful market can survive without the

underpinnings of a strong, functioning state. That simple truth is being

forgotten today. In the United States, total tax revenues paid to all levels of

government shrank by close to four percent of national income over the last two

decades, about 32 percent in 1999 to approximately 28 percent today, a decline

unique in modern history among wealthy nations. The direct consequences of this

shift are clear: crumbling infrastructure, a slowing pace of innovation, a

diminishing rate of growth, booming inequality, shorter life expectancy, and a

sense of despair among large parts of the population. These consequences add up

to something much larger: a threat to the sustainability of democracy and the

global market economy.” Many of the problems in the U.S. are self-inflicted.

The stagnation problems engendered by the

Reagan/Thatcher supply-side revolution which compromises middle-class purchasing

power, are now magnified abroad. A 12/23/19 FT article notes that in

Germany, Italy, France and the U.K., the political center has declined due to

mandated austerity. “If there was one common policy that accelerated (that

decline)…it was austerity. We have come to judge austerity mainly in terms of

its political impact. But it is the political fallout from public spending cuts

that is most likely to persist….European liberalism has a long history of

self-destruction. We are going through another such cycle. In view of the past,

extraordinary decade, only a fool would want to predict what comes next. What

remains is a sense of dread.”

Low Interest Rates

Modern Keynesian economic policies are concerned with

overall demand management. However, there are different effects whether one

uses fiscal or monetary policies. Fiscal policy expands the role of government,

and monetary policy expands the role of private enterprise. In the absence of

fiscal policy, that is appropriate government spending, the only alternative to

keeping the economy going is monetary policy that relies on the private sector

to generate all economic growth. This overreliance has produced low interest

rates, risky high financial asset prices (the present value of an annuity is

simply its positive cash flow/the discount rate) and high leverage. Both are

risky. High asset prices can easily be brought down by sustained increases in

interest rates, and high leverage resulting in financial bubbles that burst.

The following Bank of England graph

shows that interest rates remain at the lowest levels in 5,000 years of

recorded human history. During the Roman era, interest rates ranged between

4-8%. We think something is amiss, and it isn’t the data.

On 9/19, the business economist David A. Levy

published “Bubble

or Nothing.” That report discussed in great detail the effects of the low

interest rate monetary regime. It notes:

1) From

the mid-1980s on – the era of the Big Balance Sheet economy – federal decision

makers have had to choose between progressively lower returns…(or) higher risk.

2) Each

successive crisis, with more bloated balance sheets to stabilize, was more

difficult to resolve and therefore required the government to engineer dramatic

new lows in interest rates…

3) The

present cycle is almost certain to end badly. Although there are signs that

balance sheet ratios are undergoing an extended secular topping process, they

remain extreme and will produce extreme financial instability during the next

recession.

4) The

lives and behaviors of human beings and their societies are just too

complicated and too messy…for the economy to maintain machine-like textbook

functioning. Furthermore, (our note: especially now with global warming) the

future is unpredictable in too many ways to be summed up as a set of

determinable probability distributions.

5) Private

investors accept so much risk, “(because they see)…no other way to obtain

financial returns that are anywhere near their goals and in the case of many institutional

investors, anywhere near their explicit targets (of slightly less than 8%).”

Thus since stock dividends approximately equal the 1.9% ten year treasury

yield, the financial markets believe There Is No Other Alternative, although

stocks have an interest rate sensitivity in excess of 36 years and ten year

bonds have an interest rate sensitivity of around 8 years.

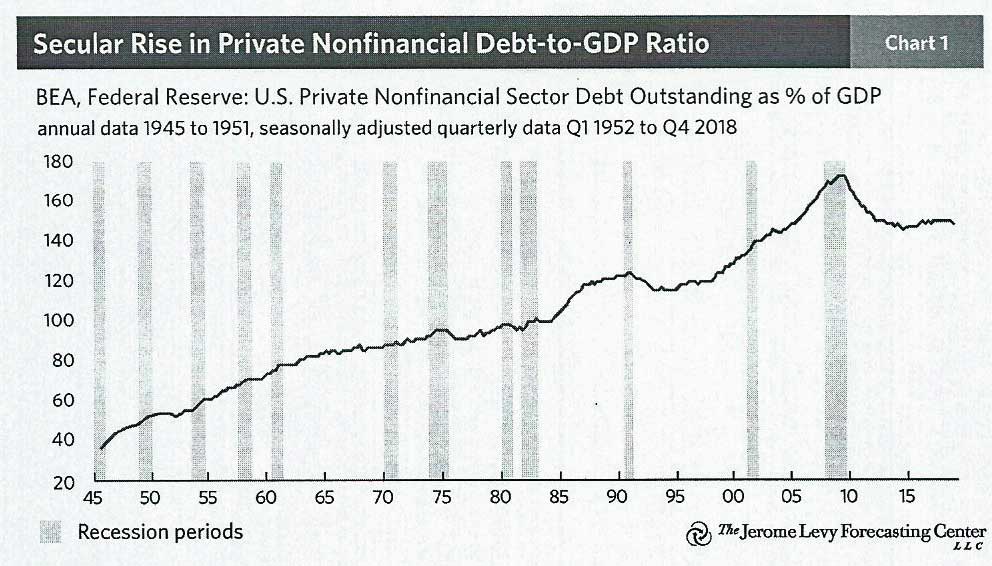

The following graph charts the ratio of U.S. Private

Nonfinancial Sector Debt Outstanding as a percent of GDP. It shows that even

with some readjustment since 2008, that ratio is at historic highs. Another

implication of this graph is that since debt has grown much faster than GDP,

“(there is)…a tendency for more of the new lending to finance purchases of

existing assets” rather than new ones that create jobs. In face of low consumer

demand, businesses have also been taking capital out of the economy in the form

of stock buybacks.

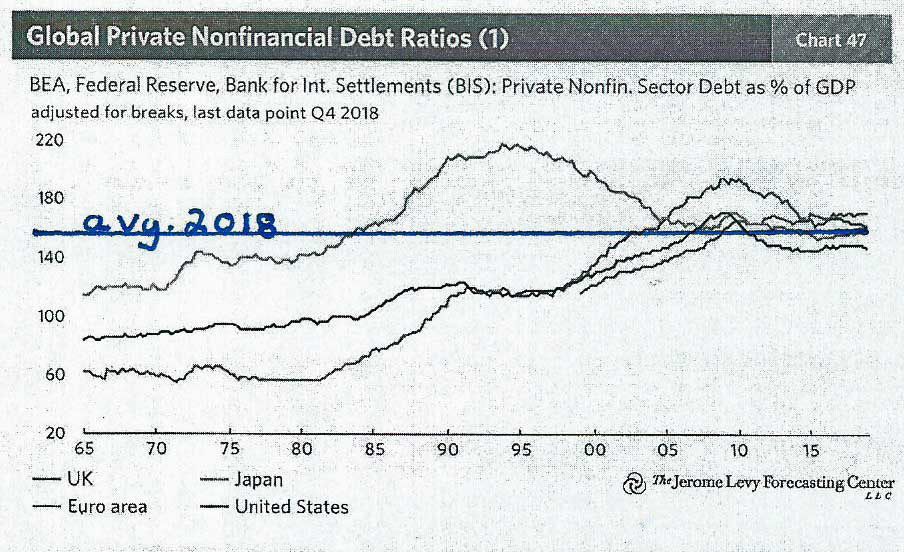

Companies in other developed nations have also

drastically increased their leverages and therefore their riskiness. We think

the financial system is risky and the financial returns available do not

justify taking this risk.

This is our first comment for 2020. We do not like to

start this year out with a litany of woe; but the solutions to intensifying

problems in the political economy require good leadership, with the conceptual

tools and skills to handle these when they come home to roost.

* In Citizens

(1989), Simon Schama wrote that a major cause of the French Revolution of 1789

was the “inanition” (starvation - we had to look that one up) of the state that

was unable to pay the debts it incurred funding foreign wars, including the

American Revolution of 1776. French society at the time was unable to achieve a

new equilibrium (consensus) to solve its problems.

2/1/20 –

On 1/24/20, the S&P 500 closed at 3295, up 1.98%

for the year, to yield long-term investors a total return of 4.68%.

At times, it is said the stock market discounts the

hereafter. We model the “hereafter” by assuming that current S&P 500 annual

operating earnings to the 1st quarter ($160.46) will increase

constantly at a non-cyclical growth rate of 2% real and 2% inflation/year, in

perpetuity. The total return of such an investment would be only 6.48%. *

However, the 1/23/20 FT notes the following

economic contingencies:

1) China’s

share of global GDP will hardly change, “… largely because increasingly centralized

government will stifle reform and make the allocation of resources less

efficient.” This means that China’s slowing economic growth will begin to

approximate low real global economic growth of around 2%+. add Now there

is the further threat of the spread of the coronavirus epidemic.

2) Changes

in fossil-fuel dynamics may happen “quicker than we think” and will affect

first the Emerging Market currencies. At Davos, a major oil company

executive finally mentioned global climate change as a factor to

consider. A 1/24/20 Washington Post article headlines, “Davos elite want

to plant 1 trillion trees to help the planet, but many still fight a carbon

tax.”

3) We

add, to remedy global warming, energy must become more expensive, cutting

somewhat into economic growth. In 2017, U.S. energy consumption was 5.8% of

GDP. More expensive energy would cause less use. Appropriate and broad

political action would result in a less impactful use of energy. What will be the

effect of global warming upon commodity prices? A 1/29/20 FT article

headlines, “Running dry Fires and drought

send Australian meat prices soaring.” At the beginning of 2019

Australian mutton prices were around A$ 410/100 kg. They are now around A$ 600.

These contingencies overlay a highly leveraged world

economy and an overvalued stock market. We would be especially careful because

there are many people (and computers) in Wall Street that have never seen a

bear market. More about rational capitalism and the market in our next essay.

*The columnist in the 1/27/20 Barron’s makes

exactly the same “perpetual growth” assumption with his rule of thumb for

calculating S&P return. He writes: 1) Start with (this year’s consensus

projected earnings growth of 10%, divide in half for estimate cuts. 2) Add two

points for dividends (should be 1.77%) 3) Take off a point because of elevated

p/e ratios. 4) Add back a point because reversion to the mean is on disability

leave. This totals to a 6.77% S&P 500 return. The Street assumes that

growth will be perpetual.

__

In the US, impeachment is charge of misconduct made

against the holder of a public office, that will result in removal from office.

Article II, sec. 4 of the Constitution is the basis for the House impeachment

of President Trump. The constitutional reasons for impeachment is “high crimes

and (high) misdemeanors.” A misdemeanor is “bad conduct.” In Federalist No. 65,

Hamilton wrote that impeachment is a political act, but “political” (not in a

partisan sense) but “political” because the offenses “…relate chiefly to

injuries done immediately to society itself.” That is, a president’s

impeachment by the House and removal by the Senate should occur because he has

acutely injured the political order.

The “political order” along with “rights” are

abstractions on how the citizens of a Republic should view things. On January

23, 2016 President Trump said, “I could stand in the middle of 5th

Avenue and shoot someone and I wouldn’t lose voters.” Most immediately, he did not

understand the government system of which he is now President, and greatly

disrespects the American voter.

More generally, the U.S. political order derives from

ancient Greece and Rome, Greek democracy and Roman law. In “The Origins of

Greek Thought,” Vernant wrote that (in the 6th

century B.C.) due to changes in social structure brought about by the

orientation of a whole sector of the Greek economy toward overseas trade, “What

was peculiar to Greece was the reaction those changes produced in society: the

refusal to accept a situation that was felt and denounced as anomia

(lawlessness)…” In particular legislation concerning homicide marks the moment

when murder ceased to be a private affair, a settling of accounts between

(relatives, as still occurs in the Mideast). “Blood revenge, which had been

limited to a narrow circle but had been obligatory for the relatives of the

dead man, and thus could set in motion a disastrous cycle of murder and

reprisal, was supplanted by repression organized by the city…involving the

community as a whole. Now the murderer defiled not only the victim’s relatives,

but the entire community.” * Thus originated the rule of law (which was the

Greek philosophical temperament anyway, to look for order in the cosmos. About

which more later).

Both the President and Senator Mitch McConnell view

politics solely through the lens of political partisanship; they propose a

rigged Senate trial without documents and witnesses. This endangers our

rule-based political order, whose capabilities will be greatly challenged in

the future by climate change and increasing economic inequality.

* Vernant (1984), p.p.

74-75.

__

A Senate impeachment trial without documents and

witnesses is not a fair trial. It would drastically change our shared power

system of government. To preserve our freedoms, the founders balanced that

power among the executive, legislative and judicial branches. If the Senate

permits this President, who has refused all House subpoenas for

information, to defy Congress, it will have failed to exercise its oversight

responsibility at a crucial time. It would then become an accomplice in placing

the U.S. on the road to dictatorship, the President putting his own interests

above that of the nation’s.

There is a lot at stake.

__

What would you do if your country were exploding in

flames, as Australia is now? A 2/15/20 NYT article

notes how the Australian way of life is changing, what the present political

response is, and where the country needs to go:

· Changes

in the way of life. “…in a land usually associated with relaxed optimism,

anxiety and trauma have taken hold. A recent Australian Institute survey found

that 57 percent of all Australians have been directly affected by the bush

fires or their smoke.”

· Political

response. “The conservative government is still playing down the role of

climate change, despite polls showing public anger hitting feverish levels.”

· What

needs to be done. Good leadership is crucial. “You can’t pretend that all of

this is sustainable…If that’s true, you’re going to have to do something

different….If they called on us to make radical change, the nation would do

it.”

It is not at all

inevitable that things will get better by themselves. Its always better to act

before being overwhelmed.

↓

We Also Suggest ↓

3/1/20-

On 2/25/20 the S&P 500 closed at 3128, a decrease

of -7.6% from the market high and a decrease of -3.1% for the year. This is a

website that discusses practical political economics. This also means

discussing the behavior of markets.

After assuming that propitious economic conditions would go on forever,

the markets are now waking up to the contingency of the Covid virus, a

potential for change, that threatens industrial supply chains from China; and

worse, threatens the lives of many more people should this virus epidemic

intensify and turn into a pandemic. We are a value investor, but we do not want

the market to result in value - in this way.

In 1931, the noted economist and value investor, John

Maynard Keynes commented upon the market conditions at the time:

“There is a great deal of fear psychology about just

now. Prices bear very little relationship to ultimate values or even to

reasonable forecasts of ultimate values…Just as many people were quite willing

in a boom, not only to value shares on the basis of a single year’s earnings

(the P/E ratio), but to assume increases in (these) earnings would continually

geometrically, so now they are ready to estimate capital values on today’s

earnings and to assume that decreases will continue geometrically. In the midst

of one of the greatest slumps in history…” *

In recent years, the stock market has gone up simply

because interest rates have gone down. The thought did cross our mind that very

low interest rates, backstopped by a permanent Fed put, could be a long-term

condition, leading to high stock prices for the long-term. A glance at the

formula for the present value of an annuity (an annual payment held constant

throughout time) however, dissuaded us from this view. PV = constant

payment/discount rate, assumes that the payment will be constant. If

not, then the markets can also assume that payments will decrease over time –

leading to a large market drop.

Consider the history of actual markets. In 2011, MIT

economist Charles Kindleberger, published a revised

edition of his noted, “Manias, Panics and Crashes.” In the Appendix, he details

that between 1618 and 2008 there have been (count them) 49 major financial

crashes – an endemic feature of markets. These crashes due to: commodity price

declines, the failure of key financial institutions, frauds, the wages of

speculation - occurred an average of once every 7.95 years. **

At present levels (context), the stock market will be

highly vulnerable if the Covid virus turns into a pandemic (contingency). The latest CDC bulletin states, “We expect we

will see community spread in this country….It is not a matter of if, but a

question of when, this will exactly happen.”

* J.M. Keynes; “Economic Articles and Correspondence,

Volume XII”; Macmillan Cambridge University Press; University Press, Cambridge;

1983; p. p. 17-18.

** This data does not

include the Spanish flu pandemic of 1918, whose economic effect was probably

swamped by the social chaos that occurred at the end of W.W.I. However, in a

St. Louis Fed study (Garrett, 2007) found, “…the cohorts in utero during the

1918 pandemic had reduced education attainment, higher rates of physical

disability and lower income.” The effects of the 1918 pandemic were not good.

The average is a very simple characterization of the Gaussian

statistical distribution, that is symmetrical. We use the average here only as

an approximation of reality.

__

Once in a while, we like to run experiments in our

portfolio. What if you found this (overstating slightly) perfect company that

will benefit hugely from global warming. What if that well-run company has

great financials, and they actually paid more taxes on increased profits? What

if it was fairly valued near the peak of the overvalued S&P 500? In December, we invested .7% of our portfolio

in that company to see what would happen. The stock increased and then

decreased.

Unfortunately in a stock market panic, there is

usually no place to hide in order to preserve capital because the correlations

among stocks approach 1 (forget about the supposed precision of MPT). For buy

and hold investors, it is important to invest appropriately in stocks. We’ll

simply lose a few fractions of 1% as the stock market drops, then add to the

position when the returns justify the remaining risks.

__

So what’s happening in the heads of market

participants? In a 2/28/20 CNN interview, former Fed governor Kevin Warsh noted, “When markets are transitioning from greed to

fear, they run.”

The present value model of financial decisionmaking, speaking figuratively, is at the Gaussian

average between these two extremes of behavior. Adjusting for some risk, it

should incorporate the best level-headed estimate of the future state of

affairs - assuming everyone else, considering the relevant facts, will

eventually believe this as well. (To plan, a belief in a continuing state of

affairs is necessary.) But positive belief during a time of turmoil is also

necessary; it is also the basis of political progressivism and the necessary

reforms to bring the past into the future.

__

The Covid-19 virus is

highly contagious, but not highly fatal for most populations. In a 3/6/20 Washington

Post article Professor William Hanage, professor

of epidemiology at Harvard writes, “Testing for the coronavirus might have

stopped it. Now it’s too late.” It would have been necessary to have a

wide-spread virus testing and quarantine program a month ago to detect and

minimize Covid’s presence in the U.S.

According to Dr. Peter Hotez at Baylor, an effective virus identification and

mitigation program with presently limited resources would target three

populations: the elderly in nursing homes, medical care providers and first

responders.

The virus’ effect on the

economy is now likely to be prolonged.

__

What is the primary role

of government? Its primary role is to keep its people safe. That is the primary

job of the president is to competently handle the exceptions that life brings.

The response of the federal government to date has been flailing. The virus is

already here in the U.S. and spreading throughout the community. Concerning

epidemic control, the most important lack in the U.S. is testing kits,

that enable the identification and functional quarantine of clusters of people

to slow its spread.

According to Governor

Cuomo of New York, in a 3/11/20 CNN interview, China does 200,000 tests/day.

South Korea, which has a much smaller population, does 15,000 tests/day. Since

testing began in the U.S. (maybe at the end of January), we have done only

10,000 tests in total. We have to do aggressive testing to get ahead of this.

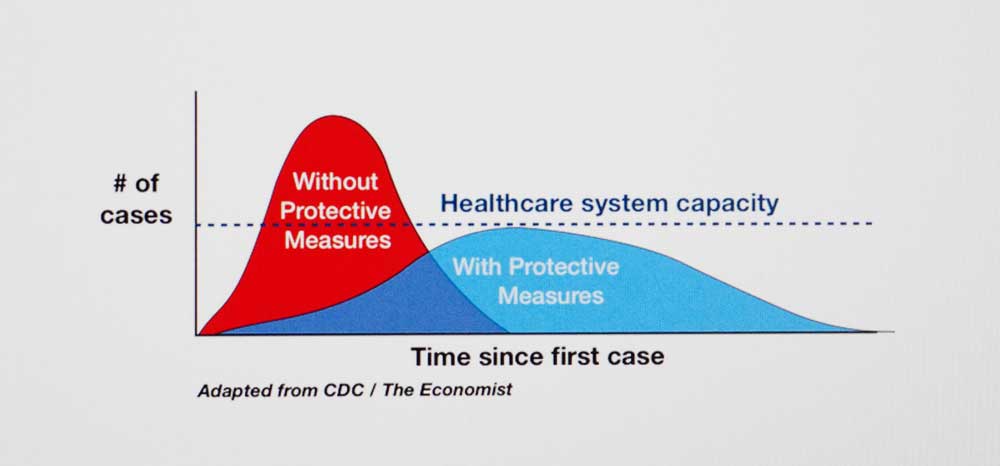

Note: If we do not, the

natural high transmission rate of this epidemic will overwhelm the healthcare

system. The role of public policy should be to flatten this curve, to slow the

spread of this virus over time and to build up the system’s “surge capacity.”

The following is a 3/11/20 NYT graph:

To do this, Governor

Cuomo says, government should:

1)

Transparently inform the public, to enable

them to act appropriately.

2)

Say, “This is what we’re going to do.”

3)

Manage the impact of this epidemic.

The goals are to

identify, isolate and treat.

__

The detailed Biden Plan

to combat COVID-19 illustrates that a president should have government

experience to effectively handle a large crisis. It is very likely that global

warming will bring on an increasing succession of crises.

__

So ultimately, why does

the truth matter? Because, as the British author Arthur C. Clarke (1972) wrote,

“Human judges can show mercy. But against the laws of nature, there is no

appeal.” The nature that we are now confronting takes the form of a highly

contagious and pernicious coronavirus.

At times like this, we

need good political leadership, real leadership to find out what is really

happening – and to give hope, by credibly showing us how to make things better.

In the 3/13/20 NYT,

columnist Bret Stephens writes:

“Very stable genius.

Millions of Trump’s supporters aren’t blind to the president’s clownishness and

ignorance. But they’ve been relatively indifferent to both, because they find

the first entertaining and the second irrelevant to his overall performance.

Who cares what a president knows about epidemiology, so long as the markets are

up? (It was a mistake to leverage this presidency on the performance of Mr.

Market.)

“They care now. The

coronavirus has exposed the falsehood of so many notions Trump’s base holds

about the presidency: that experts are unnecessary; that hunches are a

substitute for knowledge; that competence in administration is overrated; that

every criticism is a hoax; and that everything that happens in Washington is

B.S. Above all, it has devastated the conceit that having an epic narcissist in

the White House is a riskless proposition at a time of extreme risk.”

__

Given

the uncertainty of facts developing, (When will this epidemic peak? What

measures can or will the government take?), people predict either a “U” shaped

economic recovery or a pronged “L” shaped recovery – depending also upon the

resulting knock-on effects of Covid-19.

However, we can say this

with 100% certainty. After a large market drop, the world will change; because

in a capitalist social order, the purpose of large market changes is to cause

large real world changes. And we don’t want to compound market instability with

political instability.

4/1/20 –

The S&P 500 dropped a

lot.

The 3/16/20 Barron’s

has a graph that illustrates there have been 14 bear markets (where stocks have

dropped by at least 20%) since 1899. A bear market occurred, on average 1,

once every 8.64 years (data 1899-2020). This is close enough to our financial

panic calculation from Kindleberger (2011) data,

which is once every 7.95 years (data 1618-2008).

Whereas the average bear

market unfolds at an agonizingly slow pace, from the Barron’s data

taking an average of 138 days, this one occurred at a record pace of 19

(sic) days (dropping from a S&P 500 high of 3386 to a level of 2711, now at

this writing 2227).

So, to ask the reasoned

analytical question, “What’s happening?” In chapter 12 of The General Theory

(1953), Keynes wrote:

“We are assuming, in

effect, that the existing market valuation, however arrived at, is uniquely

correct in relation to our existing

knowledge of the facts which will influence the yield (price) of the

investment, and that it will only change in proportion to changes in this

knowledge; though, philosophically speaking, it cannot be uniquely correct,

since our existing knowledge does not provide a sufficient basis for a

calculated mathematical expectation. In point of fact, all sorts of

considerations (our note: like events) enter into the market valuation which

are no way relevant to the prospective yield.

“…if there exist

organized “investment” (our comment) markets and if we can rely on the

maintenance of the convention (that markets are uniquely correct), an investor

can legitimately encourage himself that the only risk he runs is that of a

genuine change in the news over the near future…” 2

Investors try to maximize

their returns and to minimize their risks. They believe the only risk they run

is changes in the near-term news, if the markets have sufficient liquidity

to enable them to get out in time. Of course, there is a big problem if

everyone tries that at the same time.

Thus Keynes further

writes, “Of the maxims of orthodox finance none, surely, is more anti-social

than the fetish of liquidity, the doctrine that is a positive virtue on the art

of investment institutions to concentrate their resources upon the holding of

‘liquid’ securities. It forgets that there is no such thing as liquidity of

investment for the community as a whole.” 3 Financial

developments since 2008 have exacerbated this tendency.

The above investor

tendency to look short-term combined with high current corporate leverage (see

our 1/1/20 graphs) have resulted in Kindleberger’s torschlusspanik, closing door panic, when panicked

investors suddenly seek the liquidity (and safety) of cash by selling their

“investments” (To whom? The Fed must again act as the lender of last resort.)

Rather than being a

simple short-term trend follower, it is useful to consider the fundamental

cause of this particular financial panic and how the course of Covid-19 might

affect the economy and the financial markets:

Covid-19

Covid-19 is a contagious

viral disease, having a high natural R0 replication rate. In

epidemiology, the replication rate “…of an infection can be thought of as the

expected number of cases directly generated by one case in a population where

all individuals are susceptible to infection.” The following table 4

compares Covid’s natural replication rate with that of other viruses:

Table I

(R0 range average)

Measles 15.0

Polio 6.0

Covid-19 2.6

Seasonal Influenza 1.5

Covid-19

is a very contagious viral disease. Left unchecked, the number of cases in the

population will grow exponentially and spike. The goal of health policy is now

to “flatten the curve” by suppressing (note, not eliminating) the number of

cases at a particular time so as not to overload the healthcare system, by

reducing R0 with public health measures such as distancing or

quarantining.

But

to reduce is not to eliminate the virus from the population. Elimination can

occur in one of two ways. The first way is by developing a vaccine against the

virus, current best estimates are in about 18 months, or by finally achieving

“herd immunity” which requires, in the instance of Covid’s R0, about

50% of the population become immune to the virus due to prior infection add:

(the worst outcome). 5

It

is possible to estimate this course of this epidemic by computer simulation.

The Imperial College of London is a major center for modeling the course and

the nature of infectious diseases. On March, 2020 in collaboration with the

WHO, Neil Ferguson, Daniel Laydon et al.

published “Impact of

non-pharmaceutical interventions (NPIs) to reduce COVID-19 mortality and

healthcare demand.” Assuming:

1)

A

lower policy R0 of 2.2. and a doubling time of 5 days.

2)

Symptomatic

individuals are 50% more infectious than asymptomatic individuals.

3)

On

recovery from infection, individuals are assumed to be immune to re-infection

in the short-term.

4)

Government

policies encouraging social distancing, case isolation, voluntary home

quarantine for 14 days, the closure of schools and universities.

They

find that “social distancing applied to the population as a whole would have

the largest impact; and a combination with other interventions – notably home

isolation of cases and school and university closure – has the potential to

suppress transmission below the threshold of R0=1 required to

rapidly reduce case incidence.”

The

optimal timing of these interventions determines the two possible strategies to

handle this epidemic, suppression or mitigation:

Suppression

“…early

action is important, and interventions need to be in place well before

healthcare capacity of overwhelmed.”

Mitigation

“…focuses on slowing but not necessarily

stopping epidemic spread-reducing healthcare demand while protecting those most

at risk of severe disease from infection…the majority of the effect of such a

strategy can be achieved by targeting interventions in a three-month window

around the peak of the epidemic.” But the problem with mitigation is that

“…mitigation is unlikely to be feasible without emergency surge capacity of the

UK and US healthcare systems being exceeded many times over (possibly 8 times,

with many deaths in the US).”

Due

to the two-month window of time lost, the U.S. is now, by default, implementing

a mitigation strategy. Therefore, emphasis must be placed on developing more

hospital facilities right away.

Had

a suppressive Non-Pharmaceutical Intervention policy been possible, the pattern

of Intensive Care Unit demand would have looked like this in England. The

takeaway here is that COVID-19 could have resulted in a series of diminishing

cyclical peaks, modulated by policy.

However,

with health policy now in a mitigation mode, there is likely to be a massive

peak in US ICU admissions, occurring very soon, and then a series of lesser

cyclical peaks in the future, provided the US is able to maintain the social

discipline to continue a NPI policy until an effective vaccine is developed and

provided COVID-19 is not like the Spanish Flu of 1918 which returned with a

vengeance in five months. 6)

Economic

Implications

Since

one person’s demand is another’s revenue, the modern economy is like a

perpetual motion machine. In 2008, there was a terrifying halt as the financial

system threatened to implode due to bad lending and investing. In 2020, there

is a necessary halt ordered by government to control a pandemic. This affects

both supply and demand and, very soon, the financial system. The goal of

government should be to try to maintain both consumer demand and the

current viability of companies; the necessary restructuring, Mervyn King,

former Governor of the Bank of England says, can happen later. The alternative

is decades of unemployment once companies disappear.

Perhaps

the best analogy to this situation is healthcare. As doctors know, during an

illness, the first priority should be for the patient to get well.

1

If this hasn’t convinced you that financial data is not (placidly) normally

distributed, nothing will.

2

John Maynard Keynes; “The General Theory…”; Harcourt Brace (ed.); San Diego,

California; 1964; p.p. 152-153.

3

Ibid.; p. 155.

4

Wikipedia; “Basic

reproduction number”; accessed 3/23/20.

5

MIT

Technology Review;

“What is herd immunity and can it stop the coronavirus?”; 3/17/20.

6

Global

News,

Toronto; “Here’s how the Spanish Flu is similar and different from the

coronavirus”; 3/21/20.

__

On

3/23/20 CNN reported that President Trump said, “‘I’m not looking at months.

I’ll tell you right now, we’re going to open up our country.’ Trump repeatedly

said that period of containment measures recommended by the federal government

wouldn’t stretch to three or four months.”

We

hope, as President, that he will make his decisions in the long-term public

interest, rather than in a reality formed by his private interest. A decision

in favor of the latter could cost many more millions of lives.

__

Dr. David Ho is a Caltech trustee and a noted

virologist at Columbia University. This is an excellent discussion of the Covid-19 virus

because he compares and contrasts the behaviors of that virus with the more

common influenza viruses. Because he believes Covid-19 is seasonal, "...we

are all facing tough challenges ahead."

If you are pressed for time, you might just read the

checked sentences and consider what should be done if Covid is seasonal and a

long-term problem without an easy solution.

__

Ronald Reagan’s soul-mate, Margaret Thatcher once

said, “…there’s no such thing as society.” This crisis shows that there is also

a social interest.

__

Several facts to note:

1) The

COVID-19 virus and its descendants will naturally circulate throughout the

world, indefinitely. Broad immunity from the virus will occur only with the

development of a vaccine (maybe in 18 months or so if we’re lucky). “Herd

immunity” to protect the unvaccinated can occur only when a fifty to

seventy percent of population has become immune (depending on the virus’

natural replication rate), either having survived the infection or having been

vaccinated.

2) The

way to reopen economies, with the virus circulating and yet without a vaccine,

is to go back to the basics: an extensive and thorough program of testing,

contact tracing, add: then providing for isolation restriction

and/or treatment to identify for those who are contagious and those

who are not. Then a planned phased opening of businesses, starting with the

most necessary.

4)

The medical COVID-19 crisis will be over

when there is an effective vaccine.

5/1/20

–

On

4/20/20 the S&P 500 closed at 2823.

.

To

stave off a financial collapse, on 3/15/20 the Fed reduced the policy rate to

0%-.25%, commenced the purchase of treasuries and agency mortgage backed

securities; then announced, with limits, the purchase of corporate debt and the

ETFs holding them. The unavoidable short-term effect of these actions is to

distort the risk pricing of the financial markets, over the short-term. But for

long-term investors, we discuss the likely effect of the COVID-19 pandemic on

long-term earnings. The following suggests that the only way the economy can

return to normality is the development of an effective vaccine. In the

meantime, the US remains unprepared for a partial return to normality, add:

requiring at least a testing supplies

program at the national level, and the rapid development of a state ability to

do local testing. Liberal capitalism assumes voluntary

social cooperation and a thought through response to the facts.

On

4/9/20 the S&P 500 hit a local peak of 2890 after recovering from a trough

of 2192 on 3/21/20, an increase of 31.8%.

On

4/13/20 a noted investor calculated the normalized level of the S&P 500 in

two years. S&P 500 = 17 (a normal P/E) X 150 (approximately

the estimated and reported S&P 500 EPS on 12/27/19) = 2,550.

Both

the market and the investor assumed the COVID-19 epidemic will be, “one and

done.” The virus will have its maximum growth now with around 609,000 people so

far infected in the U.S. The economy will be able to reopen in May

(however a system of effective immunity testing is not in place), and everyone

will be able to get on with business as usual. Most crucially, is the $150

S&P 500 EPS assumption two years from now reasonable?

But

a 2020 Harvard public health study, “Projecting

the transmission dynamics of SARS-CoV-2 through the postpandemic

period” (Kissler et al.) suggest quite

differently. We quote:

1) COVID-19

can overwhelm even the healthcare capacities of well-resourced nations.

2) With

no pharmaceutical treatments available, interventions have focused on contact

tracing, quarantine, and social distancing. The required intensity, duration,

and urgency of these responses will depend both on how the initial pandemic

wave unfolds and on the subsequent transmission dynamics of SARS-CoV-2 (the

official name).

3) After

the initial pandemic wave, SARS-CoV-2 might follow its closest genetic

relative…and be eradicated by intensive public health measures after causing a

brief but intense epidemic (like the 2003 SARS and the 2012 MERS viruses).

4) (But)

the transmission of SARS-CoV-2 could resemble that of pandemic influenza by

circulating seasonally after causing an initial global wave of infection.

* Such a scenario could reflect the

previous emergence of known human coronaviruses from zoonotic (animal) origins.

5) The

pandemic and post-pandemic transmission dynamics of SARS-CoV-2 will depend on

factors including the degree of seasonal variation in transmission, the

duration of immunity (discussed later), and the degree of cross-immunity

between SARS-CoV-2 and other coronaviruses (analogous to covariance in modern

portfolio theory), as well as the intensity and timing of control measures.

By modeling the behaviors

of two common cold seasonal viruses in temperate regions, HCoV-OC43 and

HCoV-HKU1, the researchers arrive at an approximate idea of how the SARS-CoV-2

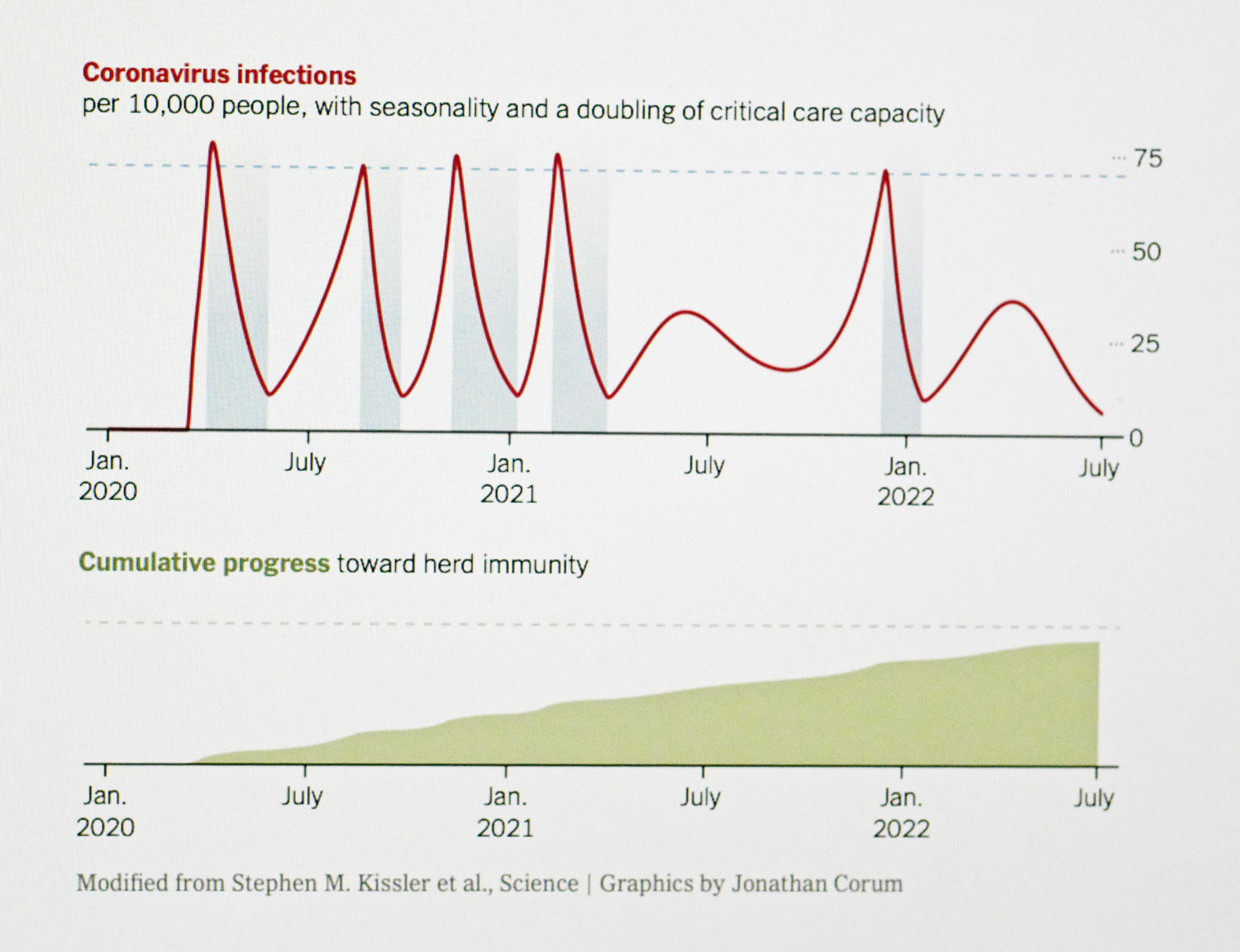

might behave. The following graphs (supplementary materials, Fig. 3) illustrate

how the prevalences of the virus/1000 people and its seasonalities vary with different assumptions:

·

Graph A - A short 40 week duration of

immunity post-infection (the peaked plot) can lead to annual outbreaks after

the initial infection.

· Graph

B - A long 104 week duration of immunity can lead to biennial outbreaks,

possibly with smaller outbreaks in the intervening years. **

· Graph

C - A higher seasonal variation in transmission would reduce the peak size of

the invasion wave, but could lead to more severe wintertime outbreaks

thereafter.

· Graph

D – Illustrates that long-term immunity will lead to elimination of the virus.

add:

Also, “Intermittent social distancing might maintain critical care demand

within current thresholds, but widespread surveillance (detections and

interruptions) will be required to time the distancing measures correctly and

avoid overshooting critical care capacity.” Social distancing is not a cure.

The 4/13/20 Barron’s notes

that there are now 140 SARS-CoV-2 experimental drugs and vaccines under

development globally. Since this is a coronavirus, these efforts have benefited

from prior studies of 2003 SARS and 2012 MERS. Researchers seem quite confident

that a vaccine will be deployed, maybe in a year or so if we are very lucky.

There is here also a major takeaway. In the past, mankind had been ravaged by

plagues. It is estimated the Black Death of the mid 1300s killed 30% to 60% of

Europe’s population. The mature Enlightenment of the 18th century

assumed that the only cure for a lack of knowledge is more knowledge, science

establishing a dialogue between humanity and its complex and changing world.

This Covid crisis is also

a chance to re-think how we should respond to both the social and natural

worlds.

* The

researchers make the crucial assumption of seasonality:

1) They

note, “Increasingly, public authorities consider (the) scenario of (complete

eradication by intensive public health measures) unlikely.”

2) In

an article we referenced last month, Dr. David Ho a virologist at Columbia

University said, “The long-term outcome may resemble influenza so that we have

seasonal bouts, with the virus bouncing back and forth between the Northern and

Southern hemispheres. This is of course just speculation, but that’s what we

see with influenza.”

3) A

2/26/20 Centers for Disease Control press briefing noted, “In terms of the

course of this illness, we have-again a team of mathematical modelers working

with us to try to predict the trajectory. One hypothesis is that we could be

hopeful (not our interpretation) that this could potentially be seasonal. Other

viral respiratory diseases are seasonal.”

We think that seasonality

is a credible working assumption.

** Covid’s presence is

highly dependent on the assumed reinfection rate. According to the 4/14/20 Bloomberg,“Understanding the level of viral immunity

in survivors of Covid-19 will prove key in making decisions about how and when

to lift restrictions. Tests that measure antibodies to the virus have been

touted as a major part of efforts to restart the economy and get people back to

work. New York state has approved an antibody test and plans to use it widely.”

But a qualification,

immunity for viruses can vary from total to non-existent; immunity from measles

is total and immunity from HIV is effectively non-existent. It is estimated

that there is some immunity to Covid reinfection, therefore simulations A

and B. More needs to be known about this virus.

__

During a 4/23/20 press briefing, President Trump

confounded the abilities of sunlight and disinfectants to kill the COVID-19

virus on surfaces with the effects of ingesting these into the

human body, the disinfectants being fatal to patients. A 4/25/20 CNN reports,

“Trump goes into hiding.” (He later said he was only joking; he was serious at

the time.)

This was after he recommended

a "game changer," the use of a malaria medicine, hydroxychloroquine,

to treat COVID-19 patients. An indicative (but not rigorously randomized)

University of Virginia study of 368 patients found that the use of that

medicine increased the fatality rate; nearly 28% of all patients who

used that medicine died, compared with 11.4% who did not use it.

· Does President Trump know what he’s doing?

· Can you trust him and the political party that

recommended him to lead us to a better future?

__

How to handle this virus? Steven Riley is the

Professor of Infectious Disease Dynamics; Imperial College, London. Here he

presents (what is an ideal case, especially in the U.S.). He was interviewed on

the 4/29/20 Bloomberg:

Bloomberg:

Will this come back every year, the coronavirus? If

it comes back will it come back with the same violence?

Professor

Riley:

We’ve got to think about the reasons its going away.

Its going away because we’re changing our behavior, and we’re trying to

find a way * to function with increased economic activity and much less virus.

If we carry on in that kind of successful way, it shouldn’t come back (in the

ideal case); and then, hopefully, we get to the stage of a good vaccine** in

very high volumes. That’s what we’re hoping is the best path forwards.

If we accepted it and allowed it to circulate then,

it would become more like flu and the other seasonal coronaviruses. But the

public health strategies we’re seeing around the world, they’re not based

around…on accepting it just circulating. (Hopefully)

But the U.S. new coronavirus case curve is leveling

off, rather than decreasing as it should. We need to build up a testing and

intervention infrastructure to take advantage of the time social distancing has

bought, at a high price.

* In systems that are complex, it is necessary to

fit the solution to the case at hand. This is but common sense.

** add: The

development of a safe and effective vaccine is no easy matter. One of the many

challenges is the animal model. Dr. Peter Hotez, a

dean of the Baylor College of Medicine says, “Mice hide and monkeys

exaggerate.”

__

Economic goals matter very much, but to achieve them

we need much less virus. add: Unless a safe and effective vaccine is developed, yesterday, this

graph from a 5/8/20 NYT article, “This

Is the Future of the Pandemic,” charts its cyclical and (its slight)

seasonal future over the next two years or so when population distancing

becomes a matter of policy - intermittent and monitored locally with widespread

testing, until 55% herd immunity is built up.

We won’t comment on what this will do to S&P 500

earnings.

↓ We Also Suggest ↓

6/1/20

–

On 5/18/20 the S&P 500 jumped 3.15% to 2954,

only 12.75% from its historic peak. Do markets always discount the future

accurately? Don’t bet on it. Long-term market valuations, Keynes wrote,

“…(assume) that the existing state of affairs will continue indefinitely,

except in so far as we have specific reasons to expect a change.” Thus,

although the market consensus has written off 2020 earnings, according to the

5/18/20 Barron’s, the market assumes S&P 500 2021 earnings of

$163/share (and normality thereafter; 2019 earnings were $157/share). If you

believe this, just look around.

Over the short-term, the market simply asks the

question, “Are things getting better or worse?” add :The short-term investor is therefore a

trend-follower, relying (especially now) on the liquidity provided by an highly

expansionary Fed monetary policy that enables him to change his mind and sell

in a flash. There is an argument that things are getting better because the

economy is starting to reopen, but see the above graph. Also, Moderna announced

a successful small Phase 1 safety trial of its COVID vaccine. On this, see the

cautious comments below from some of the NYT’s qualified readers:

BA NYC Times

Pick - I'm an infectious diseases physician who has worked in drug development

for 28 years, with 13 new drugs approved, in part, through my work. These data

are extremely preliminary. Drugs fail at every step of the way every day. But

there's another issue: mRNA * is EXTREMELY fragile and must be stored (and

shipped) in a thermally stable - and very cold - environment. How's that going

to happen? Unless they can manipulate the molecule, which they are trying to do

- to make it more stable, this is a logistics problem (along with the

manufacture of vials, syringes, needles and recruitment of health care workers

for administration of 300 million + doses) that hasn't even begun to be

addressed.

C. New York

Times Pick - I work in infectious disease research, specifically with vaccines

for HIV. While I am very, very excited about these results I find the sample

size of eight people extremely worrisome - usually vaccine studies are in the

hundreds across a number of sites (across a number of countries) for phase 1

studies. 8 people are not obviously representative of the broader human

population and specifically, given the inclusion and exclusion criteria of

healthy volunteers for phase 1 vaccine studies, for the high(er) risk

population with pre-existing conditions. While I am still very hopeful about

this, I hope that we will be able to thread the needle between the critical

need for a vaccine and the unyielding imperative to do 'good science'.

Hopefully data will be published about more than 8 patients but at this time I

think the price jump in Moderna's stock is preemptive.

* Within a cell, intermediate messenger RNA instructs a cell to produce a specific protein. The Moderna 2019 10-K does not mention this as a problem.

There are many vaccine development efforts that give hope.

__

But, “Hope is not a plan.” For better or worse,

organizations take on the characters of their leaders. In 2016, the American

electorate chose a president who cannot control himself. He therefore cannot

motivate and organize the massive government efforts necessary to do the

contact tracing and quarantine to bring the COVID virus under control and to

safely reopen the economy. America’s chaotic efforts to deal with this crisis

reflect the personal chaos of the President.

We can cite four major catastrophes that have

occurred because ideological rigidity or mental incapacity kept an American

president from adopting policies appropriate to the changing circumstances: The

Great Depression (letting the financial system fail), Iraq (lashing out at Iraq

although 9/11 was caused by Saudis), The Great Recession (further deregulating

the financial system) and COVID (letting nine weeks pass before dealing with a

highly contagious virus, expecting it to naturally “go away” with least effort)

– costing many American lives.

Americans want to be free; but so does the virus,

absent a safe and effective vaccine. Viruses are facts of nature; American

freedoms are less so, for they rely on nature remaining benign and maybe bountiful.

We need a leadership that can effectively manage both the COVID pandemic and

climate change, which are world-wide problems. In 2018, French demonstrators

held up a sign, “ Macron * is concerned with the end of the world. I’m

concerned with the end of the month.” It will also be necessary for U.S.

leadership to bridge that gap, in a world now fraught with change and new

possibilities. **

The future depends on our choices, many of them

expressed as fiscal policy.

* Emmanuel Macron is the president of France.

** On the 5/17/20 60 Minutes (clip: “How will COVID-19 reshape our world?”, the commercials are to be endured), Middlebury College Environmental Professor, Bill McKibben states this same case, but more eloquently.

__

William Haseltine is

a top U.S. scientist who founded two research departments on cancer and HIV at

the Harvard Medical School and also numerous biotech companies. A Reuters

5/20/20 article writes, “ (from a public policy standpoint)…the better approach

now is to manage the disease through careful tracing of infections and strict

isolation measures whenever it starts spreading.”

His own website gives the reader a sense of the problems when developing a safe and effective vaccine. In “Did the Oxford Covid Vaccine Work in Monkeys? Not really…All of the vaccinated monkeys treated with the Oxford vaccine become infected when challenged, as judged by recovery of virus genomic RNA…The authors present evidence to the effect that, although the vaccine did not protect the animals from infection, it did moderate the disease (in monkeys).”

__

Although all societies require motivating principles, sometimes under social stress these general principles can degenerate into ideology - when it is believed that following simple social recipes can lead to good things, such as prosperity, empowerment and freedom. The problem is that simplistic ideologies are useless when confronted with real, complex problems – such as maintaining economic growth, social peace among groups, or fighting an unknown but highly contagious pandemic. Such problems require a concept of the common interest and compromise among social groups to achieve a consensus on what to do.

In a 5/26/20 CNN article, Columbia University economist Jeffrey Sachs notes a truly horrific fact, as of Memorial Day weekend, “…America is approaching the grim milestone of 100,000 COVID-19 deaths of a population of 330 million. Six Asia-Pacific nations…have just over 1,200 (sic) coronavirus deaths in a combined population almost the same as the US, 328 million.”

“America has failed to control the epidemic while many other countries, and not just the six in the Asia-Pacific have succeeded.” Why is this so? “The American political system has not been focused on how to end the epidemic. Our political debates from the first days of the epidemic have taken the bait of Donald Trump‘s nonsensical Twitter feed, chloroquine, Clorox, China pro and con, WHO pro and con, filling church pews by Easter, the liberation of states (our note: by shotguns at the Michigan capitol), the bailout of the post office, the loyalty of Fox News, and whether or not to wear a face mask at the Ford Motor plant. Six months into the epidemic and around 100,000 deaths later we still do not have systematic contact tracing across the country. This is not the politics of problem solving; it is the politics of distraction.” These distractions emanate from a chaotic, attention-seeking President who has never run anything larger than a family business.

“Six months into the epidemic and around 100,000 deaths later we still do not have systematic contact tracing across the country…The truth is simple and grim. If we don’t stop the epidemic, we will face many more deaths and a long and deep depression. It would be wonderful if a vaccine suddenly rescues us from our persistent failure to implement basic public health measures. But don’t bet on it….That’s not a forecast, just an urgent point that we should not leave the rescue of the republic to unproven vaccines still in the early stages of development.”

__

The main advantage of democracy is that it can self-correct. But this can’t occur if everyone loses their heads. The many problems in the United States that COVID surfaced require:

· Good leadership, meriting trust.

· Social compromise that enables the solution of social problems.

· The development of effective government programs as the result of this compromise.

The next president must avoid this. The President’s one note, “Real power is...fear.” * cannot lead this nation to a positive future. Here are four major problems:

· Bringing the COVID pandemic under control.

· Providing wide-spread economic opportunities.

· Restoring social order and remedying the cultures of several police departments.

· Meeting the long-term challenge of climate change.

The call now is for “justice,” which simply means giving someone his due **, much more than just cutting the taxes of a few and expecting the benefits of their spending to somehow trickle down. Concerning the pain felt by the black community, on the 6/3/20 CNN Minnesota governor Tim Walz said, “I don’t think we get another chance to fix this.” His comment might well apply to all the above.

(+) On 6/5/20 the reported U.S. unemployment rate dropped from 14.7% in April to 13.3% in May. The S&P 500 jumped, at this writing, by 2.8%. President Trump then gave a “Mission Accomplished” speech where he said both, “Dominate the streets (against the demonstrators)” and “We’ve come together.” What’s happening? We think this analogy is apt. He thinks like a short-term stock trader, seeking a negative trend (and selling short) and a positive trend (and going long) – all with the idea of profiting no matter what.

Traders and deal people do what they do, but you can’t run a country that way. Consider a political nightmare. “National Socialism,” which if you consider closely is a stark contradiction in terms. “National,” of course, refers to the primacy of the nation-state, a binding form of social organization that replaced the dynastic empires of an earlier age. “Socialism” refers to an international movement that sought to reorganize all societies along universally rational economic lines, like a single corporation. The contradiction between these two terms lies at the heart of all modern ultra-conservative movements, whether they be fascism in the Europe of the 1930s, or allied ultra-conservatives and some businessmen in the United States. Both seek to resolve deep contradiction by …violence. A better form of social organization is a tolerant one that allows for diversity and that places people at the center.

Since violence (busting everything up) is not a very good social option, most people seek to advance their lives or/and their programs by placing priorities with, “everything in its place.” Certainly, now, the major priority should be bringing the COVID epidemic under control, because business does not have all the resources to enable people to deal with life. COVID, by the way, is beginning to badly impact the developing nations.

* Woodward (2018)

__

Do we want an ineffectual President who speaks out of both sides of his mouth, who can’t choose and therefore can’t lead?

Fact: According to the 5/29/20 Washington Post, past Miami police chief Walter Headley said, “I’ve let the word filter down that when the looting starts, the shooting starts.”

After tweeting the latter part of the sentence out, that was also once repeated by former Alabama governor George Wallace, Trump was interviewed on 6/11/20 by Fox News; he was asked whether that much criticized phrase, “frightened a lot of people.”

Trump: “It means two things, very different things," Trump told Faulkner, “One is, there’s probably going to be shooting, and that’s not as a threat, that’s really just a fact, because that’s what happens. And the other is, if there’s looting, there’s going to be shooting. They’re very different meanings.”

Harris Faulkner: “Oh, interesting.”

After four years,

America’s health care excludes more people, pollution regulations are being

dismantled, inequality has increased and “The world has watched in horror as an

American president acts not as the leader of the free world but as a quack

apothecary recommending unproven ‘treatments’. It has seen what ‘America First’

means in practice: don’t look to the United States for help in a genuine global

crisis, because it can’t even look after itself.” 1

A President who speaks out of both sides of his mouth can only lead this country in circles, or in a spiral - busting things up all the way down.

1 Foreign Affairs, 5/6/20, article by Kevin Rudd. President of the Asia Society Policy Institute.

__

If he isn’t speaking out of both sides of his mouth, then he’s degrading our government. In the above we suggested, “For better or worse, organizations take on the characters of their leaders.” The 6/15/20 NYT notes exactly this point on the federal government's current climate change policy:

“Midlevel Staff Stifles Science About Climate”

“Efforts to undermine climate change science in the federal government, once orchestrated largely by President Trump’s political appointees, are now increasingly driven by midlevel managers trying to protect their jobs and budgets and wary of the scrutiny of senior officials…

“Findings published in the peer-reviewed journal PLOS ONE in April on a subset of those (16 federal) agencies found that 631 workers agreed or strongly agreed that they had been asked to omit the phrase ‘climate change’ from their work. In the same paper, 703 employees said they avoided working on climate change or using the phrase.

“ ‘They’re doing it because they’re scared…These are all people who went to the March for Science rallies, but they got into the office on Monday and completely rolled over.’

“On April 24, 2017, Noah Diffenbaugh, a climate scientist at Stanford University, published a study showing the links between extreme weather events and climate change (with partial government support)...

“On April 25, emails show, the researchers were told that acknowledgement of Energy Department support would require additional review…

“Dr. Diffenbaugh and Stanford decided that the research should not be changed and would be published with the so-called red-flag words and the dis (est.)closure of funding sources (a matter of simple fact). Department officials later notified the project leaders that funding would be cut in half.”

-

This article illustrates why the election of a new president in November really matters. What is at stake is not only the presidency, but the effectiveness of the government that serves all Americans, in the most ideological states especially.

7/1/20 –

On 6/19/20 the S&P 500 traded at 3100 to provide a long-term investor a return of only 4.88%. As the 6/4/20 Standard and Poor’s estimate of 2021 earnings indicates the market is assuming a “V” shaped recovery, with normal 4% earnings (2% real, 2% inflation) growth thereafter. This is consistent with a high market resulting from high earning estimates.

Operating Earnings, S&P

500, est. 6/4/20

2021 $161.80 (est.)

2020 $109.71 (est.)

2019 $157.12 (actual)

No two crises are alike. A question to ask, however, is whether the COVID-19 pandemic is worse than the Financial Crisis of 2008, when the world’s financial system teetered on the brink of collapse. The following 6/20 Washington Post graph shows that from the standpoint of employment, the situation now is worse.

Since in a perpetual motion economy, one person’s expense is another’s revenue, S&P operating earnings will likely be adversely impacted for quite a while, ultimately affecting the price of stocks, even with interest rates held at the zero bound as the Fed undertakes operations to rescue the real economy and to provide the liquidity necessary to enable contract renegotiations to proceed (as they must). 1 But don’t take our word for this.

The 5/18/20 Bloomberg reports that Harvard’s Carmen Reinhart and Kenneth Rogoff are, “…the go-to experts on the history of government defaults, recessions, bank runs, currency sell-offs, and inflationary spikes.”

KR: “I also feel the markets have a very sanguine view of the virus and what’s going to happen and how quickly we will choose to return to whatever normal is. 2 It seems very uncertain to me. I don’t know how we’re coming back to (2019) levels [in the economy] in any near term. The true fall in GDP, economic historians will debate for years. It’s probably much larger than the measured fall. It’s not just the people not working. What’s the efficiency of the people who are working? (this is our major consideration)…The market is banking on this V-shaped recovery. But a lot of the firms aren’t coming back. I think we’re going to see a lot of work for bankruptcy lawyers going across a lot of industries.”

CR: “There is talk on whether it’s going to be a W-shape if there’s a second wave and so on. That’s a very real possibility given past pandemics and if there’s no vaccine….Another reason I think the V-shape story is dubious is that we’re all living in economies that have a hugely important service component. How do we know which retailers are going to come back? Which restaurants are going to come back? Cinemas?”

In the 6/5/20 NYT, economist Paul Krugman writes, “Market Madness in the Pandemic…But then came the third act, a surge in prices that eliminated most of the previous losses and drove the Nasdaq to a new high. And this surge bore all the usual signs of a bubble. Robert Shiller, the world’s leading expert on such things, has pointed out that asset bubbles are in effect, naturally occurring Ponzi schemes. Early investors see big gains because later investors drive prices up, inducing more people to buy in, and so on; the party continues until something cuts off the flow of new money, and suddenly everything crashes.” So where are the large investors who ought to stabilize the market by selling? “As John Maynard Keynes argued long ago, staid investors who usually stabilize the market tend to abdicate judgment in ‘abnormal times.’”

Maybe this is because under the pressure of short-term events, positive or negative, they forget the present value model and become, in reality, short-term investors. In the notorious Chapter 12 of The General Theory (1953), Keynes wrote:

“It might have been supposed that competition between expert professionals, possessing judgment and knowledge beyond that of the average private investor, would correct the vagaries of the ignorant individual left to himself. It happens, however, that the energies and skill of the professional investor and speculator are mainly occupied otherwise….They are concerned, not with what an investment is really worth to a man who buys it ‘for keeps’, but with what the market will value it at, under the influence of mass psychology, three months or a year hence.” The advantage of private investors is that they have longer time horizons, and can be concerned with their day jobs.

1 The 5/14/20 CNBC reports, “Starbucks sent a letter to its landlords demanding a break on rent for the next year as the coronavirus pandemic hammers U.S. sales.” Controlling only interest rates, the Fed does not seek to favor or discourage any particular industry. Its up to congressional fiscal policy to determine what our future will be.

2 The alert reader might ask how we now arrive at a long-term S&P 500 return of 4.88%, using the present value model. Here’s the trade secret:

Long-term Return of the S&P 500 = (10 year average of operating earnings/current price of the S&P) X 1.33

a) Ten year average of S&P 500 operating earnings per share ($113.72 (A)*, up to 12/31/19). For large companies, depreciation ⁓ capital expenditures, so operating earnings ⁓ EBIT. To get the operating earnings figure, as of this writing (ask S&P if this changes), navigate to the S&P 500 site, click on: Additional Info, Index Earnings. (This crucial Excel spreadsheet seems to move around a lot.)

b) 1.33, here’s where this growth multiplier applied to the above earnings yield comes from: Columbia Professor Bruce Greenwald’s lapidary book Value Investing (2001), table 7.11, p. 144. The table contains two terms: ROC/R= 12%/8% = 1.5, the ratio of a company’s return on capital/the cost of its equity capital (the rate of required investor return); and LTG/R the long term growth in distributable cash/the cost of its equity capital= 4%/8% = .50. Given these factors the multiplier for the above earnings yield is 1.33.

c) How do we modify this multiplier to take into account the long-term effects of the COVID pandemic and global warming? The answer is, we don’t. To derive what is the present value (equilibrium, undisturbed price of the S&P 500), we use the ratios ROC/R and LTG/R. All terms in these ratios can decrease proportionately due to adverse events. Unfortunately, the investor’s long-term required rate of return will decrease as well. To what level, tune in for a future episode.

d) With the above formula, you can also calculate the level of the S&P 500 given a certain required return.

e) The S&P 500 is also often disturbed ** by positive or negative events.

* YE 2019 data actual. Compare this with the S&P’s estimate of 2020 operating earnings = $109.71

add: In “Stock Prices, Earnings and Expected Dividends,” Campbell and Shiller (1988) find, “Long historical averages of real earnings help forecast present values of future real dividends (i.e. stock prices factoring out inflation).” But five years of compounded dividends recapture only 10% of a large company’s inflation-adjusted stock price. It is actually easier to estimate the level of real economic growth into the far future, than it is to evaluate the effects of specific circumstances on near-term earnings. (Here we use reported operating earnings and therefore calculate the level of the S&P 500, that includes the effects of inflation.)

Particularly for smaller companies, five years of economic growth is important because it sets the level from which a company is assumed to grow at the same rate as the general economy. For larger companies, investors consider macro environment changes in likewise matter. This also resolves an apparent paradox of why short-term stock prices are so volatile; when looking at the historical record, real growth in the long-term economy is much less so.

** For some reason, this page has been targeted by hackers, likely from a business that has been established in Hong Kong – which says something about a few business interests there. Maybe some elsewhere find our world-view disturbing; this is what happens when business is a poodle to politics. In the U.S., the problem is the reverse. An antidote to both acute extremes is the ethical, purpose driven corporation that can come to the bargaining table with government and society. This is the true nature of the liberal system of shared power.

We

will be vigilant auditing this page, noting deleted word sequences starting

with: “urbed”, index page “URL” distortions

Q.E.D.

__

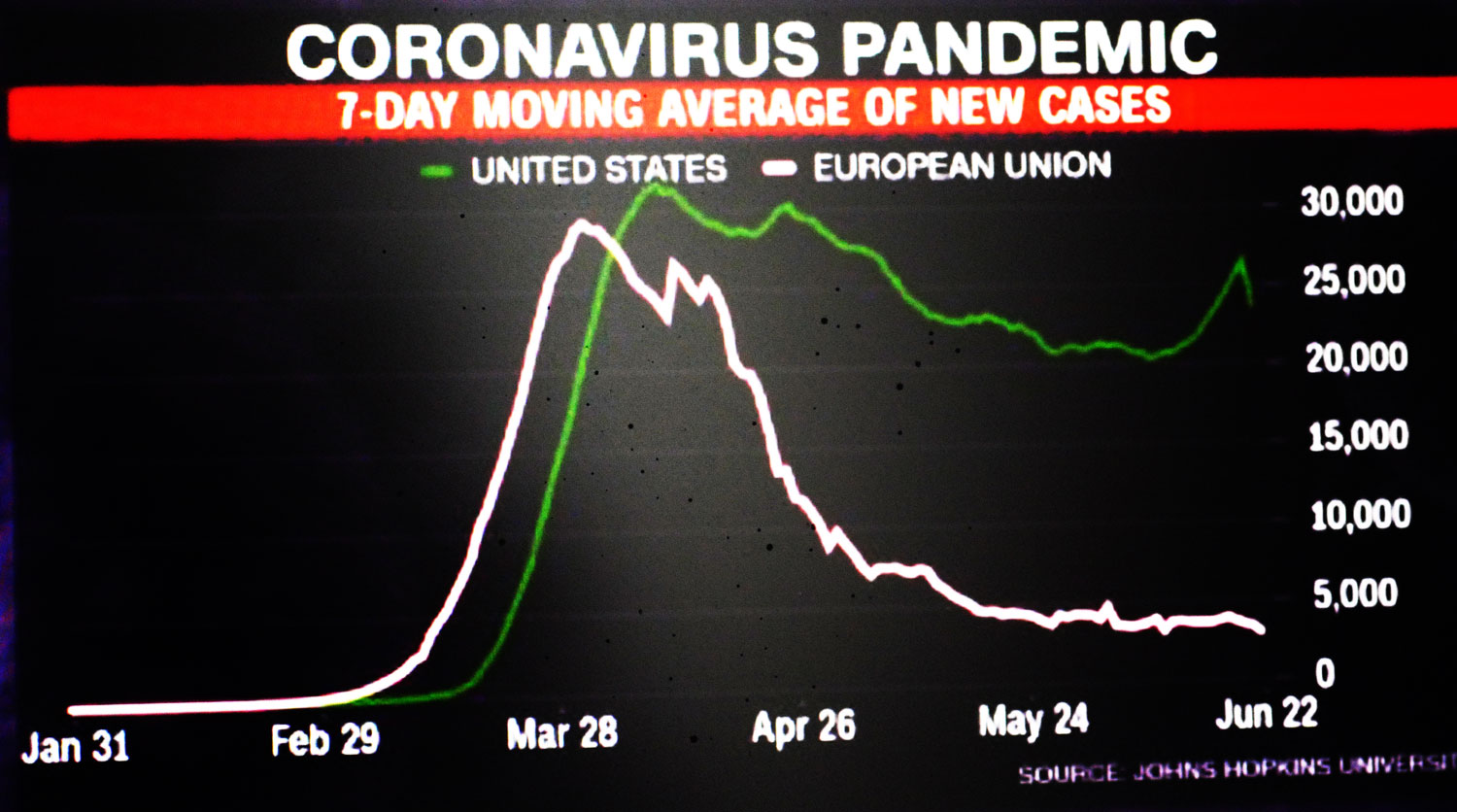

CNN published the following graph that compares the number of new US/EU cases of the corona virus to 6/22/20. The U.S. curve has not flattened out and decreased, as it has in the EU. Both have comparable populations and advanced healthcare systems.

One reason for this graph is problems at the U.S. government. Washington failed to implement a consistent, coherent and sustained plan in all the states to combat this virus, and thus allowed it to spread widely where it will continue to reappear in the general population, absent a widely effective and distributed vaccine. In 2014, in response to the Ebola epidemic, President Obama created a pandemic response team inside the National Security Council. In 2018, President Trump appointed John Bolton to head the NSC, who then reassigned the team. They would be unable to coordinate the actions of the federal government.

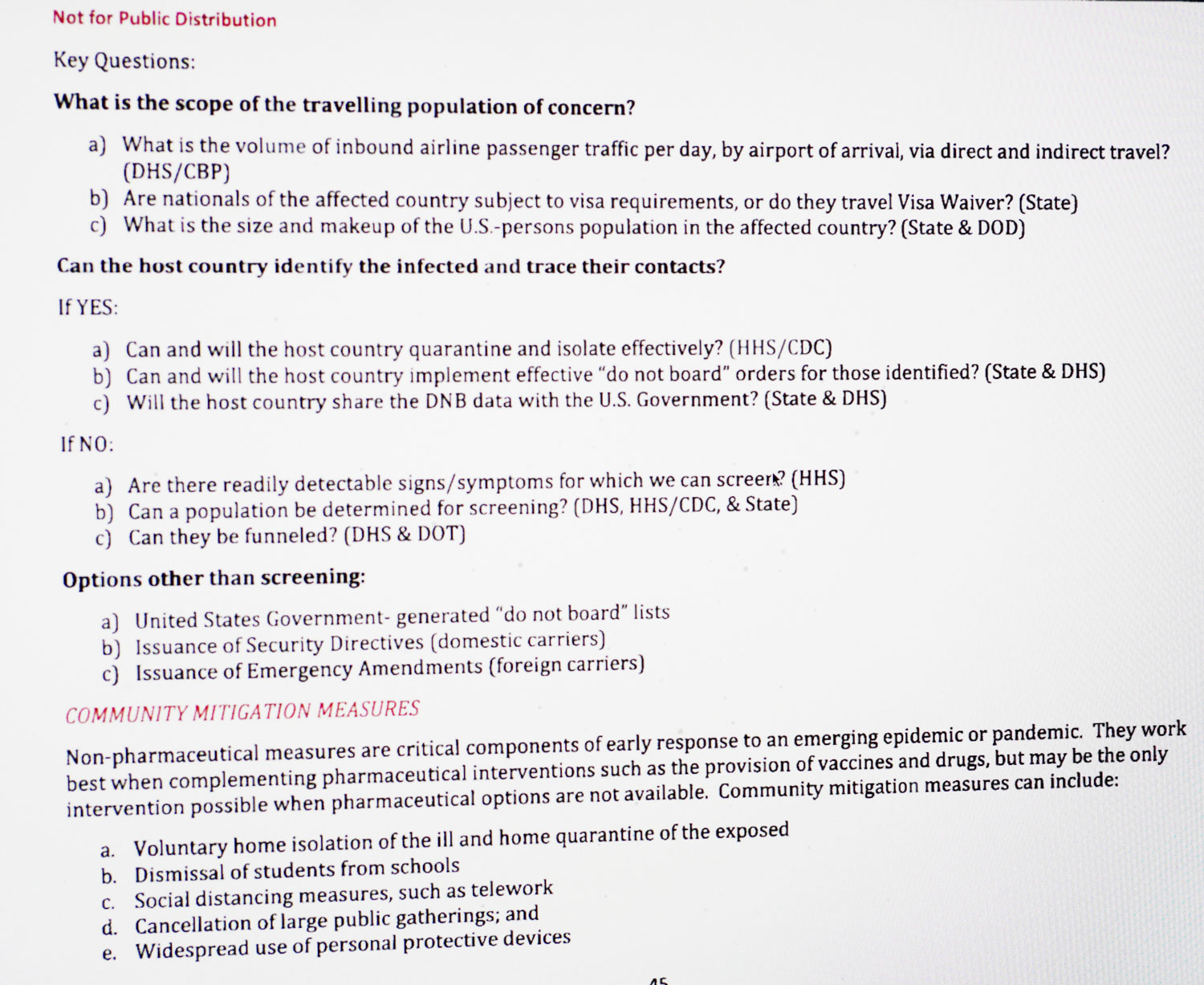

On the 6/13/20 NBC Dateline, Alex Azar, Secretary of Health and Human Services, was asked why the Trump administration did not use the epidemic Playbook produced by the previous administration. He said it was, “thin.” (The real reason was that Trump wanted to dismantle the Obama administration’s programs.) In the below, we take two examples from this very detailed 69 page plan. The first rubric (see description of Phase 2a) enables the classification of a pandemic threat; the plan then specifies all the departments that need to be involved in an effective response.

The second (p. 45) lists the recommended measures including distancing and masking which, “…work best when complementing pharmaceutical interventions such as the provision of vaccines and drugs, but may be the only intervention possible when pharmaceutical options are not available. Community mitigations measures can include…”

Bacterial infections can be cured by the timely use of broad-spectrum antibiotics. Viral infections like COVID, that tinker with the machinery of cell function, not at all easily. But there is an apt analogy between individual patient cures and overall public health. By an early failing to do social distancing and then to track and isolate individual COVID cases, the virus was allowed to escape, “into the wild,” now broadly infecting the entire U.S. A word for this is, “epidemic.”

The federal government’s flailing response to COVID-19 ” unnecessarily cost tens of thousands lives8/1/ With the virus not under control, the President has moved on to his only real concern, his re-election in 2020. Any takers?

On 7/21/20 the S&P closed close to a record of 3276, yielding a long-term investor a return of 4.62%.

The ideal investment