1/1/18 –

On 12/31/17 the S&P 500 closed at 2674, resulting in a total return of 21.83% for the year. Spanning decades, the expected present value investment return of the S&P 500 is now only 4.74%, rather than our required return of around 8%. Investors should compare this expected stock return with the likely return of the 10 year treasury one or two years from now, around 4%. The actual realized return to short-term speculators will be – whatever.

In our December posting, we noted relatively persistent economic patterns relating unemployment and inflation, patterns that momentum investors or computers could exploit. Is this pattern relevant to value investors? In The Intelligent Investor, Benjamin Graham wrote that investors should consider themselves partners in real businesses; they should analyze their investments as businesses.

“Imagine that in some private business you own a small share that cost you $1,000. One of your partners, named Mr. Market, is very obliging indeed. Every day he tells you what he thinks your interest is worth and furthermore offers either to buy you out or to sell you an additional interest on that basis. Sometimes his idea of value appears plausible and justified by business developments and prospects as you know them. Often, on the other hand, Mr. Market lets his enthusiasm or his fears run away with him, and the value he proposes to you a little short of silly….If you are a prudent investor, or a sensible businessman, will you let Mr. Market’s daily communication determine your view of the value of a $1,000 interest in the enterprise?”

Consistency is very important for investors in markets, thus the importance of an investment philosophy to guide you through the market’s complexities. But, there is also the issue of ownership. You are the ultimate owner of your portfolio, not Mr. Market.

Some of our readers may have spent decades of their careers amassing their net worth; certainly the investment of that net worth is worth some patience. A value investment philosophy would dictate, “Buy when prices are low, not high,” to preserve wealth. However, if some of our readers are just starting their careers, it is more important to consistently invest in the stock market at their comfort levels, and to invest their efforts in their day jobs, because a major portion of their net worth will accrue in the future. They will then continue to buy stock when the stock market is low and the expected returns of the market are higher. Readers at the midpoints of their careers might find it useful talking to a qualified investment advisor, avoiding complicated investments and being aware of the present historically low return of the U.S. stock market.

__

This is a website about the stock market, it is also about its political economy context - the organization of society to produce wealth. The present politics of the United States is very worrisome, because it is motivated not by the reasonable consequences of a certain course of action, but by the emotions of fear and anger. Recall school. You are rationally solving an algebra equation. Could you do so if you were overwhelmed by fear and anger? Likewise, we ask whether pandering to the electorate’s fear and anger will achieve anything like the present (albeit unbalanced) economic prosperity brought about by previous years of expert Fed management to recover.

Unfortunately, in a democracy, a way to get political power is to pander to the fear and anger of the voters, always blaming someone else: foreigners, immigrants, fake news, experts, the bureaucratic swamp in Washington, and the “deep state.” (This sounds like the Mideast.) A divisive president can’t govern, can’t convince; the next step is to blame domestic traitors for regime failures. The way to get out of this national nightmare is to realize that people are not powerless; that the 2018 elections do matter very, very much; and that the way to get out of a hole is to stop digging (to mix a metaphor) into a Pandora’s box containing the evils of the world. We would look to real concern * and the power of reason to navigate an increasing complex world created by globalization, demographic, climate and technological changes.

The 12/26/17 Washington Post contains an excellent article, “To beat President Trump, you have to learn to think like his supporters.” The author is a Madrid economist, Andrés Rondón, who grew up in authoritarian and now distressed Venezuela.

“(This is) how populism works. As long as Trump is still swinging back, scandals help him to polarize the country further. The scorn of his adversaries, in the eyes of his supporters, proves that he’s doing exactly what they voted him to do: dismantling a rigged (economic and ethical) system that they believe destroyed their hopes **….what can really win them over is not to prove you are right. It is to show them you care. Only then will they believe what you say….I believe (the solution to Trump) should rest on understanding and emphasizing with their grievances that brought Trump to power ‘(wage stagnation, cultural isolation, a depleted countryside, the opioid crisis)’. Trump’s solutions may be imaginary, but the problems are very real indeed. Populism is and has always been the daughter of political despair. Showing concern (by developing effective programs) is the only way to break the rhetorical (and political) polarization.”

The historian, Donald Kagan (1991), writes about the difficulties of maintaining a system of liberal democracy.

“The paradox inherent in democracy is that it must create and depend on citizens who are free, autonomous and self-reliant. Yet its success – its survival even – requires extraordinary leadership. It grants equal rights of participation of citizens of unequal training, knowledge, and wisdom, and it gives final power to the majority (who concern themselves with leading their lives rather than politics)…It gives free reign to a multiplicity of parties and factions, thereby encouraging division and vacillation rather than unity and steadiness. In antiquity, this led critics to ridicule democracy as ‘acknowledged foolishness’; in the modern world, it has been assailed as inefficient, purposeless, soft, and incompetent. Too often in this century its citizens have lost faith in times of hardship and danger and allowed their democracies to become tyrannies of either the right or the left.”

But why endure hardship and danger when it is easier to slide into the irresponsibility encouraged by a tyranny? The major moral virtue of democracy is responsible freedom, both to oneself and to others. It’s not, “Don’t Tread on Me.” -In Professor Kagan’s words, “(Pericles’) success and that of Athens rested on more than prosperity and rhetoric. He also had a vision for his city that offered…its citizens the opportunity to achieve, through common effort, personal dignity, honor, and the fulfillment of their highest needs.” The Athenian system of democratic self-rule survived for hundreds of years.

* This is not an article advocating gimlet-eyed rationality. This 12/29/17 NYT article discusses the importance of positive emotion to sustain your commitments, financial and otherwise.

* *Let these words sink in. More generally, the capitalist system considers labor but a factor of production like natural resources and capital equipment. Of course it isn’t just that. An economic system is supposed to benefit the country and its people at large, not just a deal oligarchy and shareholders, for a short time.

The Washington Post columnist, E.J. Dionne, concludes his new book, One Nation after Trump (2017), “…it is our shared commitment to republican institutions and democratic values that makes us one nation.”

2/1/18 -

As of 1/19/18 the S&P 500 has increased by 5.11% for the year to 2810, pricing the stock market way beyond its economic fundamentals. A crucial assumption being made is that inflation and interest rates will remain very low, supporting share prices by making fixed-income investments less attractive as an alternative to stock dividends. We make the opposite assumption because:

1) As our 12/1/17 posting suggested, the Philips curve describing a tradeoff between inflation and the low unemployment rate is starting to reappear.

2) The Congressional Budget Office projects that the tax bill just passed will increase the deficit by a 10 year average of $150 billion per year (not including macroeconomic effects; the 2018 baseline projected deficit without this tax bill is $563 billion). During more prosperous times, nations are supposed to increase their savings.

3) International economic growth and oil prices are increasing; the exchange rate of the dollar is decreasing.

We are closely tracking 10 year treasury yields, which we expect to increase.

__

add: We suggested above that the U.S. economy is primed to generate inflation in the excess of the moderate 2% expected by the Fed and by the market. On 2/14/18 the Labor Department reported that the January consumer price index jumped by 0.5%; excluding food and energy, the core inflation rate jumped by .3%. Whether 0.3% or 0.5%, this doesn’t look good. The yield on the ten year treasury jumped from 2.66% on 1/19/18 to 2.92% on 2/14/18. We think at a level of 3%, long-term interest rates will start to inflict even more pain on the stock market.

To further discuss the effect of monetary creation on the economy: In 2009, at the beginning of quantitative easing, some hedge fund managers expected higher inflation, which did not happen. The reason for this is that the excess bank reserves created remained bottled up in the banking system, held there by a low demand for funds, by the Fed policy of paying interest on these reserves, and by a Congress that had hobbled itself by spending caps and sequestration.

With the Republicans presently in control of all three branches of government, such restraints have disappeared. In the following, the Congressional Budget Office estimates the effect on the deficit of the most recent H.R. 1 Budget Conference Agreement between the House and the Senate; we add New Approved Spending and Infrastructure.

Effect on the Deficit of the H.R. I Budget

Agreement & New Approved Spending

(billions of dollars)

2018 2019 2020 2021 2022 …..

Baseline Forecast -563 -689 -775 -879 -1,027

Effect of Tax Cuts -137 -286 -273 -244 - 208

New Spending -243 -153

Infrastructure Spending - 45 -20

- 20 - 20 -

20

Total Deficit -988 -1,148 -1,068 -1,143 -1,255 ….

Rather than starting in 2022, the trillion dollar deficits will essentially start this year, with the economy operating at full capacity, driving up interest rates. The trillion dollar deficits will never end; this analysis does not even take into account economic downturns. At around 5% of GDP, these deficits will add another 25% of GDP to the debt in five years. What does this mean for the future ability of the United States to borrow? Here are OECD comparisons of the 2015 Gross Government Debt /GDP ratios of selected countries:

Greece 183%

United States 125% + 25% in 5 years

France 120%

United Kingdom 112%

Germany 79%

These figures show that the large and continuing U.S. deficits will begin to tempt fate very soon.

The $20 billion per year that the administration has allocated to infrastructure will probably be enough to improve all the hiking trails in the United States – we like hiking.

__

On January 20th, President Trump celebrated his first anniversary with a government shutdown. The major issue of contention was of his making, cancelling an Obama administration executive order that deferred deportation action for the Dreamers, undocumented immigrant children who have grown up in the United States and who are now contributing members to U.S. society. His handling of this issue subsequent to his order illustrates how he does deals. His deal style had resulted in the refusal of all the major banks in New York to do business with him, with the exception of the private banking (not the commercial banking) division of Deutsche Bank.

According to a NPR report, on January 20th, Senate Minority Leader Chuck Schumer related what happened when he spoke with President Trump:

“He’s rejected not one but two viable bipartisan deals...What’s even more frustrating than President Trump’s intransigence (after tasking Republican Graham and Democrat Durbin to reach an agreement, which they did) is the way he seems amenable to these compromises before completely switching positions and backing off (after then considering what his advisors say). Negotiating with President Trump is like negotiating with Jell-O.”

This is a telling comment, for it strikes at the President’s deal making ability, not addressing the separate issue of his intentions. From this comment, it seems that President Trump:

1) Did not exert leadership, pulling a deal together.

2) Doesn’t know what he really wants, being bereft of a political philosophy.

3) Can't govern. Before becoming President, he had run only a family business.

His presidency lacks coherence; its time for checks and balances.

__

add:

On 2/16/18 Special Counsel Robert Mueller unsealed a detailed criminal indictment against sixteen Russian organizations and individuals, accusing them of having, “…a strategic goal to sow discord in the U.S. political system, including the 2016 U.S. presidential election. Defendants posted derogatory information about a number of candidates, and by early to mid-2016, Defendants’ operations included supporting the presidential campaign of then-candidate Donald J. Trump…and disparaging Hillary Clinton. Defendants made various expenditures (our note) to carry out those activities…and without revealing their Russian identities and ORGANIZATION affiliation, solicited and compensated real US. persons to promote or disparage candidates.

On 9/22/17, Donald Trump had tweeted, “The Russia hoax continues…What about the totally biased and dishonest media coverage in favor of Crooked Hillary?” On 2/16/18 he then tweeted, “Russian started their anti-US campaign in 2014, long before I announced that I would run for President…The Trump campaign did nothing wrong – no collusion.”

These tweets show that the major concern of the President is not securing the United States from future Russian interference. They show his major concern is to be shown to be innocent of Russian involvement in his election. In other words, the presidency is all about him, not about the future of the nation. Time for a rethink about enabling this President to do more damage described in all the above.

__

Due to the common sense of the American people and our redundant government system of checks and balances, the Republic will (just) survive, even this presidency. But, the economic forces of globalization and the resulting income inequalities are tearing away at the social fabric of liberal democracies around the world: in Britain, France, Italy and (here most notably) Poland.

According to a 1/22/18 WSJ article, “…a battle for Europe’s soul is once more being fought in Poland….(European populist) rebels say control of people’s lives has been given to elites, technocrats and courts, leaving voters with limited choices. They promise to return power to ordinary people. Similar frustrations…(include) the populist wave that helped carry Donald Trump into the White House….’For years we were subject to a kind of indoctrination,’ said Witold Waszczykowski,…Poland’s former foreign minister. ‘Traditional, religious, patriotic family values were not progressive enough, not European, not developed.’”

“The message appealed to socially conservative…Poles in small towns and villages. Many of them didn’t identify with the new, cosmopolitan Warsaw of sushi bars and Gay Pride marches. In the still-poor countryside, many felt the new Europe was more interested in cheap Polish labor than in the traditions that carried them through war and tyranny….The Law and Justice party drew on a broader sense of betrayal among Polish voters. Although the nation’s economy grew during the global downturn, salaries remained low, jobs were insecure and health are and public services were patchy. A cultural divide deepened: half of Poland looked at Europe with hope, the other half with suspicion.”

The world’s economic system is now highly integrated. We do not think it can be fractured without severe consequences. The founder of the Polish democratic revolution, Lech Walesa, says of the ruling party, “They diagnose well, but they cure badly (by acting out).” The socio-economic justification for the free trade system is that the winners compensate the disadvantaged. The failure to do so is the glaring deficiency of the globalized economic system; there is still time to correct.

3/1/18 -

On Feb. 27, Jerome Powell, Chairman of the Federal Reserve, testified before the House Committee on Financial Services. He expected more years of economic growth:

“The robust job market should continue to support growth in household incomes and consumer spending, solid economic growh should continue to support growth in household incomes and consumer spending, solid economic growth among our trading partners should lead to further gains in U.S. exports and upbeat business sentiment and among our trading partners should to further gains in U.S. exports, and upbeat business sentiment and strong sales growth will likely continue to boost business investment. Moreover, fiscal policy is becoming more stimulative. In this environment, we anticipate that inflation on a 12-month basis will move up this year and stabilize around the FOMC’s 2 percent objective over the medium term.”

But the S&P 500 then dropped 1.27%. Why? If you are invested in short-term money market funds, you will finally be receiving some return on your cash. If you are invested in long-term financial assets, economic growth is beginning to cause losses. In the Keynesian portfolio adjustment process, if the return on cash increases due to a more restrictive monetary policy, so will the return on long-term financial assets and their prices will drop. The discussion now in the financial markets is whether the Fed will hike rates three or four times this year, and then more the year next (causing acute problems). Given the ability of a dysfunctional Republican controlled Congress to generate unending trillion dollar yearly deficits, not at the bottom of an economic cycle but at its likely peak, we consider four ¼% Fed policy rate increases this year to control inflation quite likely. If that does not happen, the bond markets will adjust at the long end to compensate investors for higher inflation. We also note that both the highly leveraged Fed (although it accounts for its assets at historical cost) and world economy, full of low interest rate debt, cannot let inflation get out of control.

Four more rate hikes this year will lift the Fed funds rate to 2.5%. That should, after some volatility, translate into a 10 year treasury of 4.5%, and a S&P 500 eventually priced to return investors 8% (our target) - 8.5% (including the likely equity risk premium) At a 2/28/18 closing level of 2714, the S&P 500 is priced to return only 4.67%.

__

Goldman Sachs’ most recent baseline interest rate forecast expects a year-end 10 year treasury rate of 3.25%, saying there is no immediate cause for concern. This is likely the Wall Street consensus. However, this graph series indicates that a low .75% spread between the fed funds rate and the 10 year treasury is unlikely, except in times of extreme financial market turbulence.

__

add:

This stock market discussion illustrates that stocks can (and should) be priced off their alternatives, which are long-term bonds. This is also the best explanation for our readers.

__

On 3/1/18 President Trump announced he would impose a 25% tariff on steel imports and a 10% tariff on aluminum imports. The stock market dropped 1.33% to 2678. Now add the effects of tariffs, trade wars to the prospect of an overdriven economy...

This is a political economy website. We have really been trying not to write about the Administration; but then – something happens – illustrating some lack in presidential character and self-control, violating the norms, restraints and expertise that make us free – and therefore inevitably resulting in bad policy. Such a policy is a large tariff on imported steel and aluminum. The 3/2/18 Bloomberg writes:

”…the Trump administration’s focus on metal manufacturing misunderstands the nature of America’s trade with the world, where the (trade) deficit is not in raw materials, but in (more sophisticated) finished products. It’s cheaper for U.S. consumers to buy things abroad, and that’s what they’ve been doing for many years. Little wonder, then, that U.S. steelmakers have been reluctant to invest, showing some of the lowest rates of capital spending and R&D globally.

That refusal to spend now looks to have got its reward in the form of Washington’s new protectionist stance. But the more innovative automotive, machinery and aerospace manufacturers that consume American metal are the ones employing more workers and showing better prospects for the country’s economy. Lifting the materials costs they face by protecting inefficient local mills is only going to exacerbate their problems.”

4/1/18 –

On 3/22/18 the S&P 500 index dropped by 2.52% to 2,643, bringing to mind the late economist Rudiger Dornbusch’s quote, “The crisis takes a much longer in coming than you think, and then it happens much faster than you would have thought.” Almost ten years ago, on 9/1/08, the S&P 500 closed at 1283. During the Great Recession, it dropped by 46% to a low of 683 on March 5, 2009. In the September posting , we cited three main reasons for the vulnerability of that stock market.

1) A decrease in house prices.

2) Decreasing credit extended by banks.

3) An increasingly complicated financial infrastructure, acting as a vector of contagion that ultimately required the Fed’s rescue of the entire world’s financial system.

In globalized markets the catalysts (positive or negative) can differ widely. We cite the likely catalysts for this large market drop. (We apologize for mentioning Donald Trump again.)

1) An economically optimistic speech given by the new Fed chairman, Jerome Powell, that predicted (in a data dependent way) a series of moderate but indefinite rate hikes, reaching a projected Fed policy rate of 2.9% by the end of 2019. (Needless to say at that normalized interest rate, a 4.67% long-term stock market return is decidedly unattractive.)

2) A data scandal at Facebook calling into question its business model of selling ads, targeted according to the behaviors of their users. Cambridge Analytica produced very misleading political ads and trafficked in disinformation. Steve Bannon was an executive of the company and ran Donald's Trump's political campaign. (Note Facebook's business problem. Commercial ads are ignorable, allowing "puffery." Politics is very serious. Social media facilitates the unchecked spread of rumor and untruths. Does the establishment of truth need the restraint of checks and balances? Who is to judge? How can the social media provide them? These are the classic problems of liberal society.)

3) Donald Trump’s announcement of a plan to slap large tariffs on at least $50 billion in Chinese imports, thus possibly initiating a global trade war. From perusing a summary of “The President’s Trade Policy Agenda,” we sense he means to follow up. What is further disturbing is the announcement of his appointment of John Bolton, a major advocate of the Iraq war, to be his third National Security Adviser. This new appointment, along with many others, signals that after a year of trying to live with the Washington establishment, “Donald is going to be Donald.”

Some things remain the same. We ended that posting with a quote from the Bard, “When sorrows come, they come not single spies but in battalions.” Our portfolio strategy remains risk control.

4/2/18 –

In a steep market sell-off, the S&P 500 closed at 2,582, down 2.23%. This decline was likely motivated by Donald Trump’s growing trade war with China and by his graduation from going after people to going after Amazon on Twitter. An unremitting hostility to everyone, excluding his political base, is not good for business. A trade war could have a short-term effect of driving up inflation, as domestic producers become free to raise prices; but a long-term effect of depressing business, as the international economy ceases to grow. How the crosscurrents of these affect interest rates, already biased upwards by increased deficits, or corporate earnings we cannot specify; but an increase in the former (and, or) a decrease in the latter are not good for stock prices.

For an unrelated reason we sold two of our three remaining stocks at the opening of the market, and took a slight profit. The reason we did so is related to a loss in our one remaining equity investment in Buckeye Partners (BPL). With the reduction of the interest sensitivity of our portfolio, what happens to the price of BPL (especially in this general market environment) is much less of a concern. In 2017, the company completed an acquisition that increased its risk. A long-term investor would say, "Let's see how things turn out." The U.S. tax code also discourages the sale of limited partnership investments.

This leads to the issue of short-term losses. We will likely increase our equity investments during a period of high market turmoil. The market may hit our rate-of-return buy point. At that time, we will have no assurance that we will have bought at the bottom.

5/1/18 –

In last month’s posting, we identified three major events that were likely catalysts for a steep market drop:

1) The Fed’s interest rate hikes.

2) A data scandal at Facebook, calling into question its business model.

3) An U.S.-China trade war.

The consequences of the last two, while still potentially problematic, will play out over time. The market promptly ceased to factor them into prices. But the first will continue to be a major concern to markets in the future. Some discussion of all the sources of long-term stock returns is therefore warranted.

A present value formula for calculating the rate of stock market return has a time horizon of more than twenty years – appropriate for a pension fund or an individual with a very long investment time horizon. Over a shorter time horizon, investors will experience returns that are either greater or lesser – depending upon their investment philosophies or trading luck. The Gordon model simply states that the equilibrium stock market return is equal to the sum of the present dividend yield, real economic growth and inflation. Thus:

Equilibrium Return of the S&P 500 = D0/P + real economic growth + inflation

= 1.87% + 2% +2% (the current Fed target) = 5.87%, say 6%

At long-term equilibrium, the sources of future stock market returns are roughly balanced among current dividends, real economic growth and inflation.

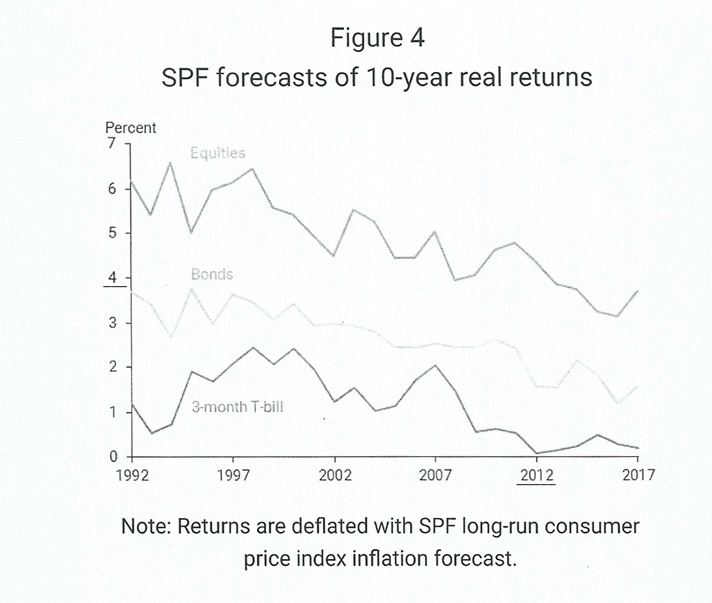

In 2017, John Williams, now president of the New York Fed, published an excellent study that explained why interest rates and investment rates of return have declined in developed countries. In this study, the Philadelphia Fed’s Survey of Professional Forecasters estimated an average 6% 10 year stock market return figure, including 2% inflation, since 2012 (that tracks the longer term Gordon model), see the following figure 4. The following graph from the Williams study also shows the markups of financial assets over the natural rate of interest, the real interest rate in the economy prevailing at full employment and non-accelerating inflation. The following graph implies a low 0% natural rate of interest, a near 0% short-term Tbill rate, a 10 year treasury bond markup to yield a 2% real rate of return equal to the growth of the economy, and an additional 2% equity markup to account for risk. The total estimated equity return is 4%. Then add 2% for inflation; totalling 6%.

But our 12/31/17 present value estimate of equity return was 4.74%, in line with the estimates of a number of pension fund managers. Why the discrepancy? We utilize Robert Schiller’s 10 year earnings average (here operating earnings assumed equivalent to distributable cash), to account for economic cycles. The Forecasters are apparently assuming the present dividend yield (at what is likely near the peak of the economy) which does not take into account dividend decreases and the extreme market behaviors described in Charles Kindleberger’s “Manias, Panics, and Crashes (2000)”, that can take 40% off the stock market’s value. We think a 4% markup of equities over the 10 year treasury is appropriate, requiring a S&P 500 investment return of 8.

__

A 5/1/18 Washingon Post article noted that in 466 days, President Trump has made 3,001 false or misleading claims. We value truth; we assume most of U.S. society does. Why does he do this? In a 4/28/18 NY Times, former CIA director Michael Hayden writes:

“It was no accident that the Oxford Dictionaries’ word of the year in 2016 was “post-truth,” a condition where facts are less influential in shaping opinion than emotion and personal belief. To adopt post-truth thinking is to depart from Enlightenment ideas, dominant in the West since the 17th century, that value experience and expertise, the centrality of fact, humility in the face of complexity, the need for study and a respect for ideas.” The value of truth is woven into this society (and economic growth cannot continue without it).

It is an idea from the classical world that the search for truth requires reason, reason to see into the factual nature of things and to inform a judgment which properly evaluates the likely consequences of our decisions. This results in liberation from the tyranny of circumstances. Mr. Hayden continues, “The historian Timothy Snyder stresses the importance of objective reality and truth in his cautionary pamphlet, ‘On Tyranny.’ ‘To abandon facts,’ he writes, ‘is to abandon freedom. If nothing is true, then no one can criticize power because there is no basis upon which to do so.’ He then chillingly observes, ‘Post-truth is (n.b.) pre-fascism.’”

In a 4/16/18 talk, Columbia journalism professor, Bill Grueskin also crucially noted that the goal of “fake news” in authoritarian societies is not to convince people on issues of government policy. Its purpose is to make it impossible for people to believe what is true. They then turn passive, close off and say its all too confusing. They can’t believe anything.

Mr. Hayden asks, “…was Mr. Trump actually able to draw a distinction between the past that had really happened and the past that he needed at that moment?”

__

Timothy Snyder is a professor of Modern European history at Yale. He believes that the degeneration of our democracy into the willed chaos of fascism is now quite close. Complacency would be a bad mistake. In “On Tyranny,” he suggests a number of steps we could take, among them:

· Do not obey in advance Most of the power of authoritarianism is freely given.

· Defend institutions. Choose an institution you care about, and take its side.

· Take responsibility for the future of the world. Life is political, not because the world cares about how you feel, but because the world reacts to what you do.

This pamphlet concisely (and brilliantly) details how totalitarianism works. It is available from amazon.com as a $3.99 Kindle download. Its value exceeds its price.

On 5/3/18 a CNN anchor said an all-time. “We know less today than we did yesterday.”

6/1/18 -

On 5/21/18, the S&P 500 closed at 2733, yielding a long-term investor a return of only 4.65%. What should that return be in a normal market? In the U.S., the yield to maturity on bonds and loans is measured by a markup from the Fed funds policy rate. Although this concept is not usually applied to equities, we treat the S&P 500 likewise to describe what is happening to risk assets in the financial markets.

Debt and Equity Investment Yields 5/21/18

Theoretical Actual Difference

Current Fed Policy Rate 1.75% 1.75% 0

10 Year Treasury 3.75%* 3.06% -.69%

S&P 500 7.75%** 4.65% -3.10%

*This is the 2% Fed rule of thumb, which calculates 10 year treasury yields above the policy rate. **This assumes a 4% risk premium over the 10 year treasury, add: about which more next month.

The table above indicates that the yield curve of risk assets is extremely flat, due to the Great Recession of 2008, the integration of China into the world-wide product supply chain and demographics. The first two factors are likely to change as the economy is at full labor capacity utilization, as energy prices increase and as the Fed contemplates four or more .25% policy rate hikes from now to 2019. Would anyone want to invest in a 4.65% stock market compared with a 4% plus ten year treasury?

__

There is an ancient military strategy, ”Divide and Conquer.” This is the exact strategy that the divisive President Trump uses to gain leverage over American society: its voters, its institutions and its allies – by trying to diminish (in any way possible) larger and sometimes balancing concentrations of power, so he can exert his will. But as playwright Robert Bolt wrote, “ …do you really think you could stand upright in the winds that would blow then?” American society is a commercial civilization where economic growth and therefore social trust matter.

On 5/15/18 PBS aired an episode of, “First Civilizations,” that examined the crucial role of trust in commercial societies. We will let the narrators speak, who provide some things to think about:

“Trust and trade may work in this...feedback loop. For trade to start, any civilization needs trust and the more trade you have the more trust you have, and so the loop continues and the benefits are really exponential. In high trust societies they don’t just thrive economically, you actually see individuals in society thrive because they have more freedoms, they have more empowerment, you see more entrepreneurship, you see more human empathy…

“The collapse of any civilization is never a simple story. (This episode looks back to the archaeological record showing increased interpersonal violence; AK-47s anyone?) It sort of paints a picture of the experience of that loss of social control.

“You can look back over history and look at the collapse of civilizations and they follow this similar pattern. Most recently, we’ve seen this in the financial crash, in that you have a system that people have confidence in, and then something goes wrong. Someone behaves badly, someone becomes greedy and the first thing to go is the confidence, and then quickly its like a house of cards.

“Civilizations are essentially social experiments in large groups of people living together, being “civil” with one another…

“Trade has always been a trigger of change. It encourages us to come together, to exchange things, to share ideas, to create societies built on cooperation, trust, peace. This was true for the first civilizations and it is still true today. Trade, the driving force of civilization.”

7/1/18 –

On

5/21/18 Federal Reserve Governor, Lael Brainard, gave a speech,

“Sustaining Full Employment and Inflation

around Target,” where she asked how the Fed would be able to sustain an economy

at full employment, currently around 3.8%, and inflation around 2%. To do so, the Fed expects a policy path

for fed funds that, “…moves gradually from modestly accommodative today…and

(then) modestly beyond neutral-against the backdrop of a longer-run neutral

rate that is likely to remain low by historical standards.”

The

causes for this policy of gradual (but of course conditions determined) rate

hikes will be:

1)

The

tightening resource utilization of a cyclical economy (as we expected).

2)

Rising

fiscal stimulus that “…reinforces above-trend growth” (which we did not

expect). According to OMB projections, beginning in F.Y. 2019, the U.S. will

run trillion dollar deficits – at what is likely a cyclical peak, for as far as

the eye can see.

3)

The

Fed’s bond sales from its $4 trillion dollar balance sheet (as we expected).

Given the above, at least another 4 quarter percent rate hikes until the end of 2019 is very realistic. Such a series of rate hikes will result in a Fed funds rate increase of 1% to a level of 3%. A parallel shift in the yield curve will then result in a ten year treasury of 4%+, a yield considered reasonable by many financial executives. Stocks, however, are not long-term treasuries. Using a measure that can be applied to almost all non-derivative financial assets, the current duration (analogous to a payback period) for the S&P 500 is likely more than 36 years, whereas the duration of a 10 year treasury is only 8.7 years. Therefore to compensate for the additional risk, an equity markup of 4% over the 10 year treasury is appropriate – especially considering the current systems risks in Washington.

As appropriate, we will discuss the S&P 500 in greater detail.

__

If you

think that those with opposing political opinions are wrong, but trust that

they are at least well-intentioned for the United States; then there is the

basis upon which to craft real solutions to the challenges of globalization and

automation. As our economics discussion in, “The Limitations of Very Limited

Government, “ illustrates, practical solutions have elements of both the

free-market right and the government-regulated left. But, by themselves, the

impersonal economic forces of globalization and automation, both pull in the

direction of increasingly rapid change and increasing inequalities, thus making

broad democratic societies ultimately impossible. It is to the discussion of

these forces and their effects on the country that we now turn.

To

start with the main problem. In the social sciences, the most numerous median

is often used to characterize data, because it is a measure of what affects

most people. The following St. Louis Fed graph illustrates that in the 36 years

since 1981, the real weekly median earnings of U.S. workers has grown by only

.34%/yr.

The

typical American worker has not benefited from the 2.72% real annual growth of

the economy during that period. In an excellent article,

“The Age of Insecurity,” * Professor Ronald Inglehart, of Michigan’s Institute

of Social Research, notes that the top ten percent in the U.S. now take home

almost half of the national income. Political democracy requires a rough

economic equality among citizens; not disparities like this. What are the

causes of these disparities? The article crucially notes that between 2000 and

2010, “…over 85 percent of U.S. manufacturing jobs were eliminated by

technological advances, whereas only 13% were lost to trade.” Many U.S. jobs

are now highly integrated into the world economy, and great care has to be

taken not to compromise them in favor of preserving a few. An effective

government jobs policy should address the root causes of their loss.

Trade

Policy (responsible for 13% of manufacturing job loss since 2000)

Economic

competition from China had a large effect on U.S. manufacturing employment in

the years beginning in 1990, Autor (2016). At that time, American workers were

not re-employed by the trade theory of comparative advantage which held that

trade could only be beneficial – the theory crucially assumes no capital flows

(Gray,1998). With the assumption of free capital flows, trade theory becomes

regional economics, where the jobs simply flow to the lowest cost region.

Professor

Inglehart notes, “Fifty years ago, the largest employer in the United States

was General Motors, where workers earned an average of around $30 an hour in

2016 dollars. Today, the country’s largest employer is Walmart, which in 2016

paid around $8 per hour. Less educated people now have precarious job prospects

and are shut out from the benefits of growth…”

But a

nostalgic effort to try to recreate the industrial conditions of the past by

scapegoating trading partners and imposing high tariffs will fail; because the

structure of the productive economy is now international. High tariff barriers

will disrupt intricate supply chains, to the detriment of all. The trade

deficit no longer has a large direct effect upon U.S. employment. But the continued

trade deficit in manufactured goods impedes the development of the producing

U.S. economy. Something has to be done to reassert national control over trade

and its spill-over effects. Harvard political economist, Dani Rodrik (2011),

argues for institutional diversity based of national priorities because, “Trade

is a means to an end, not an end in itself.” He further writes, “…a new global

financial order must be constructed on the back of a minimal set of

international guidelines and with limited international coordination….the rules

would explicitly recognize governments’ right to limit cross border financial

transactions, in so far as the intent and effect are to prevent foreign

competition from less strict jurisdictions from undermining domestic regulatory

standards…” For most countries, and we believe somewhat the U.S., the goal

should be a rough trade balance, to be effected by a combination of fiscal and

capital flow policies; also catalyzing the industries of the future. **

Automation

(responsible for 85% of manufacturing job loss since 2000)

Automation

has been and will be the largest reason for U.S. job loss. The American

Enterprise Institute notes on 3/17/18, “The main reason for the loss of US

steel jobs is a huge increase in worker productivity, not imports, and the jobs

aren’t coming back. In the 1980s, American steelmakers needed 10.1 man-hours to

produce a ton of steel; now they need 1.5 man-hours….Increased productivity

means today’s steel mills don’t need as many workers. Steel industry employment

peaked at 650,000 in 1953. By the start of the year, U.S. steelmakers employed

just 143,000….The policy point is that Mr. Trump’s tariffs are trying to revive

a world of steel production that no longer exists. He is taxing steel-consuming

industries that employ 6.5 million and have the potential to grow more jobs to

help a declining industry that employs only 140,000.”

To get

even more specific, a 6/1/18 WSJ

article quotes economist Douglas Irwin, “…we’re producing the same amount of

steel, or even more, we use many, many fewer workers to produce that steel.…The

old newsreel image of workers mixing metals next to furnaces is far from

today’s reality, which consists of “one or two (highly paid) engineers who are

adjusting dials in a highly mechanized place.”

It is a

platitude that the advance in automation will create more, high quality

jobs; because people will dream of new things to do. Professor Inglehart

disagrees. The problem is the zero marginal cost of quality products. “The

problems of cultural change and inequality in rich democracies are being

compounded by the rise of automation, which threatens to create an economy in

which almost all the gains go to the very top. Because most goods in a

knowledge economy, such as software, cost almost nothing to replicate and

distribute, high-quality products can sell for the same price as lower-quality

products. As a result, there is no need to buy anything but the top product,

which can take over the entire market, producing enormous rewards for those

making the top product, but nothing for anyone else.”

Platforms

such as Amazon, artificial intelligence programs and driverless navigation will

all be subject to the above.

Increased

employee productivity (roughly Revenues/Wages) is the key to a higher standard

of living provided everyone is well employed. A society where productivity is

infinite, because wages are zero, will simply not work; yet this is where

things are heading. The Inglehart article reiterates, “The rise of automation

is making societies richer, but governments must intervene and reallocate some

of the new resources to create meaningful jobs…”

Summary

The

economic problems we have noted, caused by trade and automation, are

large-scale; requiring the intervention of well thought out government

policies. Nationally beneficial trade policies, wage subsidies for the present

and regional economic development for the future could be useful.

*This article

is worth the time to register on the Foreign

Affairs website.

In the

May/June issue of the magazine there is also an article called “The Big Shift,”

by the historian Walter Russell Mead. He writes that the U.S. made a big

economic transition before, in the years (1865-1901), when the country

industrialized; and people migrated from farm to factory. The Republic

survived. However, this time:

“The full consequences of the information

revolution will only gradually come into view, and the ideas and institutions

suitable to it will emerge as the rising generations learn to use the resources

and wealth that an information society creates to address the problems it also

brings. It is likely that before the adjustment is finished, every institution

– from the state to the family to the

corporation – will have changed in fundamental ways. In the meantime, people

must learn to live in a world of forces that they do not always understand,

much less control…(luckily) Americans are the heirs to system of mixed

government and popular power that has allowed “them to manage great upheavals

in the past. (Because this diverse system allows creative responses - when its

not gridlocked.) The good news and the bad news are perhaps the same: the

American people in common with others around the world, have the opportunity to

reach unimaginable levels of affluence and freedom, but to realize that

opportunity, they must overcome some of the hardest challenges humanity has

ever known.”

** In a

prescient book, “One Economics, Many Recipes, (2007), p. 200” Professor Rodrik

notes the open-economy trilemma of international trade: it is necessary to

choose among only two out of these three following economic policies: capital

mobility, fixed exchange rates and monetary autonomy. The last two place

priority on the well-being of the nation-state. He then discusses an augmented

trilemma (which to us seemed theoretical at the time). International economic

policies have to choose among economies thoroughly integrated into the

international system, the nation-state and political institutions that are

responsive to mobilized groups. The last two place priority on the welfare of

citizens where they live.

The

Trump Administration’s policy of imposing tariffs on imports from other nations

will not win friends and influence people. The first's indirect policies have

been much more effective.

__

But

here’s the problem. The economic systems involving domestic jobs and foreign

trade are complicated. When things go wrong, the natural and simplest human

reaction is to look for scapegoats – “Who did this to us?” The Trumpean answer is always foreigners, immigrants, personal

adversaries and the U.S. government itself - standing in the way of restoring a

nostalgic “American Greatness.” In this he is no different from Mideast

radicals blaming “infidels,” seeking to restore the past glories of the

Caliphate. As the NYT notes on

6/12/18, "...in the complicated, nuanced world of economics and security,

(Trump) has achieved nothing except the destruction of previous agreements, of

institutions..." We won’t even try to enumerate the specifics. About his

high risk strategy in North Korea, see what can really be implemented.

A

business executive once said that it is important to, “Tell the Truth and Give

Hope.” The system requires reform for the next cyclical downturn. Perhaps the

best way is to treat voters as intelligent, to suggest real solutions: a more

nationally responsive rule-based trading system abroad and a better social

safety net at home.

8/1/18 –

There are

likely two major factors that limit the upside of the S&P 500, offsetting

short-term earnings increases.

1)

To

keep inflation at bay and to foster continued economic growth, the Fed has set

forth a program of small but continued interest rate increases. At this 7/24/18

writing, short-term rates are around 2% and the 10 year treasury is around 3%.

Assuming two more interest rate hikes this year and three more the next, the

fed funds and 10 year treasury rates will increase to 3 ¼% and around 4 ¼%

respectively. Compare this with the present long-term S&P 500 return of

4.74% (S&P 500 = 2806). The return of the S&P 500 is way too low for

the risk.

2)

The

threat of an escalation of the trade war between the U.S. and the rest of the

world is increasing. Trump is now talking about targeting all $500 billion

of Chinese imports with tariffs. A broad

tariff war would first increase inflation, and therefore bond yields; and then

decrease S&P 500 earnings, as business slows. The effect of these upon the

stock market is obvious.

We

think this is a time to be very cautious. The economic cycle is maturing. In

the short term, higher financial asset prices accelerate the economy; lower

financial asset prices will retard it.

__

In

2017, the price of Buckeye Partners (BPL) reached $72.11/share. By 8/9/18 it

had declined to $40/share after flirting with a low of $32/share. We have

invested in this partnership interest for many years for income. We do not

greatly care what price the current market is quoting because our assessment is

that there is a very low risk of a permanent loss of capital (for instance as

might occur in a bankruptcy or massive restructuring).

However,

the current price of BPL is an irritation; it is 3.7% of our portfolio. The

following is an analysis of data from the partnership’s second quarter 2018

10-Q and 8/3/18 News Release. Available here.

Compare

the company’s dividend coverage with the prior year’s:

6 mo. 2018 6 mo. 2017

.89 x 1.07 x

The cash flow (profits + depreciation)

reported according to GAAP, does not cover the company’s $2.52 six month

dividend.

1)

The

reason for this is a decline in the capacity utilization of Buckeye’s global

marine terminal business to 87% from 95 % in the same period. This is the

result of “backwardization” in the oil market, where

it is more profitable to sell on the spot market rather than to store oil in

tanks, hoping for higher prices in the future.

2)

Buckeye,

in our opinion, has become overexposed to the international oil terminal

business. According to the company, 45% of of its

2017 operating EBITDA (which excludes interest paid on debt) comes from that

business. Contracts in the oil storage business are much shorter term than the

typical take or pay contracts in the oil pipeline business, increasing

Buckeye’s exposure to volatile oil commodity prices.

3)

The

partnership continues high capital expenditures. In the six months ending June,

2018 Buckeye spent around $250 million on projects – its capital program should

be temporarily reduced, given the partnership’s low dividend coverage.

Buckeye

is unbalanced. The 7/12/18 company report states, “Buckeye has previously

stated its goals of maintaining the distribution level and preserving its

investment grade credit rating (our note: important). In light of Buckeye’s

need to access capital to support its identified growth initiatives and the

impact of ongoing market conditions in its segregated storage business, Buckeye

has retained financial advisors to assist in a comprehensive review of its

asset portfolio and financial strategy.”A good idea.

The 2nd

quarter 2018 Term Debt/Equity ratio is only 1.02, thus there is a lot to work

with. However, it would likely be appropriate for Buckeye to temporarily reduce

its dividend or capital program, somewhat. This should, paradoxically, improve

the partnership’s price.

__

The

unnecessary tariff war, however, was created by the President. But why? The

7/23-24/18 press contains three different explanations of Trump:

1)

Financial Times, Anne-Marie Slaughter. Trump is

a hyper-nationalist. Putin, Netanyahu and Duterte, “…embrace the same values

and methods. They reject a free press and the rule of law, preferring a tame

media and loyal judges. They favour symbolism over

substance; and rule in the name of tradition, nationalism and ethnic purity.

This ideology of authoritarian patriarchy rejects any constraint on the ruler

at home or the state abroad.”

2)

The Washington Post, Richard Cohen. He panders.

“Those of us who write newspaper columns know that sheer brilliance, should it

happen, gets a silent nod of the head, but affirmation – saying what readers

already think – get loud hurrah. This is Trump’s appeal as well. He validates

the thinking – some of it ugly – of many Americans. To them, Helsinki doesn’t

matter and even Putin doesn’t matter. Only Trump does. To them, he hates the

right people (the other).”

3)

The Washington Post, Professor Danielle Allen,

political theorist at Harvard. Trump is inappropriately a deal guy in a world

where long-term relationships matter the most. “President Trump’s foreign

policy is perfectly coherent - so coherent,

in fact, that we could give it a name: pure bilateralism….He (got) out of the

Trans-Pacific Partnership, the Paris Climate Accord and the Iran Nuclear

Deal…because they were multilateral; he’s working on…deals with (Putin, Kim

Jong Un and Xi Jinping) because they are bilateral.” The reconfiguration of the

international order can make Trump a great deal maker (assuming he can

successfully negotiate any deal). “But what about us? Is pure bilateralism good

for the American people? Is Trump’s interest the same as the national interest?

A thousand times, no. A democratic republic cannot afford to become dependent

on the bilateral relationships a single individual has with other countries of

the world. We need to secure and preserve institutional

relationships, both multilateral and bilateral, that we the people can control

and steer over time through temporary representatives.”

So

who is Trump? All of the above. Who is Trump, mainly? We would choose the

third. He’s a deal guy caught in the presidency of the nation that has been the

linchpin of world order. In an essay, “Political Judgement,” Isaiah Berlin

wrote, “To be rational in any sphere, to

display good judgement in it, is to apply those methods which have turned out to work best in it. What is

rational in a scientist is therefore often Utopian in a historian or a

politician (that is, it systematically fails to obtain the desired result)…” *

* Isaiah Berlin; “The Sense of Reality”; Farrar Straus and Giroux, New York; 1996; p. 52.

9/1/18 -

There are two different models for stock market returns. The first is used by long-term value investors and by some pension funds. This Gordon model assumes that stocks are financial assets that provide cash flows:

Annual Investment Return = D0/P + g

where: D0, to simplify, is the current annual dividend

g = the annual growth rate in that dividend

The required investment return of stocks depends upon those available from other financial investments. The payback period of stocks is very long, currently greater than 36 years. The payback period (duration) of a 10 year treasury is currently around 8.7 years. The risk premium for stocks over treasuries should be around 4% (the present markup of equity over debt in the private placement market is around 4%).

The present yield of the 10 year treasury is around 2.85%, say 3%.What is it going to be in the future? The 8/6/18 Barron’s quotes the partner of a major hedge fund: “Fixed income isn’t all that attractive in an absolute sense or relative to the equity market. Having said that, the increase in the 10-year yield will be modest rather than sizable….The U.S. 10-year yield is likely to peak around 3.25%...Bond rates shouldn’t move up sizably because there are significant secular disinflationary forces in the U.S., such as globalization, demographics, disruptive technologies, and deregulation.” If this is so, the outlook for the stock market is bullish.

Contrast this with the view of the CEO of America’s largest bank in the 8/5/18 Bloomberg. “I think (10 year) rates should be 4 percent today…You better be prepared to deal with rates 5 percent or higher – it’s a higher probability than most people think.”

Balance the continued “secular stagnation” hypothesis against the cyclical momentum of a growing and overdriven economy; we think the latter will come to pass.

The second model for stocks is the total return model:

Total Stock Return = Appreciation + Dividends Paid = (P1-P0) +D

P0

This model is used by short-term stock market investors such as: traders, most portfolio managers, and (likely) the general public – and computers.

The first term is the result of superimposed contingencies:

1) Changes in expected inflation.

2) Manias, Panics, and Crashes

3) Company events

4) Cyclical economic events and sector rotation

5) Patterns (computers and technical investors)

Investment management according to the first model is about realized fundamentals related to growth. The second model is all of the above as reflected in the markets, the waves and molecules rather than the tide. Guess what the average holding period of a stock in the U.S. last year was…22 seconds. *

* J.M. Keynes, also an accomplished value investor, wrote about laissez-faire markets (1953), “Speculators may do no harm as bubbles in a steady stream of enterprise. But the position is serious when enterprise becomes the bubble on a whirl-pool of speculation.”

“Economic Articles and Correspondence: Investment and Editorial (1983 ed.)” chronicles his saga as an investor. His writings illustrate two very useful traits: a basic optimism and judgment, knowing when to act and when not to.

__

According to the 8/20/18 NYT, breaking with tradition, econ major President Trump started criticizing Fed Chairman, Jerome Powell, saying, “I’m not thrilled with his raising interest rates, no. I’m not thrilled….I should be given more help by the Fed.” (The Fed is now supposed to take the punch bowl away.)

A 8/21/18 Bloomberg article quoted, “The Fed’s most recent projections are for another two interest-rate increases this year, following the two already implemented in 2018. A step back by the Fed could dent the U.S. currency and, if it was deemed to be more politically motivated, spur a steepening of the yield curve….That would stem from an increase in inflation fears and concern about the role of U.S. assets as a traditional haven.”

__

In recent years, the negative Philips Curve relationship between inflation and unemployment has been muted, due mainly to the (now decreasing) effects of globalization. A 10/29/17 Financial Times article notes, “The Philips Curve is still visible in state-by-state data in the U.S. If the national PC has been disguised by structural shocks, including globalization, these shocks should have applied fairly evenly across all of the 50 states in the Union. If so, this would imply that interstate variations in wage inflation should be fairly well explained by variations in unemployment, since other factors that distort the PC have been eliminated. There has been a great deal of work published in this question recently, and most of it has concluded that the PC is indeed apparent in cross-section data between US states and cities.”

10/1/18 -

On 9/26/18, the S&P 500 reached a level of 2906, yielding a long-term investor a return of only 4.58%. The stock market has been appreciating even though the Fed has hiked its policy rate from the zero bound to 2.25%. The yield of the 10 year treasury has now increased to 3.04%.

Considering the future, what is the calculated equilibrium point of this hiking process, that allows for stable inflation and continued moderate economic growth? The 9/24/18 Barron’s quotes a Goldman Sachs analysis which utilizes the Fed’s Laubach-Williams model to calculate a natural rate of interest of .9%, which is very low. Now add on a 2% targeted inflation rate, a 2% Fed estimated spread between the policy rate and the 10 year treasury (we’re up to 4.9%), and then a 4% equity risk premium – we get a required S&P 500 return of 8.9%!

We aren’t greedy. We think a 4% ten year treasury would be a good investment, and we will likely begin to accumulate these at that point. As for the stock market, we will still likely begin to accumulate the S&P 500 at a 8% return pricing. The facts: inflation, a trade war, and the further unraveling of a dysfunctional Administration (in that order) bias us to the above analysis. But there is also a risk of missing then rapidly moving markets.

By seeking to pay wholesale, rather than retail, the value investing philosophy emphasizes the preservation of capital. What in your own circumstances should cause you to be especially careful? This 9/21/18 WSJ article states this well:

“When the stock market becomes historically expensive, as some metrics suggest it is today, research shows it’s often a harbinger of below-average future returns. This can be especially painful for retirees with long life expectancies because withdrawals combined with poor returns will leave less in an account to compound over decades.

Take, for instance, a 65-year-old who retires when his or her portfolio is worth $1 million. If the retiree withdraws 4%, or $40,000 the first year, and the portfolio loses 40% of its value soon after, he or she will have just $576,000 to fund a retirement that could last 30 or more years. Any subsequent withdrawals will make it even harder for the portfolio to recover.

Returns ‘in the first five to 10 years of retirement matter most,’…Early declines can ‘lock a portfolio into a downward spiral.’”

__

The next ten years and then beyond will present everyone with common problems:

1) Climate Change, whose effects are becoming increasingly obvious.

2) Technological changes causing large disruptions in:

· Jobs, challenging societies and the Keynesian economic system of demand management, to meet the changes resulting from A.I. 1 Note the economic specifics in this article from the 9/10/18 Washington Post, especially the Martin Ford and McKinsey analyses.

· Privacy, that is challenged by the development of large data collection systems.

· The very nature of human beings, as bioengineering begins to link people with computers. 2

In a 9/21/18 NYT article, Roger Cohen writes, “It is important to put our current democratic travails in perspective. At the best, democracy is a culture that empowers free citizens to participate in shaping their fates….Of late, Western democracy has concentrated rather than spread wealth, suggesting it serves injustice. But it is stubborn and adaptable.” How so? We think because it is soundly rule-based. The above are all very large systems problems, to be dealt with by developing a reasonable and common-sense consensus about what can be done and what cannot be.

The alternative of very limited government 3 has no answer to the above problems, which will simply overwhelm everyone. First will be chaos and then an extreme backlash, that will make the irrationalities of the present Trump administration but a sideshow.

1 Artificial Intelligence. Harari (2018) makes a useful distinction between A.I., which can only problem solve (or predict) and consciousness, which feels. Both are necessary.

2 You think this is all in the far future? The 9/20/18 WSJ describes an Amazon plan to turn Alexa (the voice speaker) into a home operating system. It has announced a chip costing only a few dollars, that will enable users to remotely control basic appliances, such as lights, microwave ovens, etc. The eventual development of a brain link to Alexa could begin to cause even greater disruption.

3 It is very necessary to create a consensus about these crucial matters. Simply to say, at the levels of the economy or community, that “Man is essentially good (or bad), and the future will provide for itself (or the past will),” is to run large risks with these real existing forces.

__

If the full Senate votes to confirm Brett Kavanaugh to the Supreme Court without the credibility of a FBI investigation to confirm or deny Dr. Ford’s serious allegations, it will have abandoned the fundamental principle that unifies our increasingly divided democracy – the continuing search for the truth by imperfect people. To abandon this search in favor of “impressions,” rather than confirmed facts, will ultimately undercut the rule of the law that enables the exercise of freedom.

The Senate Judiciary Committee advanced his nomination to the Senate, where the Republican margin for approval is razor thin. This means that Senator Flake’s (R-Arizona) request that the FBI investigate the most recent allegations against the nominee has to be implemented. In the U.S. system, Madison’s “reason of the public” can happen by the due processes of a representative government, common sense, or in close cases by individual conscience. *

Whatever then happens, the result is likely to accepted by the country. Ultimately, democracy depends upon the willingness of people to stand up for it.

* In Federalist No. 49, Madison wrote, “…it is the reason of the public alone that ought to controul and regulate the government….The passions ought to be controuled and regulated by the government (i.e. the balance of powers).”

__

On 10/5/18 the Senate confirmed Brett Kavanaugh to the Supreme Court after unprecedented rancor. Continuing to embattle Justice Kavanaugh will not aid his decision making and will call into question the legitimacy of the Supreme Court at a time when the presidency is chaotic and divisive. Better to let things settle and work to restore the checks and balances that the U.S. government acutely needs. Vote!

__

On 9/26/18 the S&P 500 reached a high level of 2906, yielding a long-term investor a return of only 4.58%. On 10/11/18 it dropped to 2728 in just a few days. In contrast, the 10 year treasury yield has increased continually from the beginning of the year, from a level of 2.46% to a level of around 3.22%. Likely, that given the present prospect for further S&P 500 earnings increases, the tipping point for the stock market is a 10 year treasury rate of 3.22%.

To add, but slightly, additional complexity. The catalysts for this sell-off were also unemployment at its lowest rate since the 1960s, oil prices above $80/barrel, and a large intensification of the trade war with China.

To sum up, all these factors are likely relevant to markets over the short-term; but the first is determinative for value investors – the expected long-term rate of return of stocks relative to other alternatives – keeping in mind all the term risk premia.

11/1/18 –

Political economies are social systems, thus they require common information to effect co-ordination. For this coordination to lead to good results, the information has to be accurate.

In capitalist systems, the primary mechanism is the market.

But over the short-medium terms, say zero to five or ten years, this market is subject to “Manias, Panics,

and Crashes,” and thus requires regulation to curb its excesses. Over the

longer-term, well-regulated markets carry accurate information because the experiments

that are successful will produce growing earnings and prosperity, and those

that aren’t, won’t. Its that simple. Because of

this inherent efficiency, the somewhat impersonal market system has spread

quickly throughout the world under the rule-based Pax Americana, which has provided the stability of a rule-based

order while at the same time allowing local experiments in “creative

destruction.”

__

Fed Beige Book 10/24/18

"Pricing pressures

intensified in response to a variety factors, resulting in moderate price

increases on average….All but one manufacturing contact reported charging

higher prices…Trucking costs—which increased 5 to 10 percent—continued to

present a major problem, contributing to recent price increases by

manufacturers….Construction costs continued to climb at a brisk pace in

response to increases in the costs of construction labor, land, and raw

materials, and one contact expects the higher costs to get passed on to tenants

and buyers."

The S&P 500 closed at

2656.

__

The need for accurate

information and the truth is much more acute in political systems, because

misinformation can not only result in economic policy mistakes, but also

foreign policy blunders leading to a large loss of life. It is for this reason

that Donald Trump’s disrespect for truth is highly dangerous to our democracy –

truth that enables the American people to effectively diagnose problems and to

hold government to account. Because he favors (infallible) instinct over actual

information from experts and the free press, he is making large mistakes in climate

change (whose effects are increasingly obvious), fiscal policy (overdriving the

economy with deficits, consider

this) and foreign policy

(destroying trust in America’s word *).

It is not possible to govern

successfully without reason, particularly in the United States, which was a

Republic founded upon Enlightenment principles. In Federalist No. 49, Madison

assumed that the “Reason of the Public,” leading to the common good, would

emerge from the checks and balances of government. Contrast this with a Trump

quote, “Real power is - I don’t even want to use the word - fear.” ** Fear is typical of a command and control

regime, not a liberal democratic one.

Our next essay will discuss

the challenges the U.S. will face, and how reason guided by principle is

necessary for lasting solutions.

* But he might have been

temporarily successful in averting a crisis with North Korea, initially

instilling fear in the country’s dictator. Add: Or maybe not.

What’s a greater threat to

the United States? Hundreds of poor people, trying to migrate to the United State

for a better life, or this. A 11/12/18 NYT article

reports:

“North Korea is moving ahead

with its ballistic missile program at 16 hidden bases that have been identified

in new commercial satellite images, a network long known to American

intelligence agencies but left undiscussed as President Trump claims to have

neutralized the North’s nuclear threat. ₡ The satellite images suggest

that the North has been engaged in a great deception: It has offered to

dismantle the major launching site – a step it began, then halted – while

continuing to make improvements at more than a dozen others that would bolster

launches of conventional and nuclear warheads. ₡ The existence of the

ballistic missile bases, which North Korea has never acknowledged, contradicts

Mr. Trump’s assertion that his landmark diplomacy is leading to the elimination

of a nuclear and missile program that the North had warned could devastate the

United States.”

Of course, the realistic

comment is, “Why would they?” The Republicans in Congress are also being

snookered by the President in his dream world.

** Trump quote from a 3/31/16 interview with

Woodward and Costa. In 1995, the scientist Carl Sagan wrote, “If we can’t think

for ourselves, if we’re unwilling to question authority, then we’re just putty

in the hands of those in power. But if the citizens are educated and form their

own opinions, then those in power work for us.”

_

What is happening with this

presidency? In the lead up to the Nov. 6 midterms, the President has doubled

down fomenting fear and division by: 1) Mischaracterizing the journeys of poor

people as an “invasion,” calling for 15,000 federal troops (more than are

fighting in Afghanistan) to be sent to the border (to carry water for the

border patrol). 2) Working with the Republicans to cut medical care. 3) Cutting

corporate taxes during a time of peak economic activity to further increase

“growth.” 4) Turning the international trading system upside down with tariffs,

upsetting the chessboard because U.S. multinationals are developing economies

abroad, rather than at home. All these problems require phased in and measured

reforms in a complicated world, rather than an unproductive acting out.

It is possible to attribute

this to an effort to retain a Republican majority in Congress. But there’s

more; we’re being snookered by an operator of bankrupt casinos. Bob Woodward,

speaking on CNN around 10/31/18 noted, “To summarize…we’re being had because

he’s doing things to distract us from the big policy decisions he’s gambling

on. “

He’s playing, “Heads, I win. Tails, you lose.”

_

In the

2018 midterms, the Democrats won back the House majority, thus restoring checks

and balances. With this majority comes the ability to investigate one of the

most challenged and challengable administrations in

U.S. history. We are sure the Democrats will use this authority well.

12/1/18 –

The 11/18 “Fourth National

Climate Assessment,” discusses the specific, predicted effects of climate

change upon American life. Here, we note the effects of global warming upon:

· The Economy. “Without substantial and sustained global

mitigation and regional adaption efforts, climate change is expected to cause

growing losses to American infrastructure and property and impede the rate of

economic growth over this century.

· Agriculture. “Rising temperatures, extreme heat, drought,

wildfire on the rangelands, and heavy downpours are expected to increasingly

disrupt agricultural productivity in the United States.”

· Health. “Impacts from climate change on extreme weather and

climate-related events, air quality, and the transmission disease through

insects and pests, food, and water increasingly threaten the health and

well-being of the American people…”

Scientists makes a crucial

distinction between the climate (which is the long-term description) and the

short-term weather (that people notice). The slow but steady warming of the

earth’s climate due to the accumulation of greenhouse gasses affects the

severity of the short-term weather.

People often say that stock

market is like the weather. This comparison is apt. In the long-term, the level

of the stock market is determined by the initial dividend yield and by the

subsequent growth in dividends (earnings). This stock market is driven by

realized earnings. In the short-term, the stock market is affected by events,

changes in expected inflation, cyclical sector rotation, patterns (largely

programmed into computers and proprietary), short-term trends and

“manias, panics, and crashes.”

Most stock investors are

short-term trend followers (valuing, as Keynes (1953) noted, liquidity), a

maximal response to a lack of knowledge about the summation of the above.

Consider the recent trend in the S&P’s operating earnings:

S&P 500 Operating Earnings

&

Rates of Change

2019

174.47 (E)

2018

157.69

2017

124.51 growth 14.8%/yr

2016

106.26

2015 100.45

(1988-2015) growth 5.4%/yr

The S&P 500 grew by

14.8%/yr. between 2015 and 2019 (E). This is way in excess of the 5.4% growth

between 1988 and 2015. The stock market closed at a level of 2632 on 11/23/18,

at a forward P/E ratio of only 15x 2019 earnings. Reasonable valuation? Only if

you assume that earnings will not ever drop below the 2019 level of 174.47

after this kind of growth. If you take a cyclically adjusted ten year average

that we use in our present value calculations, the earnings will drop to

$104.31. This is a 40% drop in earnings, somewhat more than the present 34%

overvaluation of the stock market.

So, considering only the

trend, do you think that S&P 500 earnings can be grown steadily from the

2019 (E) level in the next 36+ years? As the Wall Street saying goes, “Trees

don’t grow to the sky.” We don’t consider stocks this way at all; but this is

an explanation of short-term market behavior that our readers might find

interesting. We have nothing against trend investors because in the ecology of

the markets, we can buy or sell stocks to them. It is not by accident that

market societies are tolerant.

__

In an 11/28/18 speech